Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

This week in our newsletter:

- Tesla vs mining

- Sentiment on socials

- Market update and outlook

- Opportunities within mining stocks

It started out as a joke and is now a reality. Or perhaps it was never a joke… and it was just a declaration of intention.

Either way, it’s here now.

Tesla reached $420 per share.

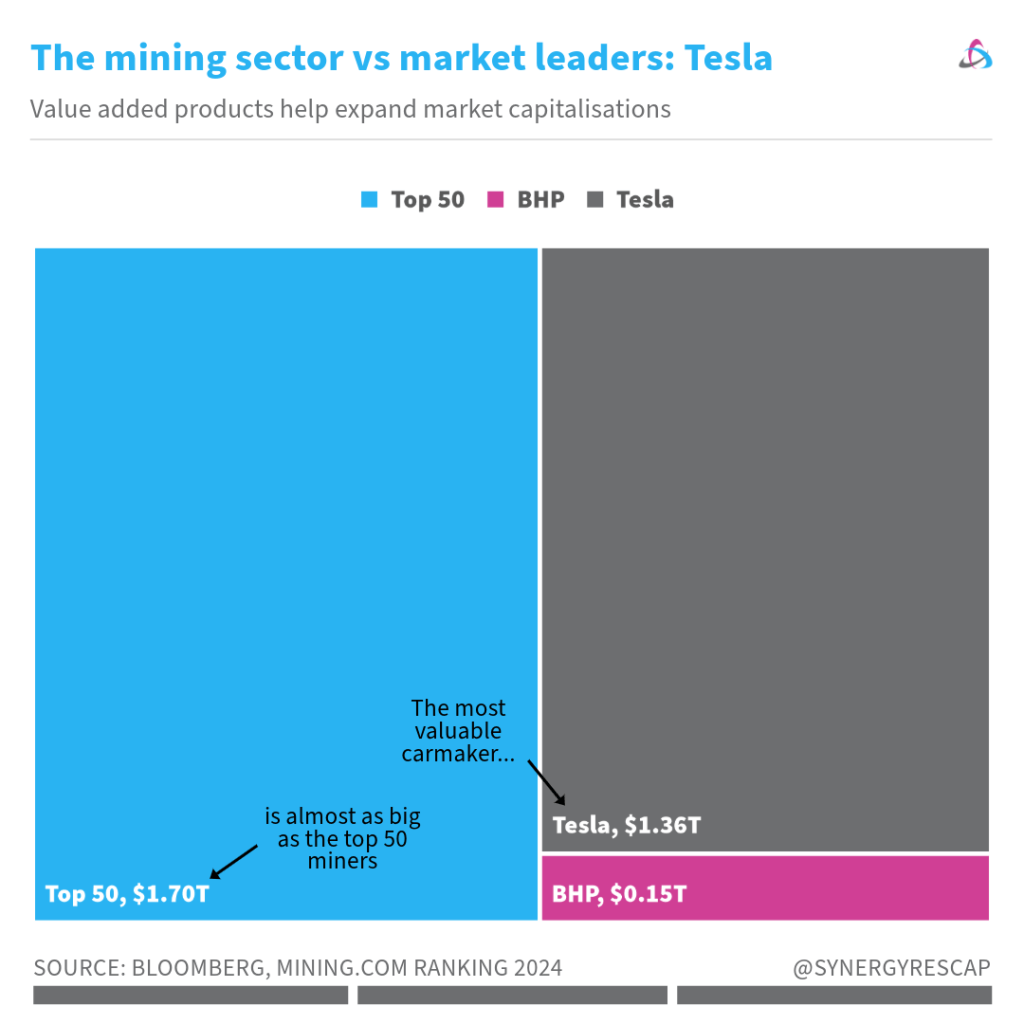

In fact, it’s nearly 3 BHPs away from beating the top 50 #mining companies.

Yet another achievement for the company that has revolutionised the auto industry, while becoming one of the so-called Magnificent 7, the tech leaders. In mid-2024, this group accounted for nearly $16 trillion of the S&P 500’s total $46 trillion market capitalization1.

Tesla is also the most valuable automaker, worth $1.3 trillion.

Inversely, BHP is the largest mining company, valued at a mere $150 billion.

The power of producing high-value-added end products is clear here. The top 50 miners may control the mining industry that finds, extracts and process the raw materials that civilisation needs to function but when compared to the markets at large, miners are the minnows.

But Tesla still needs to buy minerals. It currently buys from… BHP! but also Glencore, Piedmont Lithium and others.

And EVs continue to drive (pun intended) change.

While oil and gas are still crucial to our energy needs and produce about 80% of requirements, cleaner sources are expanding on the back of clean transportation. Electric vehicles are already displacing nearly 1.8 million barrels of oil every day. This figure is expected to double by 2027 and triple by 2029, per BloombergNEF’s Road Fuel Outlook2.

This is all enabled by minerals.

Sentiment on socials

This week I asked our audience on X where they plan to allocate more capital among the top metals. It’s always interesting to see how feedback changes with prices… it comes with the territory when dealing with an asset class as price takers.

The sentiment may surprise you (although it shouldn’t, really).

If you are reading this via email, click the date to view the above tweet.

Copper’s resilience is undoubtedly bringing more bulls to the party. This, is of course, in addition to BHP and Rio (as I wrote recently). Copper seems to be on everyone’s mind as we head into 2025 and is set to end the year in the $4.1-4.2/lb range.

Gold and silver were virtually tied in 2nd place, and several commodities were mentioned in the comments but no clear 3rd place.

This week in the markets

Signals have been mixed. In Australia, the RBA kept rates on hold and All Ords lost 1.6%, while gold, copper and silver had a strong week but closed down. Bitcoin reached $100K again.

As we get ready to end another year, uncertainty and geopolitical tensions seem poised to exacerbate. This uncertainty is likely to keep gold ~$2,700 to end the year, according to analysts.

In case you missed it, in our last newsletter we talked about geopolitics and how opportunities can be found even in the toughest places.

Meanwhile…

In recent related news…

- Agnico Eagle Mines to acquire O3 Mining for $144M.

- Australia’s Northern Star buys De Grey Mining for $3.3B. Reuters.

- Rio sells copper mine stake to Sumitomo for $399M. Bloomberg.

- China restricts graphite exports. Bloomberg.

- SSR Mining acquires gold mine in Colorado for $275M. Mining.

- Plus SpaceX reaches $350B valuation, Argentina mild recovery thanks to Milei.

Gold and #copper strength are keeping the momentum in mining M&A.

Time for research

To start, these will help with a general perspective:

- Tesla | TSLA > chart >

- BHP GROUP LIMITED | BHP > chart >

- Relevant sources > @benchmarkmin > | @Thematicafunds >

If you’re keen to jump on the deep end, here are this week’s highlights:

- Best performers: Q2 Metals Corp. | QTWO > up 236% YTD > chart

- Stellar drill results: Patriot Battery Metals Inc. | PMET > Patriot Drills 31.2 m at 3.35% Li2O at CV13 including 4.7 m at 5.37% Li2O, Significantly Expanding the High-Grade Vega Zone via GoldDiscovery > chart

- Insider transactions: Calibre Mining Corp. | CXB > +$100,000 > filings > chart

Definitely worth analysing to learn more.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

- Become a member for weekly opportunity alerts and access to the whole vault

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.