Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

A few months ago, we did an in-depth video discussing where we saw mineral commodities headed, and also posted my short & long-term sentiment for everyone to see. So far… so good!

It’s time to make an update, so here’s my current sentiment in a nutshell. Just to shake things up, let’s think about each set as actors in a movie. Because… why not!

The stars

Not much has changed here. As I said before, I remain bullish short + long term on these, and in this order:

- Copper: the absolute king, long-term demand is now emboldened by the massive infrastructure required for AI data centers (like OpenAI’s Stargate), even if the energy transition takes longer.

- Gold: A fragmented, chaotic world means gold will continue to do well. We said $3,500 at the beginning of the year, and look where we are!

- Silver: same reasons as gold, plus more industrial uses. Ka-ching.

The supporting cast

These commodities have a strong future, ergo long-term fundamentals, so we’re bullish long-term. The main caveat is that these need patience to recover and active portfolio management, given current weakness and volatility.

- Lithium: other technologies continue to advance, but we think li-ion will remain the prevalent type of battery, generally, this decade and maybe even the next decade. We’ve lived through a few booms and busts already, so we feel much more comfortable weathering the storm. It will come back in favour, but I hope not to the insane levels of 2021. I wrote more about this here.

- Uranium: we need more and more energy, and nuclear is finally getting a true second chance. Let’s do this.

- REEs: We added REEs earlier this year, and what a ride already. With a complex geopolitical world that views China as a ‘mean girl’, the West needs to be serious about supply. Brazil will surge as well as other ex-China sources (with some help from governments). More on this here.

The extras

These guys cannot catch a break… Bearish (for the foreseeable future):

- Cobalt: I learned a (painful) lesson when I jumped on this a few years ago, only to see it implode and honestly, I don’t see it changing, and if anything, I think cobalt content will continue to be reduced in batteries.

- Nickel: Indonesia to keep dominating with cheap stuff, mines shut down, just not fun to invest in. Staying well away.

- Graphite: I said before that, despite initial excitement, natural vs synthetic was making too much noise in my head and that I’d ponder a tad longer. I did, and couldn’t find enough to get excited. Then this happened…

Granted, it may not fully become widespread, but it screams ‘Stay away!’, for me.

I think this is all hinting at a grand finale bigger than life.

But let’s put a pin on it for a sec…

What we’re paying attention to this week

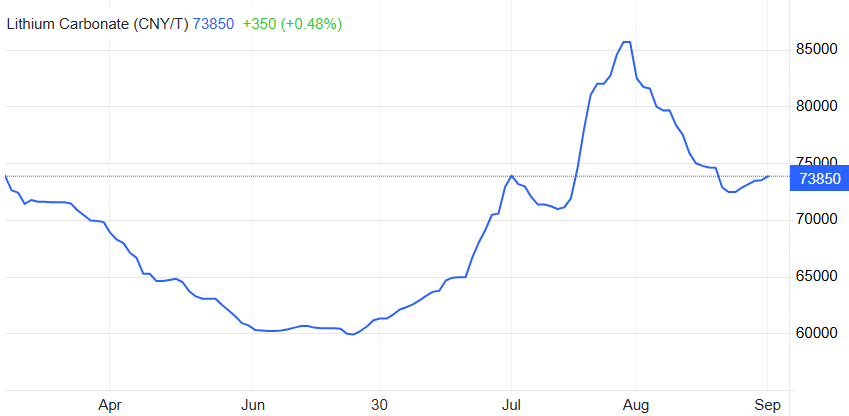

- Lithium sentiment mixed, prices volatile: Lithium carbonate prices rebounded slightly this week to CNY 73,500/t ($10,575/t), but remain down 14% month-on-month. CATL’s Jiangxi mine is reportedly restarting, UBS and Benchmark see upside risk for 2026–2027, but near-term pricing remains under pressure.

- Copper steady, but volatility risk remains: Copper futures are holding above $4.55/lb, up 3.4% over the past month. Chilean output is rebounding, but J.P. Morgan expects a “multi-month destocking cycle” in the U.S. as tariffs unwind and Chinese demand slows. The LME premium over COMEX has narrowed, but policy risk remains. Consensus 12-month price target: $5.16/lb.

- Gold and silver rally on Fed cut bets: Gold is consolidating just below $3,700/oz. Silver is holding above $42/oz, with analysts watching for a breakout above $42.45. The market is pricing in a 100% chance of a Fed rate cut this week, with further easing expected. Consensus sees gold testing $3,800–$4,000/oz by year-end, silver targeting $43/oz.

- Rare earths and uranium: bullish undertones Rare earth prices are up sharply on procurement-driven sentiment, with NdPr and terbium up 5–20% since August. Uranium spot is at $76.65/lb, with Citi forecasting $100/lb in 2026. Supply disruptions at Cameco and Kazatomprom are tightening the market, and U.S. utilities are signing new long-term contracts.

- Economic calendar: PMI in Australia, EU, UK; inflation data in Australia; BHP, Rio, Fortescue dividends incoming.

- Regulatory: Trump’s “Liberation Day” tariffs are now in effect: 10% on nearly all imports, 25% on steel/aluminium, 50% on semi-finished copper. Critical minerals (lithium, rare earths, gold, uranium) are mostly exempt, but supply chains for mining equipment and chemicals face higher costs. Chinese export restrictions on 6 heavy rare earths to the US remain in place, with new permit requirements for exporters. Congo to end cobalt export Ban in October, but set to introduce quotas.

Meanwhile…

These companies are making bold moves.

Deals, capital raising and IPOs

- Newmont sells entire Orla stake for $439M

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Desert Minerals $DSM is set for a listing on ASX via A$5M raise; their focus is gold and lithium in desertic regions in Australia and North America. Canaccord Genuity is the lead manager and the price on listing will be A$0.20/share.

- River Road Resources Ltd. $RRRL, a Canada-focused explorer, is now listed on TSXV.

- On LSE, Richmond Hill Resources PLC plans a $3.3M RTO.

- Anfield Energy $AEC was approved to begin trading on NASDAQ last week.

Normally, we expect to see a lift in targets and weakness in acquiring parties, and often, peers to targets get some extra love, providing some arbitrage chances. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

Announcements and rating updates

- Newmont Corporation $NEM sells Yukon project to Fuerte Metals for up to $150M in cash and script, marking the end of their portfolio streamlining program >> read

- ST GEORGE MINING LIMITED $SGQ reports major REE and niobium discovery 1km east of the existing resource at Araxa >> read

- NGEx $NGEX receives court approval for spin-out of royalties >> read

- Atico Mining $ATY announced entering into an investment protection agreement (IPA) with the government of Ecuador >> read

For more, join +40K and follow us on socials

Going back to today’s topic…

Estimates point to over $2 trillion by 2050 to meet the raw materials demand of a net-zero emissions world. Add the AI layer on top, and we’ve seen nothing yet.

The future is mineral-intensive. We’ve got some transformative decades ahead.

Any way you dice it.

Oh… just in case, I’m not saying this is what you should think, it’s just where I sit. Or to wrap up the analogy, it’s how I see the movie ending. At least, part 1. I reckon the sequels will be solid gold (ha!).

Where do you stand on this one? Would love to hear.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

Extra resources

From the blog

Member alert

What I’m reading

If you enjoyed this…

- Invest more confidently with Mining Investing 101

- Become a member for weekly opportunity alerts and access to the whole vault

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, NASDAQ, LSE and SRC research. Figures shown in US dollars unless clarified.