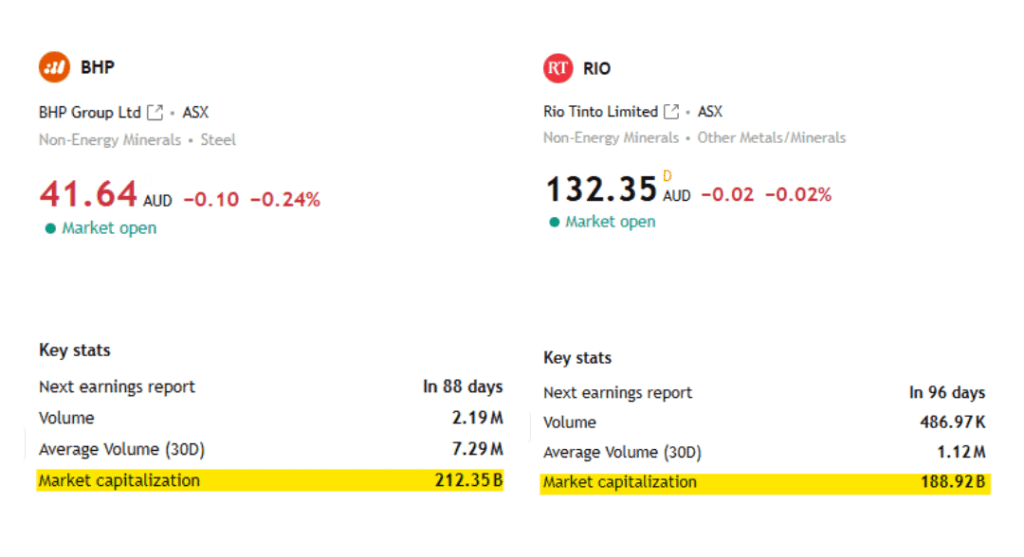

BHP & Rio Tinto are the world’s largest mining companies, with $261 billion in market value*, combined.

As leaders, their outlook is a crucial signal for investors.

Here’s what they see ahead for copper:

BHP views long-term fundamentals as favourable.

They cite 4 key commodity demand drivers (with a slight adjustment from previous stance):

- traditional growth (population/economic)

- energy transition

- substitution/thrifting

- digitalisation (data centres, AI)

But here’s the crux:

‘A decarbonising world amplifies the need for mining’.

In fact, these trends will drive demand for decades, particularly for:

- steel

- copper!

- uranium

- potash

They expect persistent volatility in commodity prices but…

They don’t see swings altering the long term outlook.

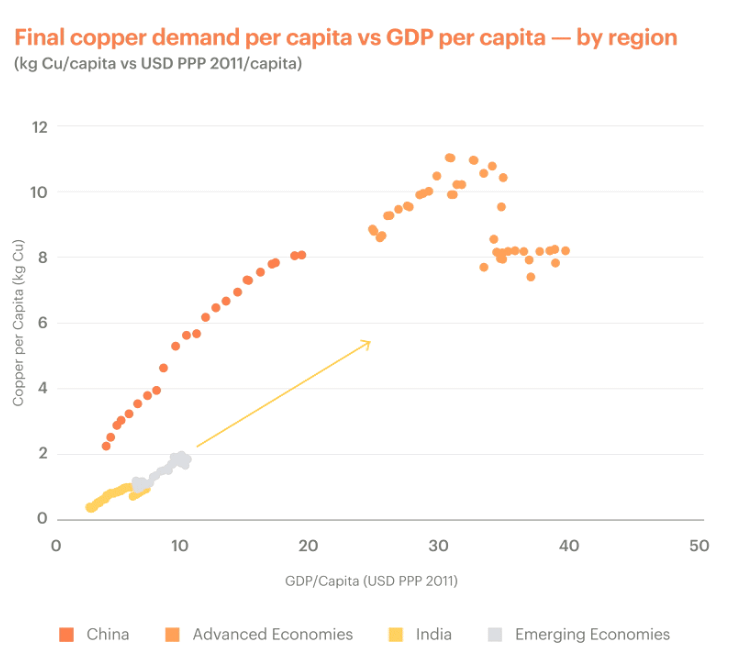

As infrastructure investment accelerates and manufacturing expands, metals intensity is likely to rise sharply.

They affirm copper pricing is “moving into a phase of durable outperformance”.

(strong 2025!)

In 2026, BHP expects a copper market broadly balanced.

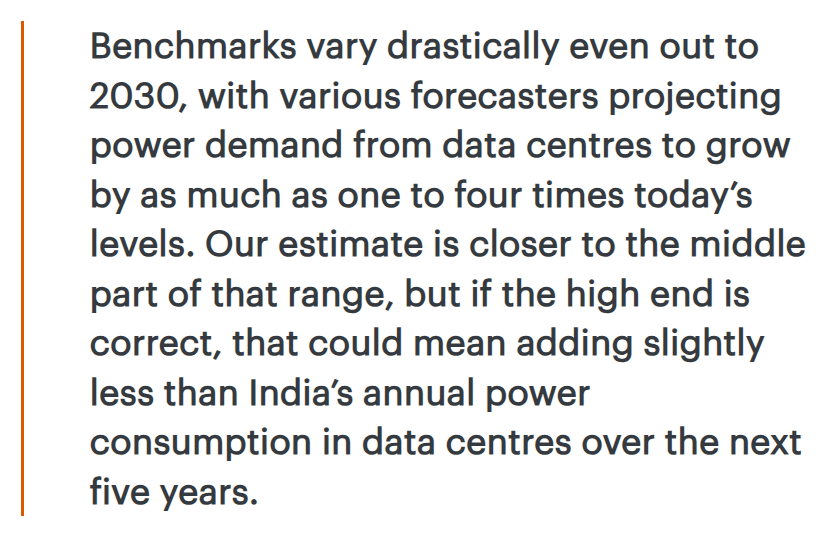

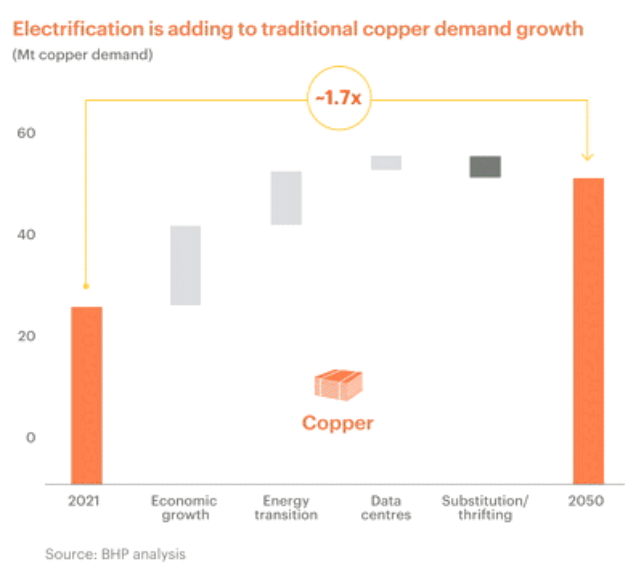

Deceleration in electrification may be partially offset by higher-than-expected power demand growth from digitalisation.

Supply chain resilience measures across jurisdictions, strategic stockpiling may continue to provide further upside.

In fact, IEA projects installed data centre capacity to grow by 2.3x by 2030, with ~60% in Europe/North America (regions w/most deceleration in energy transition spend).

BHP cautions that uncertainty in the digitalisation space is significant.

(e.g. $NVDA OpenAI shenanigans)

They believe global demand is expected to grow from 32MT to over 50MT by 2050, 2x over the next 30 years.

Accordingly, $BHP produced 2MT for the first time, up 28% over the past 3y, becoming the largest copper producer, with the largest copper resource base.

But guess what?

Challenges are compounding.

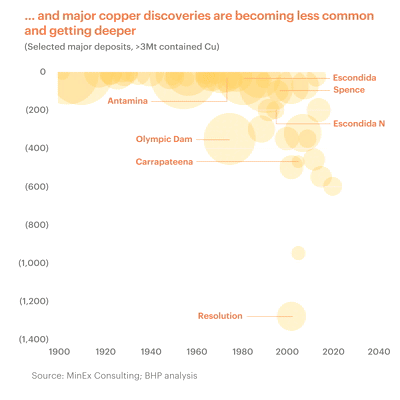

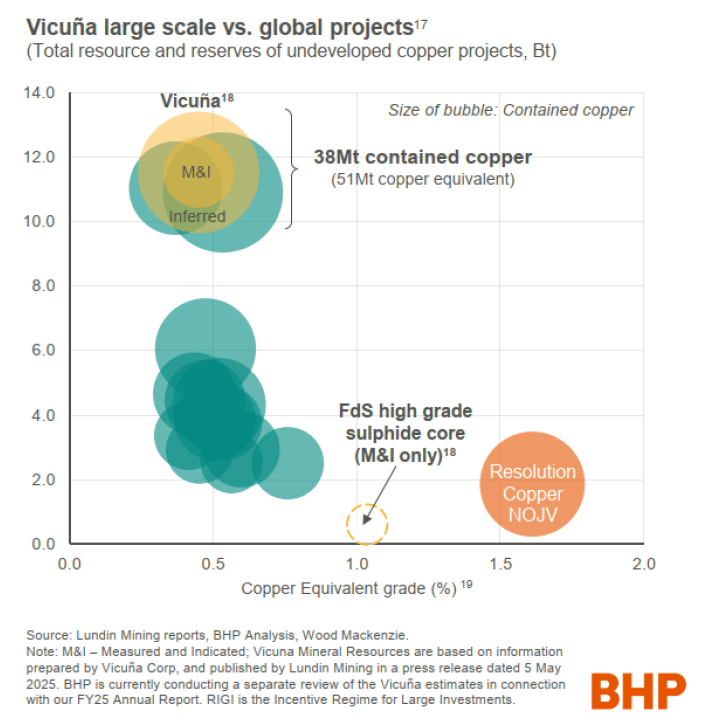

Economically viable copper is hard to find.

Major deposits are less common and found deeper and deeper. With depth, mines become more expensive and technologically complex (even if somewhat easier to permit, at least from the social license perspective).

So, they are also leaning on M&A.

This enabled their return to Argentina where they joined forces with Lundin $LUN in the massive Vicuña district.

With the $AAL fail, I reckon more acquisitions are coming.

Probably targeting smaller deals, could be Azules $MUX

Meanwhile…

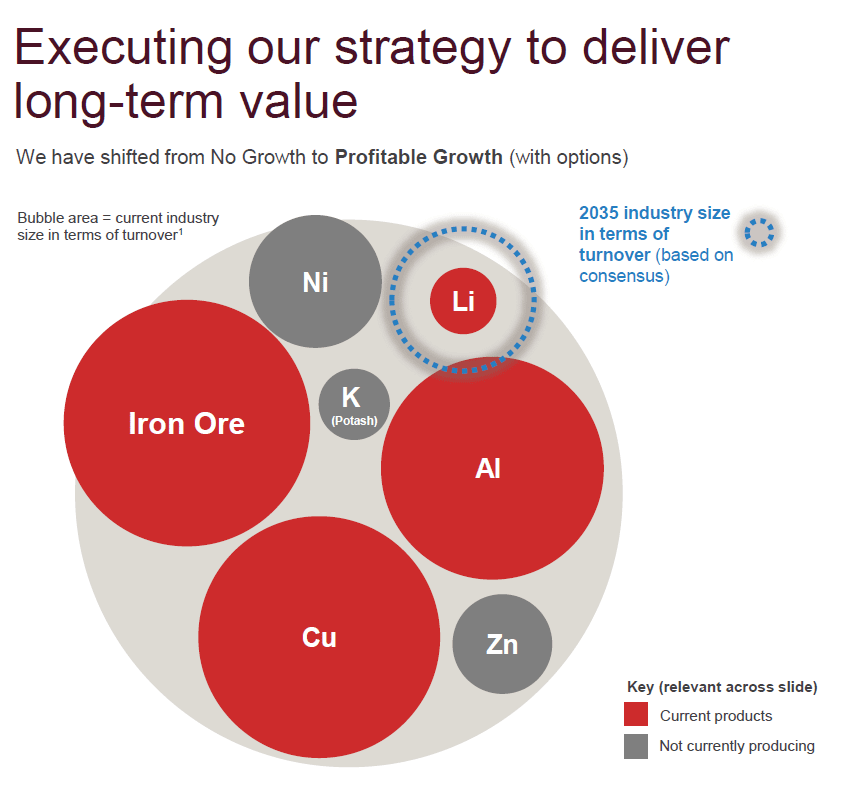

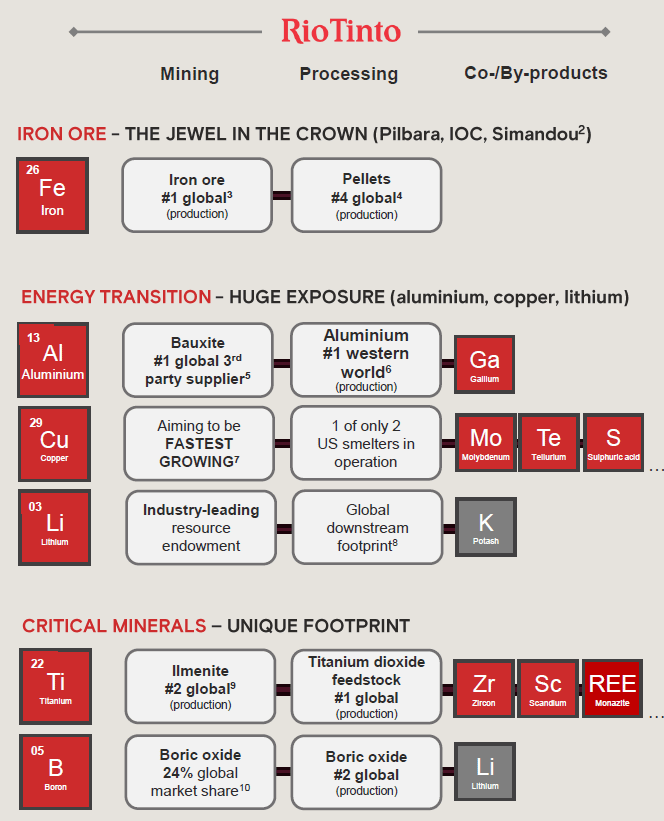

$RIO also bets on a strong future.

They expect total commodity demand growth to continue, including in:

- steel

- aluminium

- copper

- lithium (w/big growth expectations)

And their rationale is similar but simpler.

3 trends of focus:

- energy transition, large exposure to aluminium, copper and lithium

- critical minerals, unique footprint including titanium

- iron ore

They continue on track for ~3% CAGR production, 2024-2033.

And here’s the kicker.

These two leaders are JV partners in Resolution, a proposed underground mine in Arizona.

It was discovered over 2 decades ago. $2 billion spent, expected to be producing by now, but faces opposition from aboriginal communities.

This deposit would bring ~40b lbs, with a juicy 1.5% Cu grade.

Among stalled projects, I reckon this one has the best shot to be greenlit over the next 3 years.

You’ll find links to both $RIO and $BHP insights at the end of this thread if you’d like to read the fine print and dissect their assumptions.

And that’s it for today.

Both BHP and Rio have a crucial role to play in driving this unprecedented growth globally. We’ll likely see more investment and M&As from these majors.

PS: they both had a good 2025

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Figures in USD unless noted.

*up from $250 billion (2023) and $238 billion (2024). It’s been a GOOD year

**Elon Musk said in Tesla’s 2023 AGM that we’d be mining less 😎

***from 2021 figures

Sources:

💻 Rio Tinto: presentation | all presentations

💻 BHP: outlook