Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

Today, we’ve got wars and commodity moves coming up, plus deals, companies and the meme of the week.

Let’s dig in:

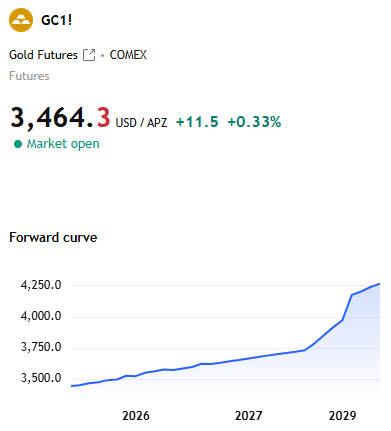

- Gold is poised for renewed strength as Israel airstrikes on Iran, re-igniting fears of a broader conflict in the Middle East. Could very well rise beyond the latest all-time high, if this escalates further.

- Copper should see a quiet week. While downwards pressure could be expected after the conflict, lower output (mainly attributable to stability issues that caused a revised guidance at Ivanhoe’s Kamoa Kakula in DRC) is likely to cancel out those forces.

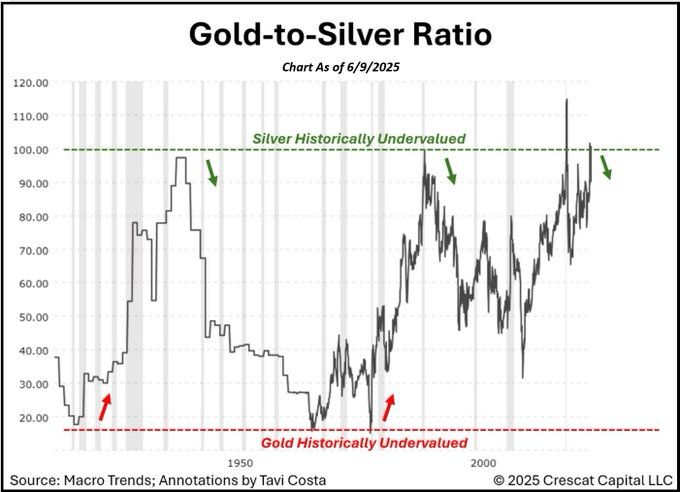

- Silver is getting a lot of attention recently as the gold-silver ratio is again showing silver as undervalued. Time to grab some more silver?

- But beware… Jefferies says that rising Middle East tension also implies some volatility more broadly among mining stocks.

- Economic indicators: FDI in China, US rate decision (w/expectation of hold)

- Argentina’s former president Cristina Kircher has exhausted all instances in her corruption trial and is set to start her 6-year sentence (and lifetime ban on holding public office) this week. Bodes well for investment in the country (and for the MANY copper hopefuls currently progressing like McEwen Copper).

But that’s not all…

ICYMI

Keen on the big themes in metals and mining?

Looking for investment opportunities?

Companies

Deals, capital raising and IPOs

- Dundee Precious Metals $DPM to buy Adriatic $ADT in $1.25B deal

- Perpetua Resources $PPTA secures $400M equity financing for Stibnite project in Idaho

- Upcoming/recent IPOs:

- Linq Minerals Limited $LNQ is set for a listing on ASX via A$10M raise; their focus is copper-gold in Australia. Alpine Capital, Bell Potter are joint lead managers and price on listing to be A$0.20/share.

- Axo Copper Corp. $AXO listed on TSX-V. They hold a copper project in Mexico

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

Normally, we expect to see a lift in targets and weakness in acquiring parties. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Discover

- OR Royalties $OR > shared updates on held royalties

- South32 #S32 > makes additional Investment in American Eagle $AE

- St George Mining $SGQ > kicks off 10,000m drilling program at the Araxa #niobium project in Brazil

- Fortuna Mining $FVI > completes C$8.2M investment in Awale Resources $ARIC

Whether you are bullish on gold or not, I think this is unquestionable:

Gold exposure across portfolios globally remains laughable.

As more mainstream investors seek to protect their ‘normal’ portfolios, gold is poised to benefit and expand.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, plus our own research. Figures always shown in US dollars unless clarified.