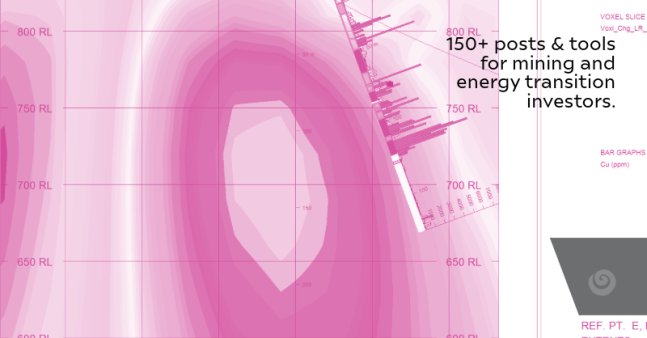

When investing in mining, grade is a highly nuanced, yet a fundamental concept to, not only grasp but master. Say, you're reviewing a new company or an announcement and they very cheerfully discuss a 0.55% Cu intercept. Is this good? Is it high grade? The response is... it depends. Many times a result could look … Continue reading Mining grades cheat sheets

Mining grades cheat sheets