Nuclear remains deeply controversial.

Yet recent geopolitic struggles have reignited the flame sending uranium (and many related stocks, producers and explorers alike) higher.

There are many reasons to be bullish:

Hey hey! I’m Paola Rojas. I’ve been investing for 17 years, and as a corporate advisor to miners and investors have worked on over $80m in deals. Most of my work has been focused on the metals and minerals used in the energy transition. But I digress. Let’s keep going!

- Uranium can greatly contribute to the energy transition

Today, nuclear energy (enabled by uranium) provides ~10% of the world’s electricity*. But this is just a fraction of the potential.

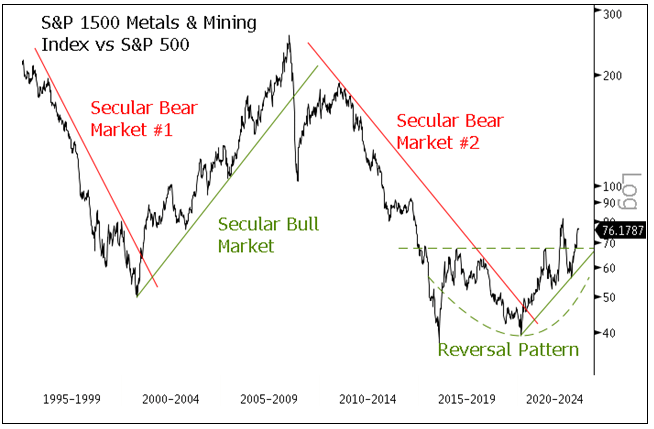

Sprott has said we are starting an energy transition materials secular bull market. This is supported by many large institutions and analysts.

Highlights the need to:

- speed up the global energy transition

- secure critical minerals supply

All after a decade of underinvestment, which magnifies the task ahead.

(Indeed)

📊 @Sprott

Yet uranium’s dual role in this transition is severely overlooked.

Now, started to be recognised, how it can contribute to and provide both:

*Energy transition + energy security*

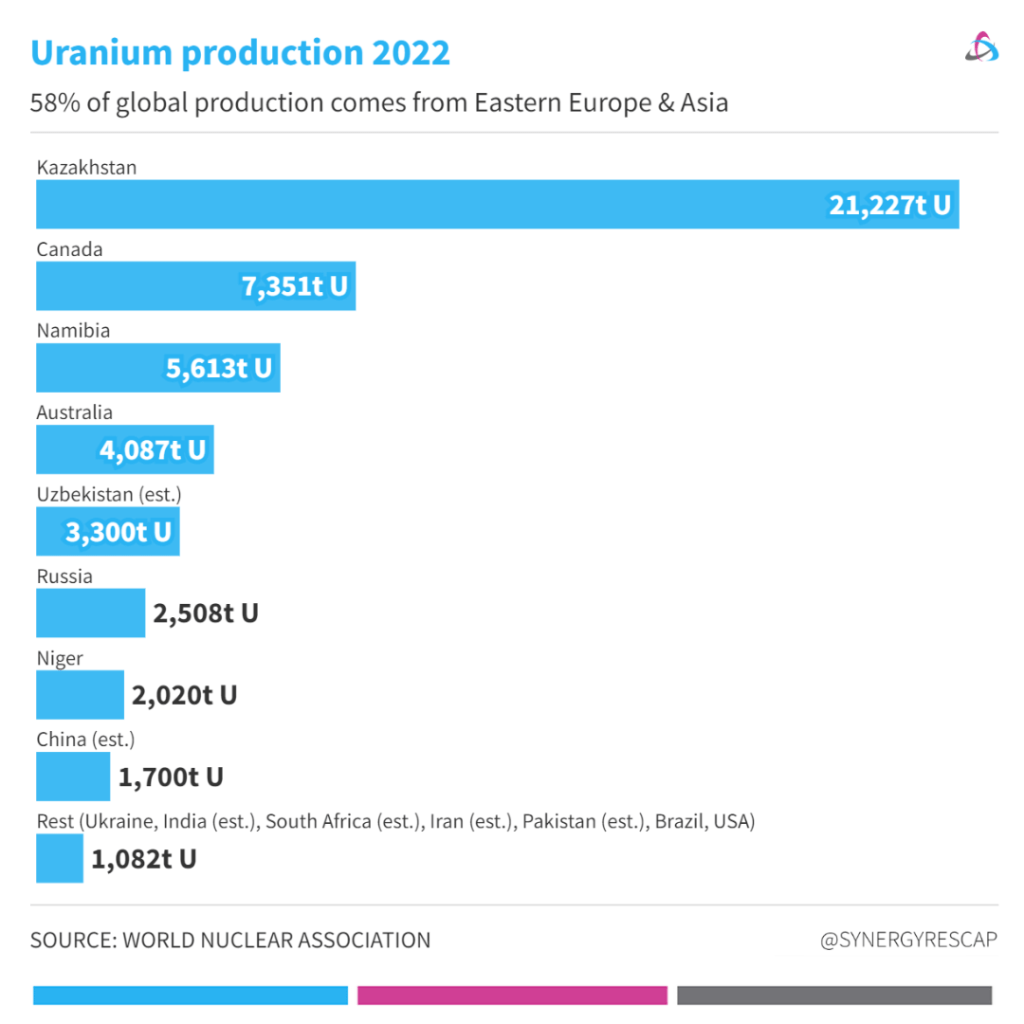

Political tensions in Eastern Europe/Asia, where most supply comes from, are not easing.

Uranium looks then, poised for a meaningful shift.

2. Price has started to react.

It has seen a decent recovery over the last 18 months.

(not 2007 good, but still promising and catching up to it)

Uranium doesn’t trade on an open market, but via private contracts yet the trend is clear.

📊 @cameconews

3. Concentration

Concentration is never good in #commodities, but in this case, these rising (and now clearly sticky) political tensions are upping the stakes.

An adjustment seems underway:

Eastern Europe & Asia produced 58% vs 63% the year before.

📊 @WorldNuclear | @synergyrescap

4. Geopolitics

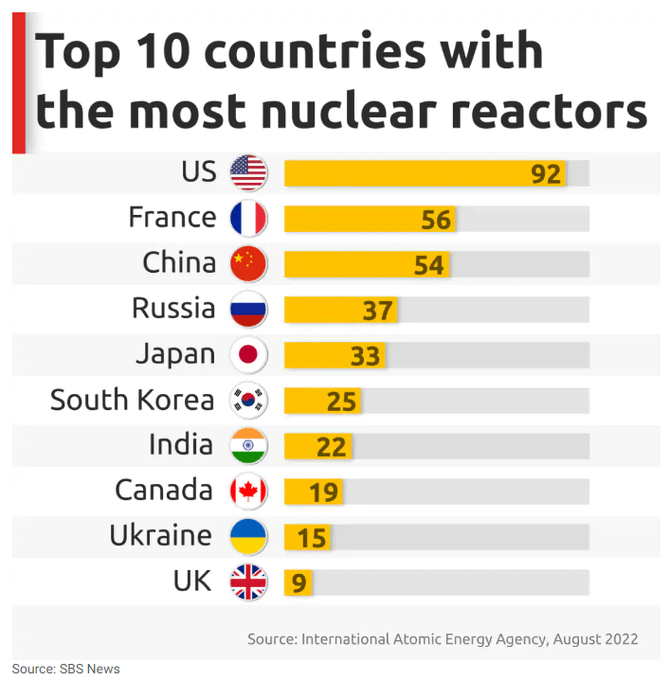

Geopolitical tensions and the energy crisis have made waves in Europe, and sentiment has improved in some regions.

With Fukushima firmly in the rearview mirror, we can look ahead.

Nuclear is crucial for baseload. And many countries have taken advantage.

📊 @iaeaorg

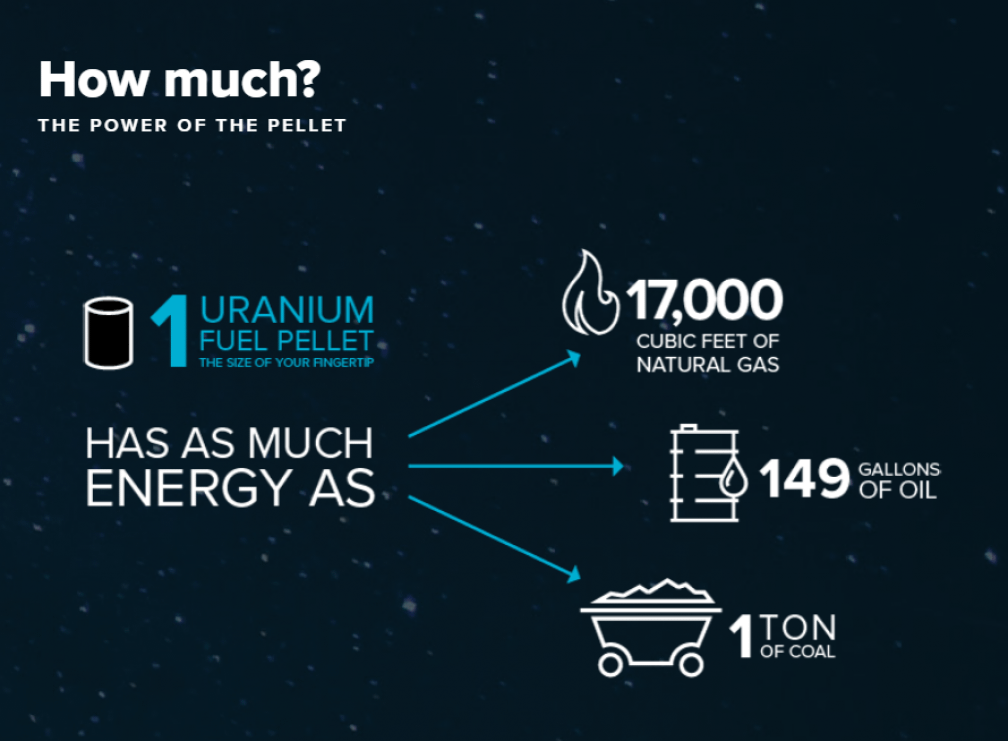

5. High density

Goldman Sachs has stressed we still need traditional sources of energy (currently supplying ~80% of energy needs) for the transition.

And uranium’s energy density is unparalleled.

While it’s not renewable, but it’s clean energy.

📊 Nuklearna elektrarna Krško

Here’s the kicker:

Over 50% of uranium production is controlled by state-owned companies.

It’s not as easy to get exposure.

Among the top 10 producers:

- $CCJ

- $BHP

- plus ETFs such as

- $URNM w/37 holdings inc producers and explorers

- $ARKQ added Cameco this mo

This makes it a niche sector yet poised to grow.

How about that?

Investing in uranium specifically, and nuclear energy more broadly is a wise choice.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.