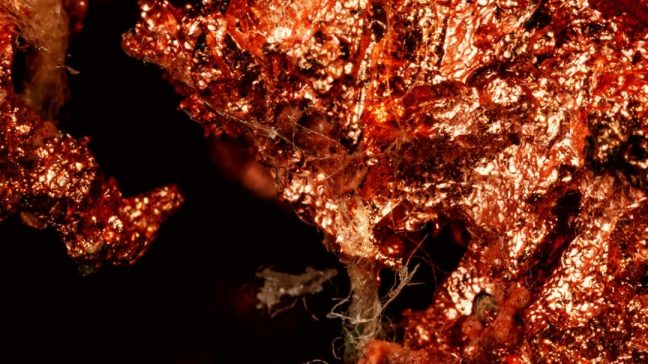

Nuclear remains deeply controversial. Yet recent geopolitic struggles have reignited the flame sending uranium (and many related stocks, producers and explorers alike) higher. There are many reasons to be bullish:

The truth about uranium investing is peeking through… and here’s why you should care