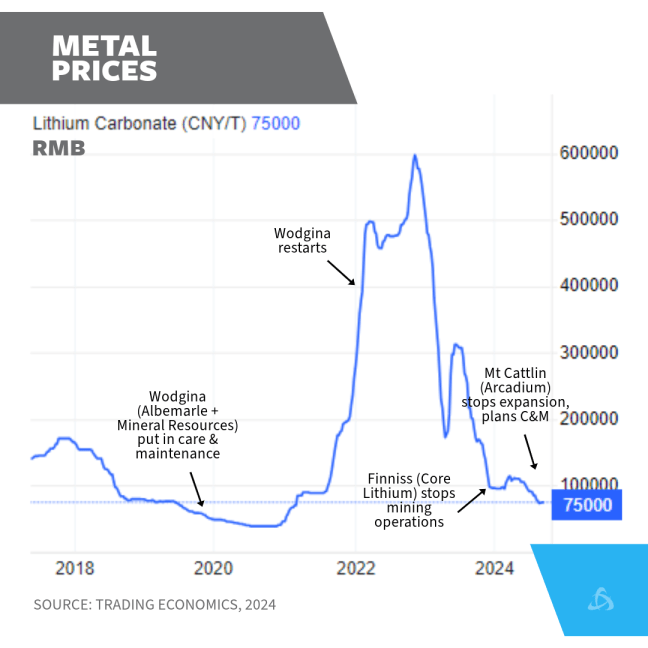

Hey hey! Lithium prices had an abysmal August (and year) triggering curtailed production and stoppage announcements. But this is not the first time we’ve been here.

In fact, just before the last price spike, we saw a similar phenomenon.

As guideline prices for the chemicals (carbonate & hydroxide) suffer, related stocks are trading at equally depressed levels.

Unsurprisingly, consolidation is happening but we believe motivations are more strategic this time.

Pilbara Minerals (whose CEO is such a delight and we had the pleasure to share a panel with) has an optimistically realistic take: first, they’ve decided to acquire Latin Minerals, an ASX-listed lithium explorer focused on Brazil, in an all-share $560M deal. The country has become, thanks to market darling Sigma Lithium, a hot zone.

Effects on both stocks didn’t disappoint.

Secondly, they plan to lift production by 50% over the next 12 months. And here’s the crux of the rationale:

“What we’ve learned historically from lithium pricing is that it can change, and it can change rapidly”

-Dale Henderson

In lithium, broad diversification seems to be a necessary strategy for long-term, sustainable operations. Different jurisdictions and sources (brine vs hard rock, extraction, etc) can provide distinct cost structures while giving access to new markets.

Until the lithium market matures, prices will remain volatile. Hence, base case scenarios and price assumptions in feasibility studies should be highly conservative and in our view, incorporate such optionality.

The world may have gone on a ‘de-globalization retreat’ but mining can’t function in isolation.

Meanwhile…

These new stories are live on this blog:

- What’s up with copper and what’s ahead for the metal?

- How you can get started with the Mining Investor Toolkit

- The basics you need to know about gold processing (subscriber-only)

If you enjoyed this analysis, subscribe to our deal alerts* to receive it via email.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

*corporates and sophisticated investors

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.