JP Morgan and Morgan Stanley recently announced BOLD initiatives.

Trillions of dollars of investment in key areas and commodities, led by the US.

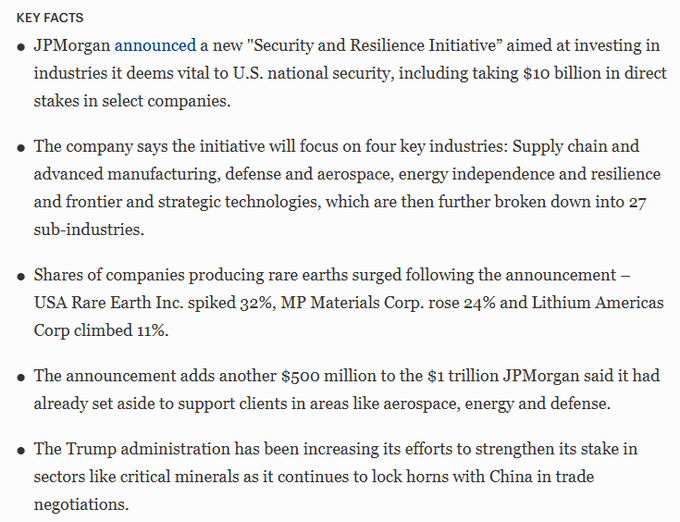

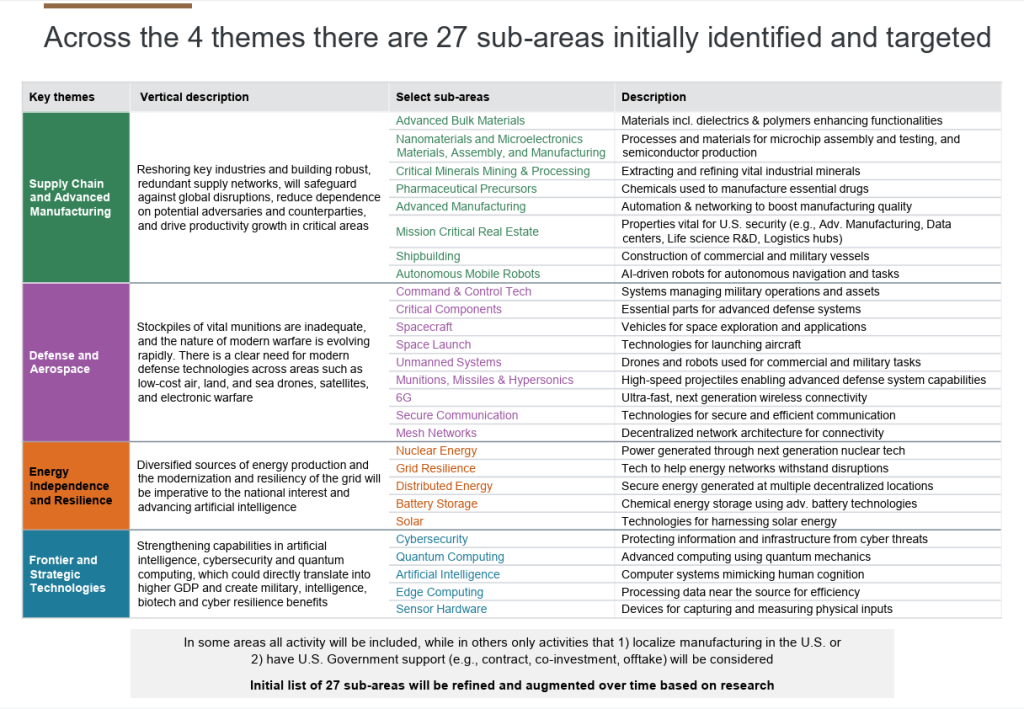

JP Morgan $JPM announced a new “security and resilience initiative”. They aim to accelerate investments that enhance resiliency and drive innovation across industries in the US and around the world.

- 10-year plan

- $10 billion in direct investments

- $1.5 trillion set aside to support clients in aerospace, energy, defence and other areas

And here is the rationale behind the decision:

While reshoring is the thread that ultimately connects it all, they see 4 themes.

- supply chain: mining, processing, materials

- defence + aerospace: stockpiles and communication

- energy independence and resilience: nuclear, batteries

- frontier and strategic technologies: cyber, quantum

US + allies also considered.

They plan to hire, use long-standing relationships, and an external advisory council of experienced leaders from the public and private sectors to guide this long-term strategy.

The initiative will include special, thematic research on private companies and supply chain management issues related to rare earths, AI and technology.

“Hopefully, once again, as America has in the past, we will all come together to address these immense challenges. We need to act now.”

—Jamie Dimon, CEO

Meanwhile…

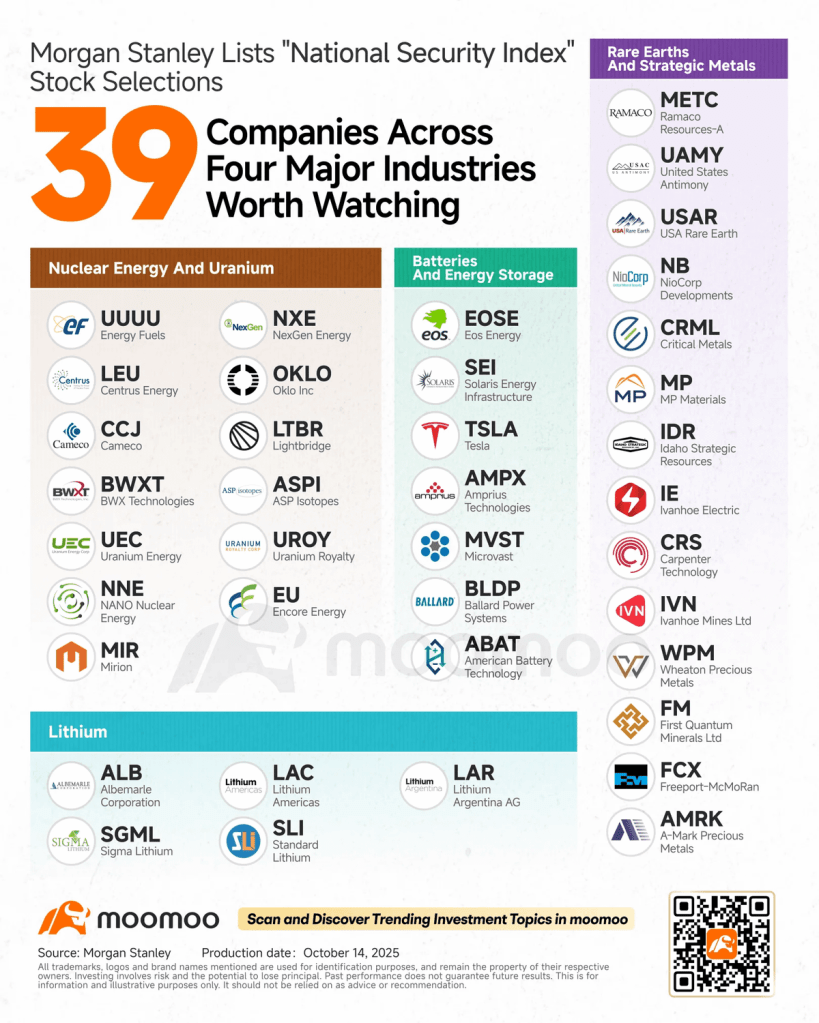

Morgan Stanley $MS highlights opportunities in specific mineral commodities and stocks emboldened by the “Trump Trade.”

They launched a “National Security Index” with 39 stocks in these areas:

- nuclear power and uranium

- lithium

- rare earths and strategic metals

- batteries and energy storage

(Are these the best choices? My take in a second)

The Trump trade is proving extremely profitable for those with investments in these commodities. Happy to be one of them.

I did say that it was bullish in Jan, but honestly, I didn’t think it was going to be this wild.

But I digress. Let’s break down each of the 4 areas:

1. Nuclear energy is going through a glow-up moment.

First, it was the energy transition; now the challenge is powering AI.

The index has $CCJ $UUUU $OKLO

Uranium is central, of course, but also energy generation and related technologies.

2. Lithium is at the core of the batteries we use daily and will remain the dominating battery technology for the rest of the decade and likely next.

The index lists $ALB $LAC $LAR (we hold)

3. Rare earths are vastly dominated by Chinese mining and refining, and have been for ages.

The West has timidly attempted to shift, but not much progress was made until this year.

$MP $NIO are in the index

Guess what? REEs have a best friend…

Motors function thanks to electromagnetism, used literally everywhere. They need both copper and REE.

Plus copper is the backbone of electrification and without it, slim chance of transporting energy where you need it.

The index includes $FCX $FM and $IVN

4. Batteries and energy storage are essential for electrified transport and to take full advantage of renewable energy generation.

The index includes $TSLA and several other battery players.

Now… are these 39 stocks the best options for each area?

Not necessarily… the truth is always nuanced.

These 39 are considered the best US-listed companies; most have US production/operations.

Many, like $MP have overperformed global peers, deemed perhaps overvalued, yet the trend is set to continue (with pullbacks, I reckon).

But important to note that these initiatives can’t guarantee 100% success in the short term.

E.g. the US intended to buy up to $500M in cobalt, but the tender was cancelled, after extending deadlines several times. Maybe no one could fulfil the requirement.

How did we get here?

Because the US (and much of the West) became complacent.

- Too much NIMBY, let China deal with the environmental impact (all industries have impacts, and mines carry their share of risks)

- Delays in granting permits

- Vilifying miners

So here we are.

In any event… This is just the beginning.

For this to work long term, the strategy needs to be sustained.

A quarter or a year of work is not long enough for meaningful progress; we should aim for ‘from now on’.

A true shift.

The future is mineral-intensive. We’ve got some transformative decades ahead. If we dare.

And that’s it for today.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

*Sources:

https://www.jpmorganchase.com/newsroom/press-releases/2025/jpmc-security-resiliency-initiative