BHP & Rio Tinto are the world’s largest mining companies.

$237 billion in market value*, combined.

As leaders, their outlook is a crucial signal for investors.

Here’s what they see ahead for copper:

BHP views long-term fundamentals as favourable.

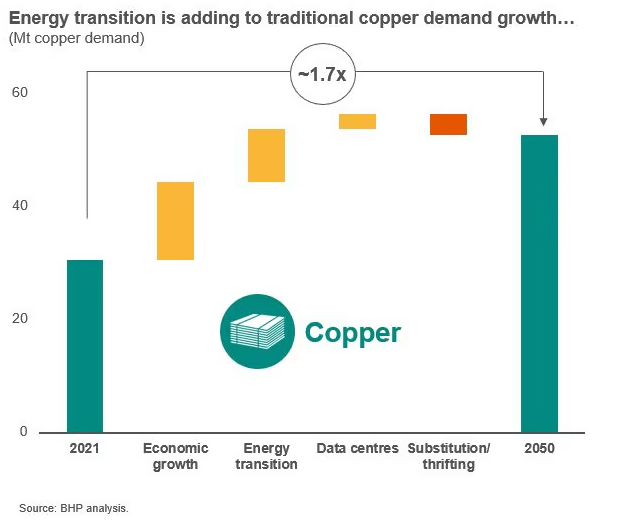

Commodity demand to be supported by:

- population/economic growth

- energy transition

- data centres (AI)

- substitution/thrifting

However, commodity markets are expected to remain volatile over the next 18 months.

Beyond that horizon…

They see copper pricing “moving into a phase of durable outperformance”.

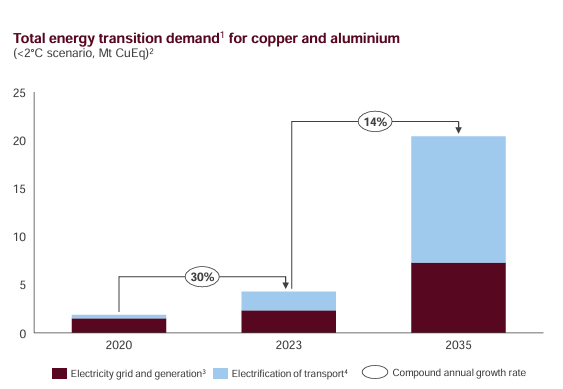

With EVs being more copper-intensive than ICEs, they see transport at 20% of global copper demand by 2040 (vs 11% today).

This translates into 1.7x more copper needed by 2050.

Remember how they said that ‘a decarbonising world amplifies the need for mining’ (despite what Elon** says!).

That hasn’t changed at all!

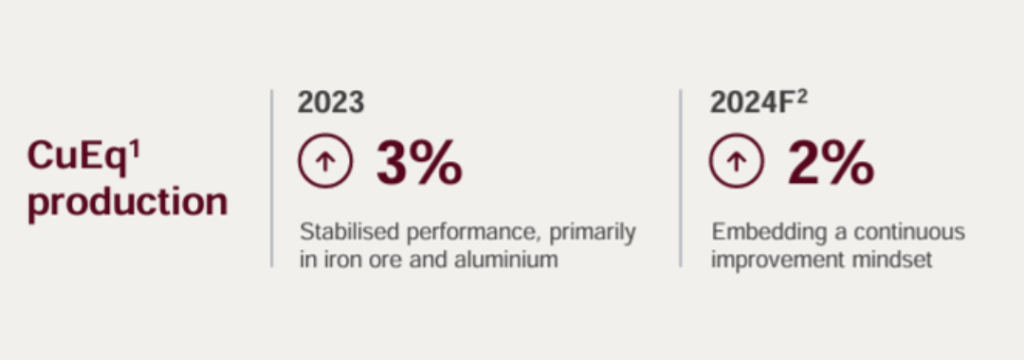

As they gear up for growing demand, here’s some clear action: $BHP increased copper production by 9% in FY24.

We’ll likely need 2x as much copper over the next 30 years, compared to the previous period.

That’s unprecedented growth and guess what…

They reckon the required investment for copper will be ~$250b by 2030.

For their share of the investment, they have already earmarked a big chunk to tackle the shortfall:

Plans to spend $11 billion+ at the world’s biggest copper mine, Escondida, and other projects in Chile over the next decade.

(IMO also a few more global M&A)

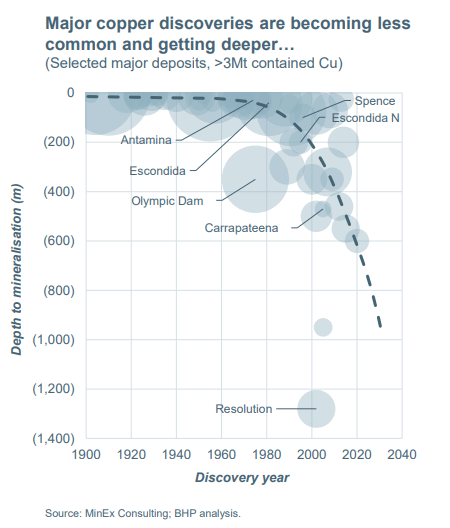

They know economically viable copper is hard to find.

Major deposits are less common and are being found deeper and deeper.

The deeper we go, the more expensive mines become, and technologically challenging (even if somewhat easier to permit).

Given that BHP expects a global copper deficit of 10MT a decade from now, they are investing heavily in growth and M&A.

First, attempted to snap up $AAL and when that failed, joined forces with Lundin $LUN to buy the rest of $FIL

(unlikely to be the last!)

Meanwhile…

$RIO also sees growth.

They expect copper and steel to grow substantially through 2035 and with the energy transition to reach 22% of demand for both metals (vs 7% in 2023).

In line with these forecasts, they are not sitting idle…

Rio is growing both production and investment.

For example, via Nuton (bioleaching technologies to unlock copper) in Argentina-focused McEwen Copper $MUX and Aldebaran $ALDE.

(side note, Rio also snatched Arcadium Lithium for $6.7 billion).

But here’s the ‘copper nugget’:

It’s no coincidence.

Argentina has copper potential comparable to Chile and has been out of favour for ages.

BHP was there in the 1990s (Dad was the last country manager, had to close the office and fire everyone inc himself in 1998), Rio too.

What’s changing now?

The new libertarian president is opening up the country again.

These large copper deposits need BIG money, typically in the billions. So you need conditions to be very stable. It’s a challenge but it seems reachable.

Plus opportunity is not restricted to the majors…

Many comparable projects exist.

Some well advanced like those mentioned plus Pachon held by Glencore $GLEN

Others also around, such as La Coipita held by junior AbraSilver $ABRA in JV with $TECK

While still speculative, the potential is HIGH. Worth serious analysis & DD.

And that’s it for today!

Both BHP and Rio have a crucial role to play in driving this unprecedented growth globally. But I reckon the Argentina component of this play will expand substantially.

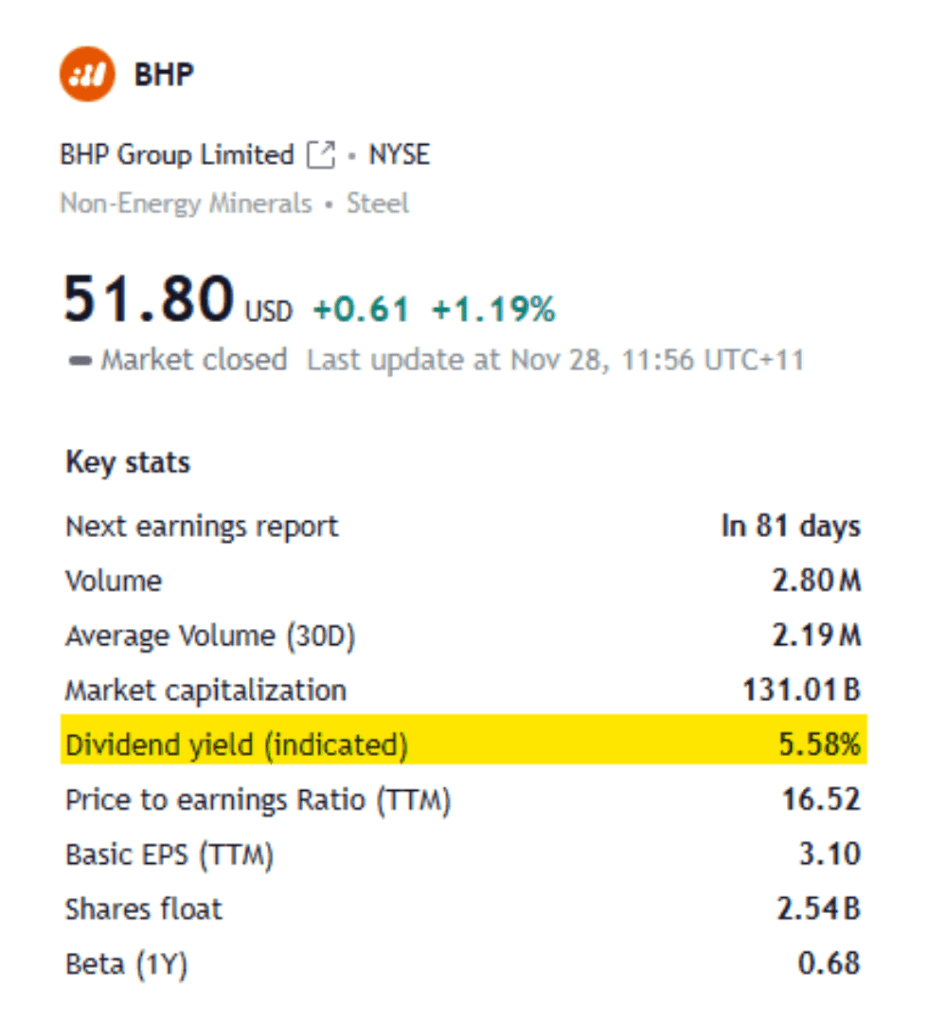

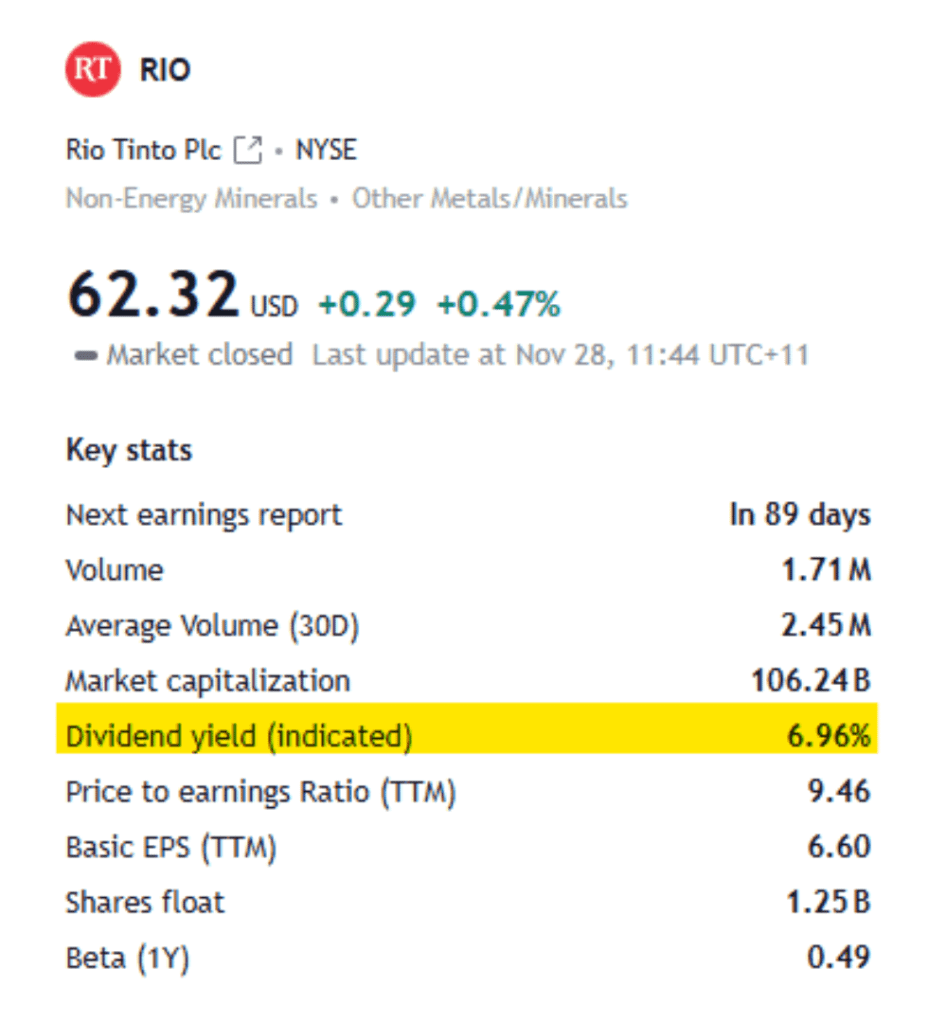

PS: their dividend yields still quite nice

- *down from $250 billion in mid-2023. It’s been a tough year

- **Elon Musk said in Tesla’s 2023 AGM that we’d be mining less 😎

- Presentations, @bofa_business conference, reports:

- 💻 Rio Tinto

- 💻 BHP Presentation / report

- For a bit of comparison, here’s my previous review of these top miners here, from last year

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.