Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

Global copper demand is forecasted to increase by 70% over the next 25 years, with other critical minerals chasing behind. To get there, the investment required may be as high as $2 trillion.

But here’s the thing.

Supply may not come from where you’d expect:

Here’s what $BHP said about investment:

“We estimate the total bill for all expansion capex from 2025-2034 to be around a quarter of a trillion US dollars [$250B] (in 2024 real dollars). This represents a significant increase from the previous 10 years, where the total spend on copper projects was approximately US$150 billion.”

More broadly, BloombergNEF said in their Transition Metals Outlook that the industry will need $2.1 trillion by 2050 to meet the raw materials demand of a net-zero emissions world.

Despite a decade of growth, availability remains insufficient to meet the rising demand.

At the centre of this expected bottleneck is time.

Mines take, on average, over 16 years from discovery to production. Way too long!

With grassroots exploration at a historic low (as per S&P data, we looked into that here for copper), this will only exacerbate needs and push prices higher (and higher prices can lead to bubbles -like lithium in 2022- and substitution).

This shows how corporates are being extremely careful to allocate to the riskier side of the lifecycle.

This will not end well if it continues dropping.

I think there’s a substantial opportunity to pivot portfolios, hidden here.

But let’s put a pin on it for a sec – here’s what we’re paying attention to this week:

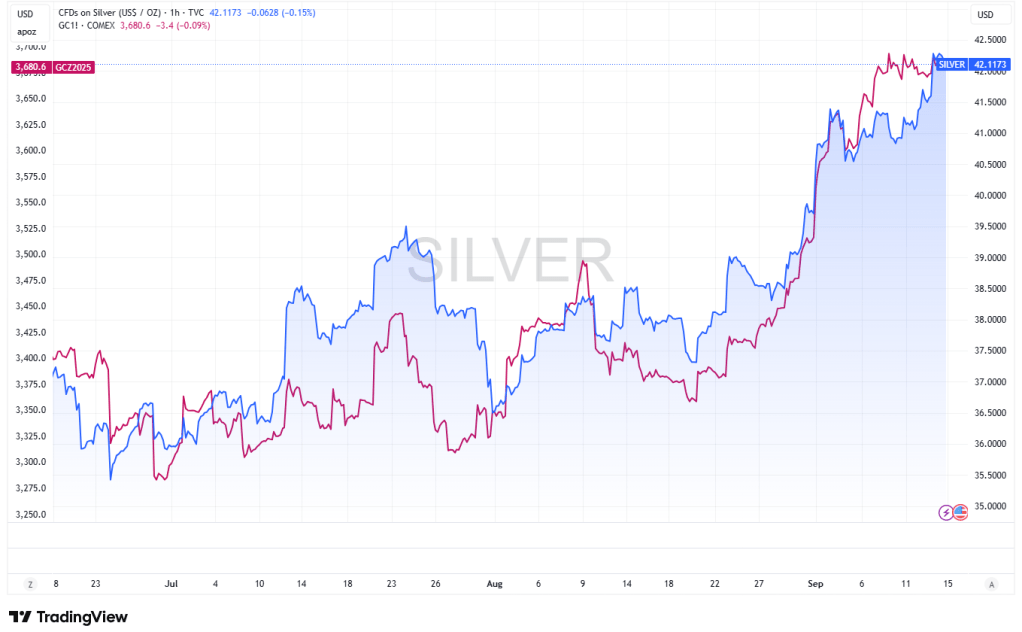

- Gold and silver rally continues: Gold hit $3,650/oz, and silver reached $41.20/oz, driven by expectations of multiple Fed rate cuts. Analysts now forecast gold to test $4,000/oz in 2026, with silver potentially breaking $50/oz. Central bank buying and dollar weakness are reinforcing bullish sentiment. In addition, ANZ raised its year-end gold price forecast to $3,800/oz; said prices could peak at ~$4,000 by mid next year on robust investment demand for bullion

- Copper steady but risks loom: Copper futures are hovering around $4.58/lb, up 2% month-on-month and 10% year-on-year. Supply remains tight, with China’s September output down 5%, and Freeport-McMoRan’s Grasberg mine still offline due to safety concerns. Inventories at the LME are 40% below the five-year average. JP Morgan remains cautious, expecting a multi-month destocking cycle in the U.S..

- Lithium sentiment rebounds: After a 90% price drop since 2022, lithium is showing signs of recovery. CATL’s mine shutdown in Jiangxi and an explosion at Albemarle’s La Negra plant in Chile triggered an 8% surge in futures. UBS raised its 2026–2028 spodumene price forecasts by up to 32%, citing supply risks. Lithium carbonate is trading around US$11,388/ton, with expectations of US$13,980/ton in 2025.

- Rare earths bullish: Prices for NdPr, dysprosium, and terbium surged due to aggressive procurement by manufacturers. Terbium metal now trades at ¥8.85M/ton, with oxide prices up 5–20% since August. Sentiment-driven buying is outpacing actual demand, but supply constraints remain a concern.

- Uranium momentum builds: Uranium demand is forecast to rise 30% by 2030 and 100% by 2040, driven by nuclear energy expansion and AI-related power needs. Spot prices are nearing $77/lb, with Citi forecasting $100/lb in 2026. U.S. and European utilities are signing long-term contracts, and new refining capacity is planned in New Mexico and France.

- Economic calendar: This week, we are waiting for the FOMC meeting (with a rate cut widely expected), US CPI, Industrial Production, Canada policy announcement, and EU rate decisions. National holiday in Chile.

- Regulatory: 50% tariffs on semi-finished copper products, steel and aluminium settling in, and de minimis exemptions removed for all countries. Luckily, gold, tungsten, and uranium are exempt. This all boils down to higher costs for imported machinery and components for new developments and mine expansions. Strategic realignments and supply chain diversification are underway.

Meanwhile…

These companies are making bold moves.

Deals, capital raising and IPOs

- Barrick sells Hemlo mine in Canada for $1.1 billion as it continues to leave its former gold self behind

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- PC Gold $PC2 is set for a listing on ASX via A$8.5M raise; their focus is gold in Queensland and New South Wales, Australia. Bell Potter Securities are lead managers and the price on listing will be A$0.20/share.

- Rio2 Limited $RIO, a Chile-focused gold developer, has upgraded to the TSX.

- Pecoy Copper Corp. $ALK is now also listed on TSXV. They are a copper explorer focused on Peru, currently worth over C$1.1B.

Normally, we expect to see a lift in targets and weakness in acquiring parties, and often, peers to targets get some extra love, providing some arbitrage chances. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

Announcements and rating updates

- ST GEORGE MINING LIMITED $SGQ announces first RC assays, delivering high-grade REE and niobium intercepts; US strategic alliance for Araxa rare earths project, paving the way for fast commercialisation >> read

- McEwen Mining Inc. $MUX reports encouraging results for new high-grade gold zone at Windfall Project in Nevada >> read

- Fury Gold Mines Limited $FURY intercepts 59m of 1.59g/t gold and 1.5m of 546g/t silver at the Sakami Gold Project in Quebec >> read

- Newmont $NEM raised to outperform and price target raised by RBC >> read

- Agnico Eagle Mines Limited $AEM confirms further investment in Maple Gold Mines >> read

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Member content

Going back to today’s topic…

There’s no easy solution here. But, in our view, there’s a huge opportunity to progress smaller projects… shovel-ready… and leaner, agile management teams to fill the gaps.

These groups, often shunned by these big institutional investors, can:

- produce significant amounts

- navigate permitting quicker, often with stronger local relationships

- shorten the investment horizon for investors, fixing the duration mismatch, thus allowing more generalists to join in

Still aiming to produce quickly, ergo investors can benefit from cash flow in the short term, plus lower valuations leave room for substantial appreciation. You’ll find some of these discussed on our channel.

Food for thought.

Where do you stand on this one? Would love to hear.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

Extra resources

From the blog

What I’m reading

If you enjoyed this…

- Invest more confidently with Mining Investing 101

- Become a member for weekly opportunity alerts and access to the whole vault

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, NASDAQ, LSE and SRC research. Figures shown in US dollars unless clarified.