Albemarle & SQM are ‘top dogs’ in lithium production.

Combined market value is just under $47B.

Their 2023-2030 outlook gives clear insights into what’s ahead for investors, EVs and the battery supply chain.

Here’s your summary:

Before we dive in, note both:

- produce lithium carbonate/hydroxide, and more.

- grew revenue exponentially in 2022, due to higher li prices.

- operate globally, including US, Australia, China, etc.

- highly exposed to Chile (will get back to that shortly)

- are listed on NYSE

Albemarle sees continued secular growth via shift to clean transportation.

This is anchored with EV investments by OEMs and public policy:

- Growing global EV production

- Rising lithium demand in all applications

- Battery grade demand lags EV production ~1-2Q

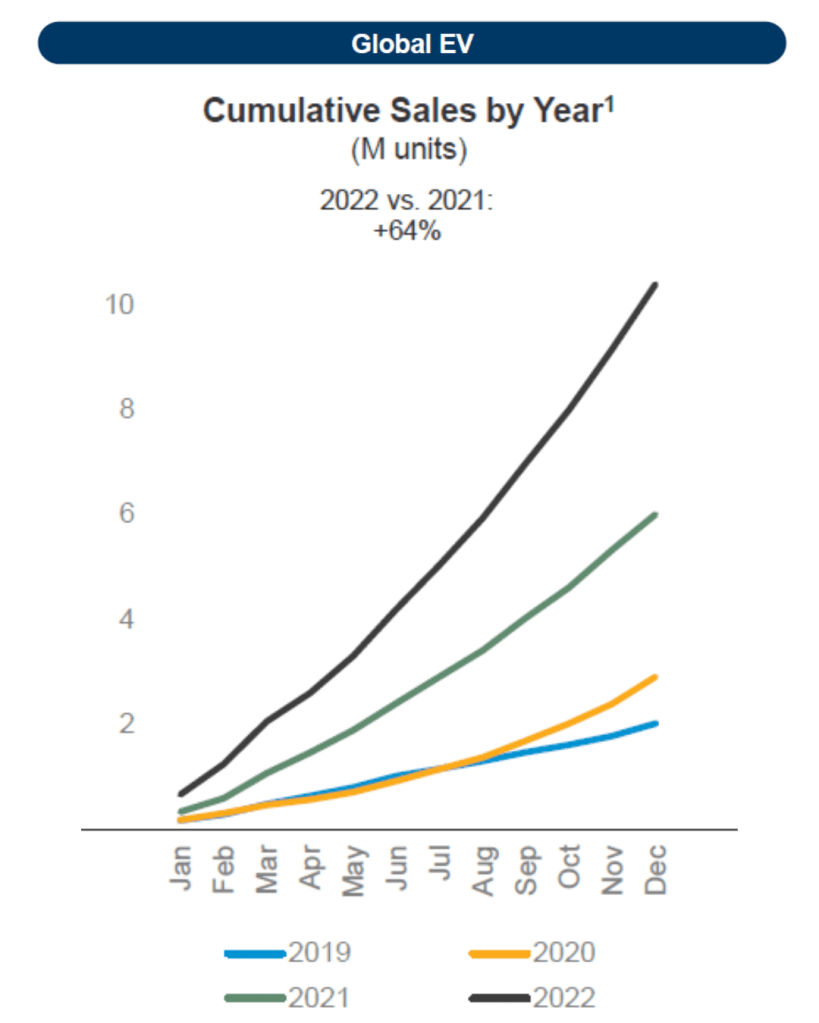

1) Global EV

Cumulative sales per year have accelerated significantly in 2021 and 2022 vs the previous 2 years.

(2022 looks like a double black diamond slope to me! ⛷️)

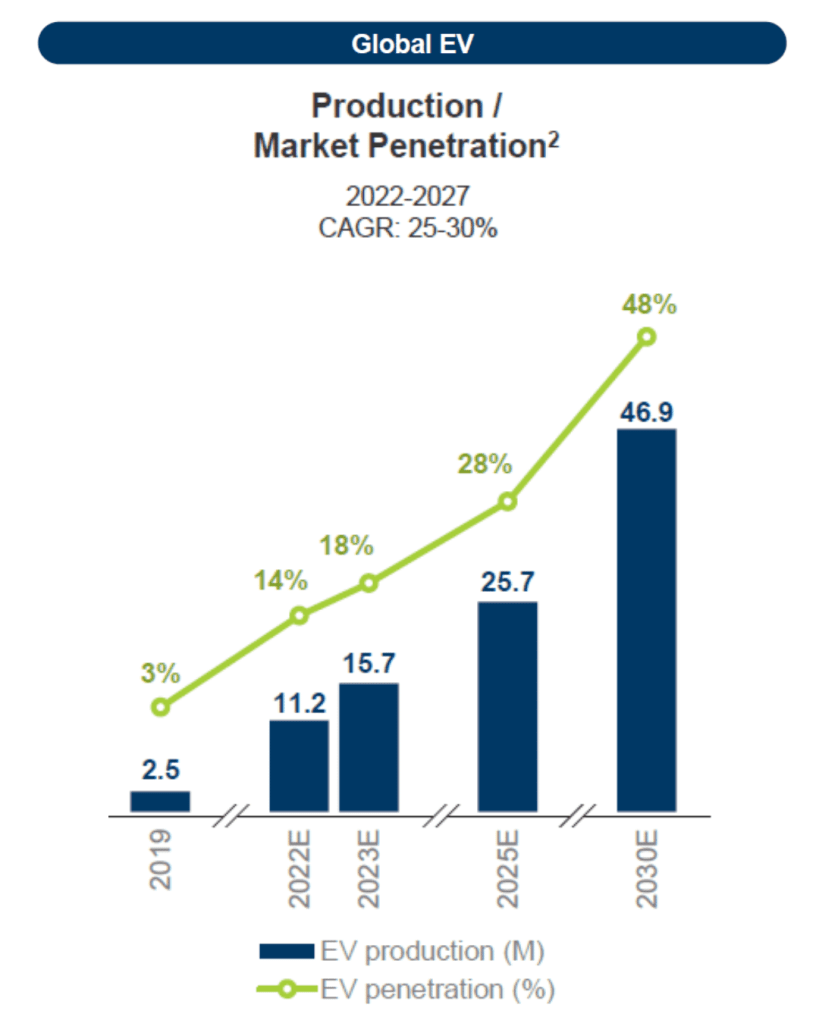

EV production is growing, climbing from 3% in 2019 to 14% in 2022 (@IEA more up to date figures put total vehicles at 10m instead of 11.2, but still 14%).

Albemarle sees penetration (i.e. adoption) to reach 48% by 2030!

And CAGR 25-30%.

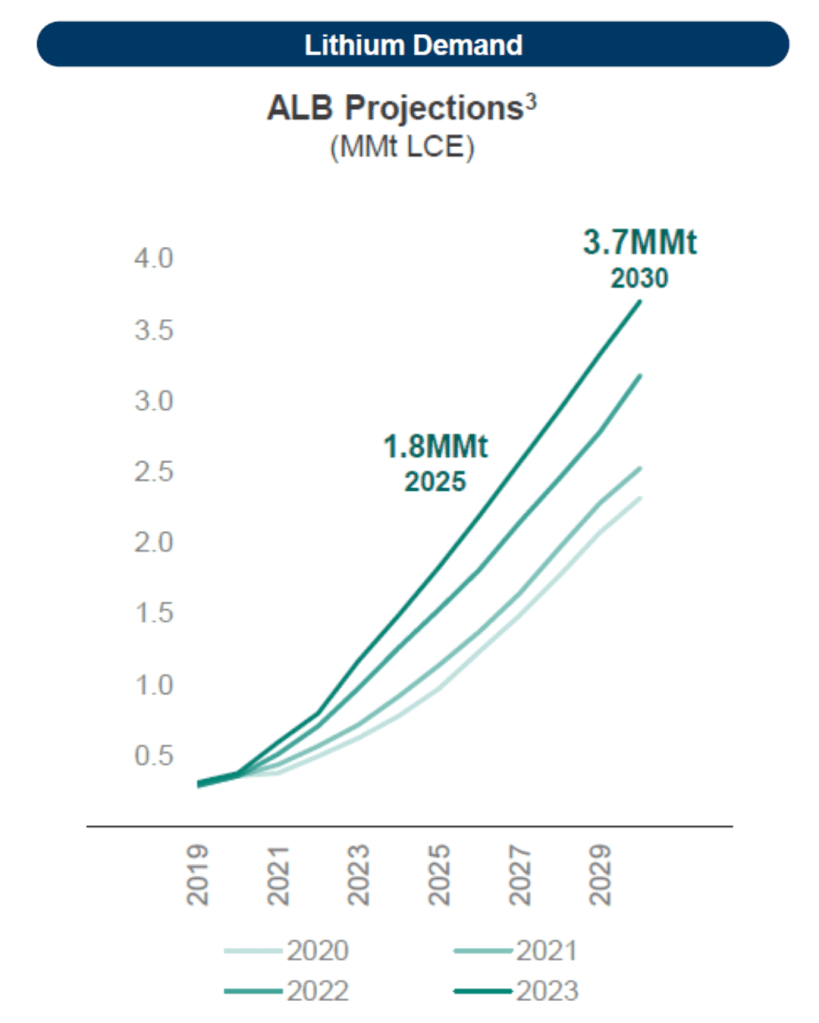

2) In terms of lithium demand:

They estimate 2030 demand will reach 3.7MMt LCE

This is +15% from their previous forecast and this is due to IRA (Inflation Reduction Act in the US) and strong EV demand.

To further break down demand:

- EV

- Grid

- Mobility

- Consumer electronics

- Industrial and other

are all growing (but EVs growing by far the most).

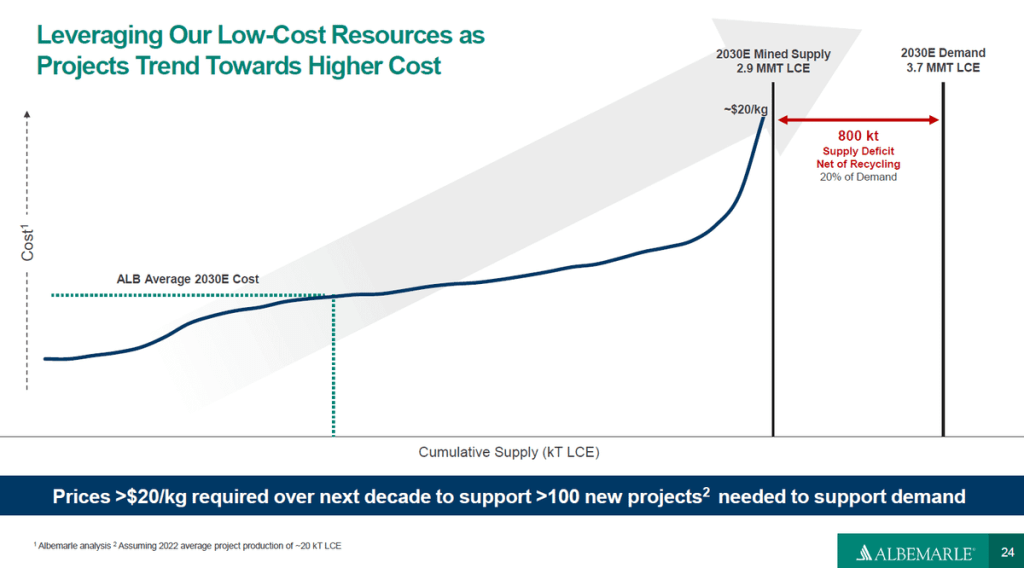

And here’s the nugget…

In their models, they see an 800kt supply deficit, net of recycling by 2030 (~20% of demand).

The gap is between estimated mined supply and expected demand.

ALB also says prices need to stay above $20,000/t LCE to support the ~100 projects needed.

$ALB had revenues from lithium of $5b in 2022 (68% of their total rev), up 3.6x from 2021.

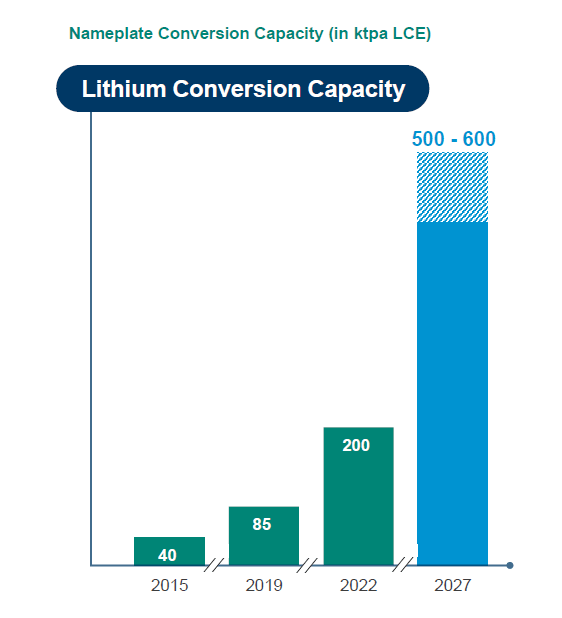

Putting money where their mouth is, they have been consistently expanding their conversion capacity via investment and acquisitions (like failed for $LTR).

And have more planned.

SQM notes that lithium chemical demand in 2022 increased by 43% to ~760kMT (with 70% linked to EVs).

Energy storage will continue to drive demand.

Going forward, w/ CAGR of ~23%, demand would reach ~1,500kMT by 2025, with EVs at 75%. In turn, they’ll grow by only 14%

$SQM had $8.1B in revenue from lithium and derivatives, (76% total, 12mo to Mar 23), producing 168kMT.

(for comparison, $936m in CY2021!)

They estimate market share to be:

- SQM ~20%

- Albemarle’s 16%

- Tianqi 7%

- Ganfeng 6%

- Allkem* 4%

- Livent* 3%

(*merging)

In 2022, SQM sold to 198 customers, with 1 being a whopping 19% of their lithium revenue, and their 10 largest accounted for 60%.

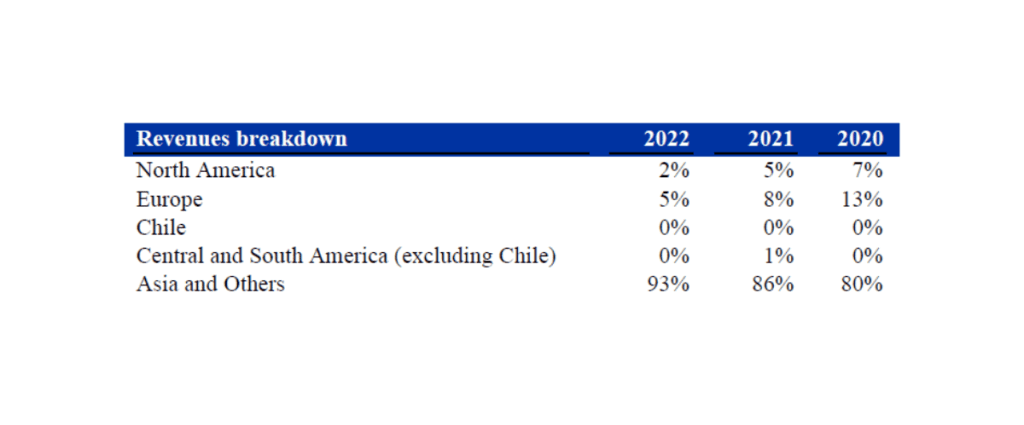

Revenue by region is highly concentrated too…

(Asia’s share is linked to China’s ~60% of refining capacity!)

Now back to the Chile issue.

Chile is changing its lithium policy and the markets were confused.

$ALB and $SQM have huge exposure to the country as they operate in the rich Salar de Atacama & their licences expire in 2043 & 2030.

But it is NOT a nationalization.

We discussed in depth w/a local lawyer:

In summary, Albemarle + SQM see:

- LCE Demand: 1.5MMT by 2025, 3.7MMT by 2030

- CAGR ~23-30% over the period

- 800kt supply deficit, net of recycling by 2030 (~20% of demand)

And they

- Serve 36% of the market today, ~0.27MMT

- Collect $13.1B in revenue

You’ll find links to both $ALB and $SQM presentations, annual reports, plus the IEA EV outlook report at the end of this thread if you’d like to read the fine print and dissect each assumption.

And that’s it for today!

Both Albemarle and SQM have a leading role in driving growth and circumventing challenges for lithium. More consolidation, investment and new entrants are ahead for the sector.

PS: share price is in the lower mid 52wk range if you’re wondering

Presentations:

ALB

💻 https://investors.albemarle.com/overview/default.aspx

📒 https://s201.q4cdn.com/960975307/files/doc_earnings/2023/q1/filing/Q12023_10Q.pdf

SQM

💻 https://ir.sqm.com/English/events-and-presentations/presentations/default.aspx

📒 https://ir.sqm.com/English/financials/annual-reports/default.aspx

IEA EV outlook

📒 https://www.iea.org/reports/global-ev-outlook-2023/executive-summary

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.