And there is a funny reason…

This niche mining market was recently valued at $3.5 billion/pa, forecast to grow by 30% by 2030.

Here’s your Niobium 101 to better understand this unique sector:

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

To start, it has a bit of an identity crisis

The primary mineral for niobium is columbite (or niobite).

Thus, you might have heard its other name, columbium.

And this all leads to its buddy…

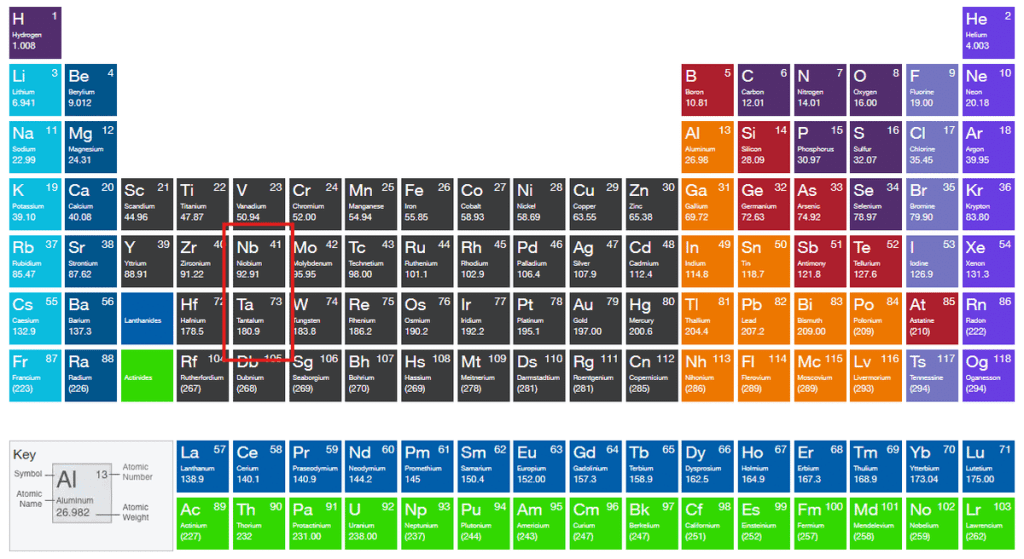

Tantalum’s neighbour*

In the periodic table, niobium lives directly above it.

They share many characteristics, commonly found together, ergo nicknamed ‘coltan’ (columbite-tantalites):

- niobium-dominant (columbite) and

- tantalum-dominant (tantalite)

*This is not the only association you’ll want to know, though. I’ll get to that in a sec

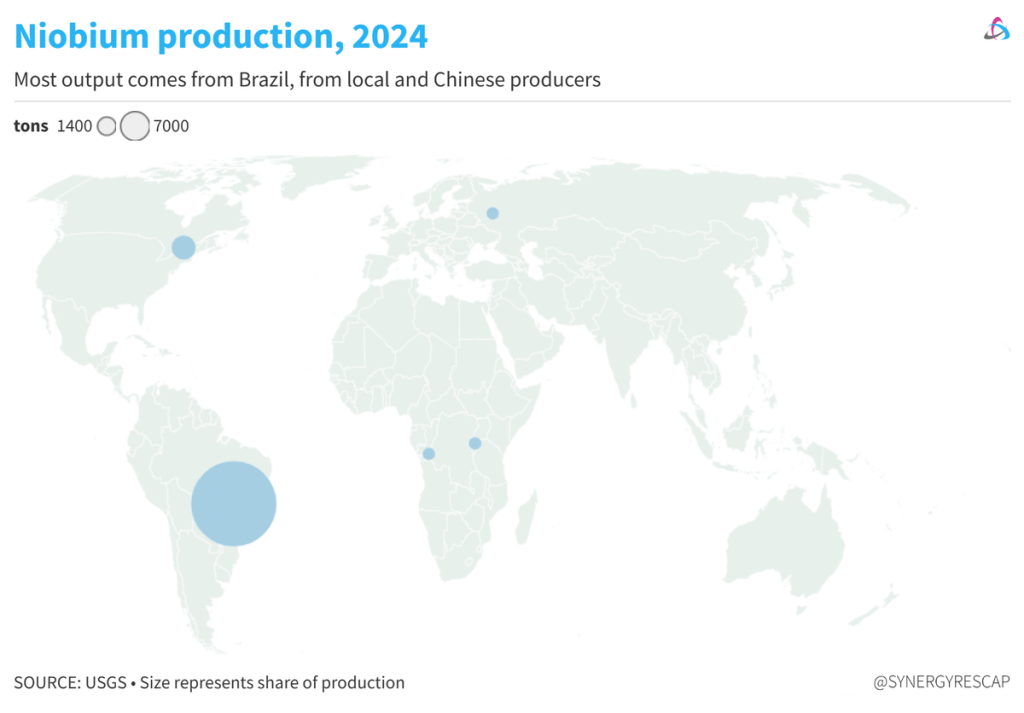

Brazil dominates the market

Over 90% of supply comes from Brazil (with CBMM the dominant supplier), which also boasts the largest reserves.

Canada is the very distant 2nd producer.

The US hasn’t had any production since the 50s, but it’s 3rd in reserves.

📊 @USGSMinerals

Several deposit types

Primary

- Carbonatites: Niobium-bearing minerals like pyrochlore. Eg. Niobec and Oka (Canada)

- Alkaline/peralkaline rocks: In granites, syenites, and related types. Eg. Dubbo (Australia)

- Pegmatites: in columbite and tantalite

- Grades ~0.5-0.7% Nb2O5

Secondary, or supergene (enriched)

- Probably derived from the former by the leaching out of carbonate minerals. Contains iron oxides, phosphate minerals, barite, quartz and bariopyrochlore. Grades may be 2-10x of primary carbonatite. Eg. Araxá, Catalão (Brazil), Mt. Weld (Australia)

- Placer: accumulations in alluvial or elluvial settings, often associated w/hard rock mineralisation

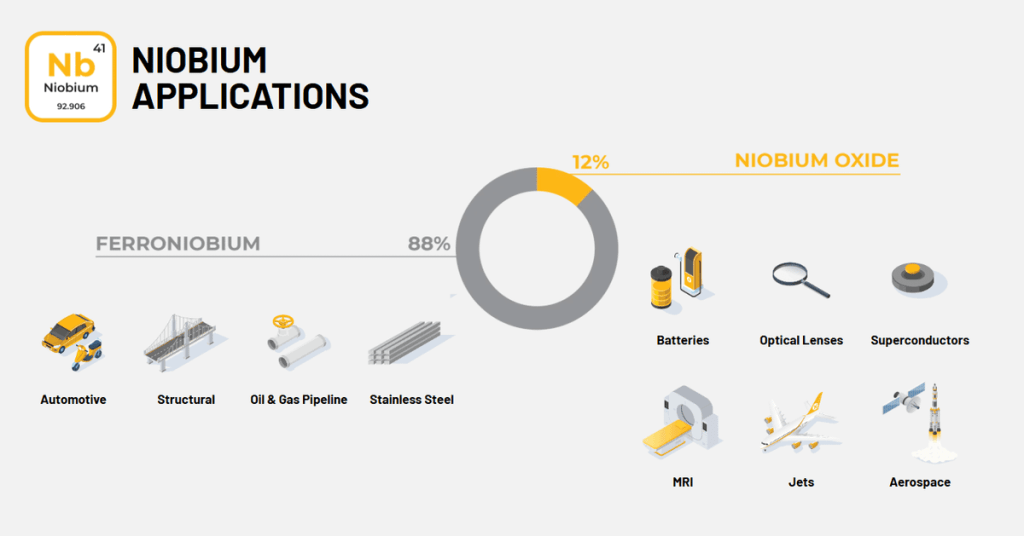

A myriad of uses, 2 end products

Niobite has applications in aerospace, construction and the medical industry.

It has been deemed critical in many countries as essential component in high-strength corrosion-resistant low-alloy steels and superalloys and due to supply risk.

Produced into:

- Ferroniobium

- Niobium oxide

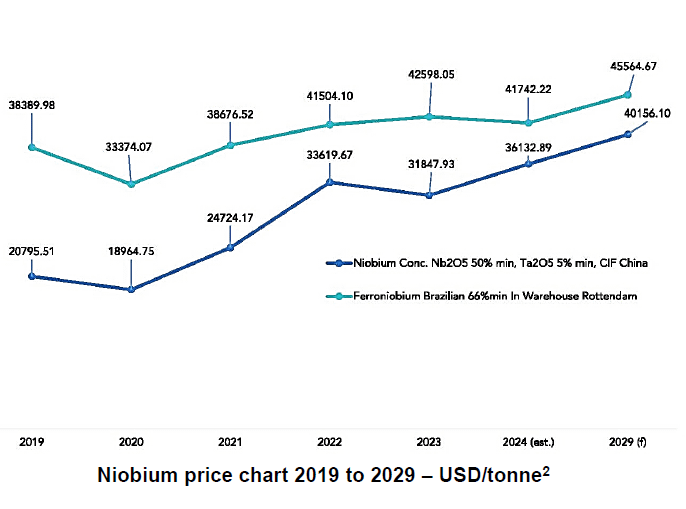

Price is trending upward

Slow and steady, prices seem on a good footing, without crazy swings.

After enduring lithium’s growing pains, this looks good to me.

Private hands

Gaining exposure via listed companies is a bit of a problem.

Most production comes from private players. $IAG sold the only Canadian mine for $530M.

But there are options among explorers/developers:

$SGQ #WA1 $REE $GBE

And here’s the kicker:

Not REE but so close…

Niobium, while not a REE, is often found in association with rare earth deposits, along with other elements including zirconium and yttrium.

It can thus be a co-product/by-product of REE extraction, especially in certain types of deposits like peralkaline rocks, carbonatites.

And that’s all for today!

We can think of niobium as inverse kryptonite! Making everything much stronger.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.