Time to read:

Minerals are critical in the race for tomorrow and this has vast implications for investors and the markets.

The ascent of AI needs massive amounts of both:

- computing

- energy

Modern electronics are mineral-intensive plus higher energy use calls for grid expansion and new generation.

But here’s the thing.

Not all minerals have the same relevance in these applications…

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

▣ Let’s start with electronics.

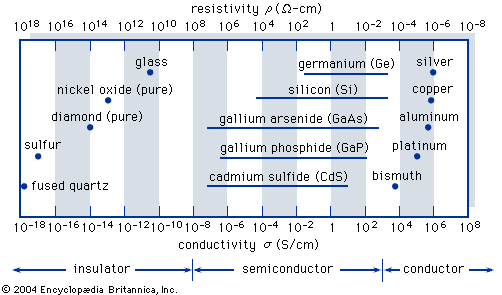

Semiconductors control the flow of electric currents within devices.

To do this, semiconductors use a variety of minerals for their conductive, semiconductive or insulative properties.

Silicon is the most common material for chip wafers due to its ability to be either.

Silicon wafers are made using silica sand, which is made of silicon dioxide.

The sand is melted and cast in the form of a large cylinder called an ‘ingot’. This ingot is then sliced into thin wafers.

Some chipmakers build their own, others use fabs such as Taiwan’s TSMC.

During manufacturing, wafers undergo doping, where metals like gallium, arsenic, iridium, and phosphorus are added to slightly modify their conductivity.

Copper and cobalt wires connect billions of transistors into a single integrated circuit.

By the end…

…a dozen minerals may have been used in a single chip.

But the challenge is each one has a dissimilar supply/demand equation.

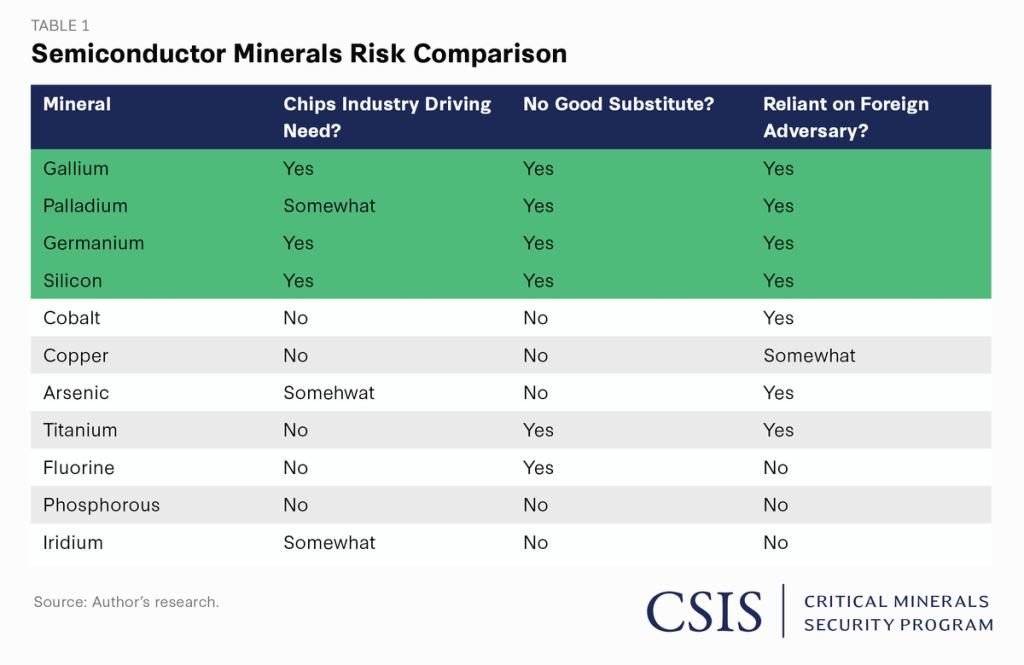

So, in terms of criticality…

There are 3 dimensions to consider:

- is demand for the mineral mainly coming from chips?

- is there a good substitute able to replace it?

- are its sources linked to geopolitical complexity/risk?

These variables create 2 groups with different potential strategies for investors:

a) High risk:

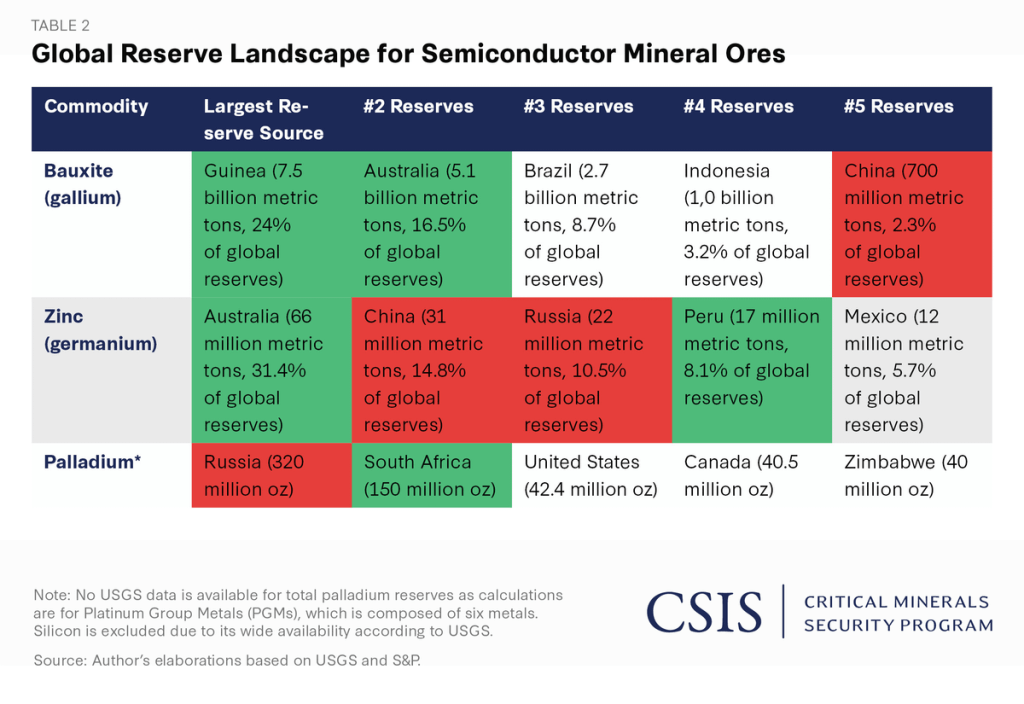

→ Gallium, germanium, palladium, and silicon.

These minerals face significant supply chain risks due to heavy dependence on China and Russia.

The West lacks domestic production for some of these, making the semiconductor industry vulnerable to supply disruptions.

(one of the reasons there are ‘critical minerals lists’)

▣ For regularly updated lists of critical minerals see here

For instance, China controls 98% of the refined gallium and 68% of germanium, while Russia is a major palladium supplier.

Recent export restrictions by China on gallium and germanium have already impacted the US semiconductor industry.

To mitigate these risks, the West needs policies that incentivise private sector investment in alternative supply chains and foster cooperation between allied nations.

This may include:

- tax incentives for mineral processing and refining projects

- funding research and development for refining technologies

- providing subsidies to make Western-produced minerals competitive

- fast-tracking approvals for mining projects of these minerals

Additionally, HIGHLY important:

- funding projects focused on securing semiconductor mineral supply chains

- partnering with mineral-rich allies (Australia, Peru, South Africa and others) to help diversify sources and reduce reliance on China.

(but also, remaining realistic about trying to replace China… It may never happen)

For the second set of minerals:

b) Lower risk:

→ Cobalt, copper, arsenic, titanium, fluorine, phosphorous and iridium

In contrast with the first group, demand for copper, titanium, and cobalt is driven by energy, construction, automotive, and aerospace industries.

Hence, still needed but the geopolitical implications and risks are less severe (plus quantities much smaller).

The disruption potential is shown in blue.

📊 @CSIS

Meanwhile, let’s not forget. China is adamant about ‘reunifying’ Taiwan.

And this doesn’t get much discussion:

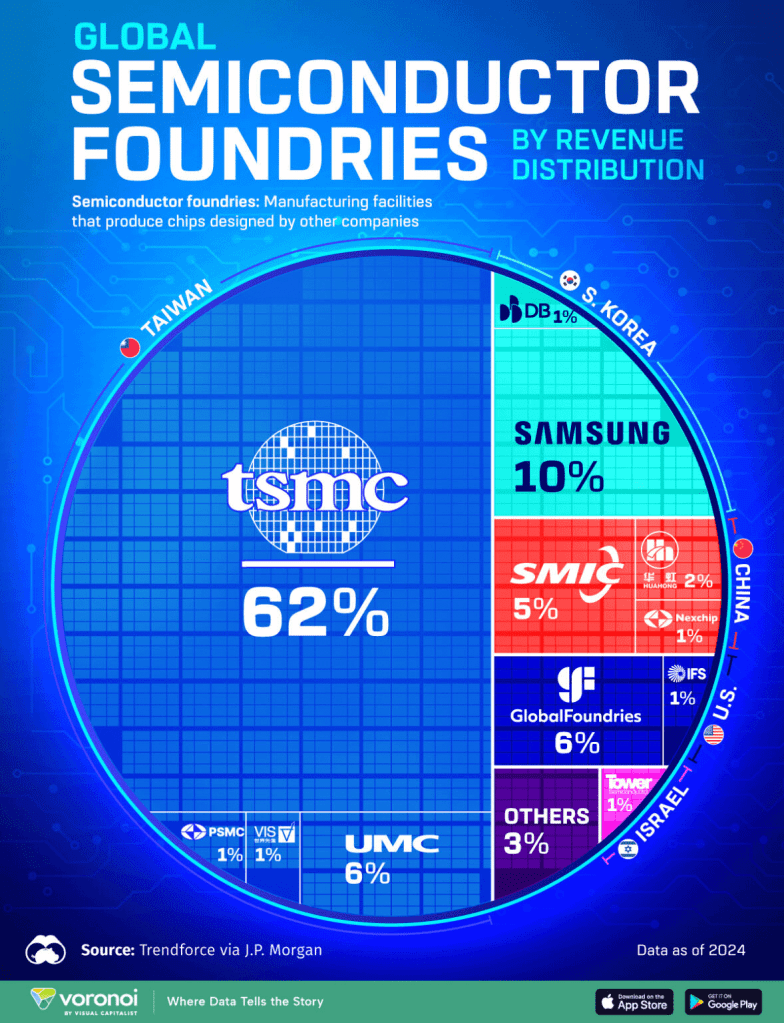

Taiwan is home to TSMC. The leading fab, a semiconductor foundry that produces chips designed by other companies.

China already dominates minerals… supply chains could get even riskier.

▣ Now, energy.

From chipmakers like $NVDA $INTC to tech giants like $META $GOOG leaning heavily on AI (directly, via OpenAI, DeepSeek or whoever!), this means MORE energy.

Ergo, infrastructure & generation will need to GROW.

Copper and uranium are set to excel, among others.

Copper is essential to electricity infrastructure, and nuclear as clean energy base load.

▣ Why does any of this matter to investors?

EVs and mobility have driven (!) the energy transition investment theme for a few years. Investment continues to grow, reaching a record $2.1 trillion in 2024, an 11% climb.

But more investment in mines is also forecasted as we get to 2030 and beyond:

- BHP sees $250 billion for copper

- Benchmark estimated $54-116 billion for lithium

Despite warnings that the transition has lost steam, over 17 million EVs were sold globally last year.

Another RECORD.

Now there’s an additional demand source in AI.

Uranium noticed. Mine production is insufficient to meet nuclear reactor needs – a structural deficit.

Prices in 2024 reached a 6-year high.

Among many experts and investors the sentiment is bullish. Sprott sees “accelerated investment in both AI-driven applications and nuclear energy infrastructure as their synergies become more apparent.” So many more voices agree.

All in all, this looks like the perfect storm.

Minerals are essential to our future. AI brings a new opportunity to invest in alignment with your highest convictions, betting on a better tomorrow.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.