JP Morgan just did something remarkable.

No, I’m not talking about First Republic Bank.

They released a note on copper with crucial insights on what’s coming ahead for investors.

Here are your key takeaways:

Refined copper demand:

• Forecasted to grow by a CAGR of 2.5% over the next decade (vs 2%).

• Over 32MMT by 2033, or 7MMT higher than 2023 forecasts.

Energy transition demand:

• To grow by a CAGR of 11% from 2.5MMT this year, to 8.5MMT by 2035.

Copper intensity of GDP & energy transition:

• In developed regions such as North America and Europe, forecasted to reverse a decades-long fall.

• China is set to continue significant declines but slowing down.

• Globally, continuing to move sideways to 2035.

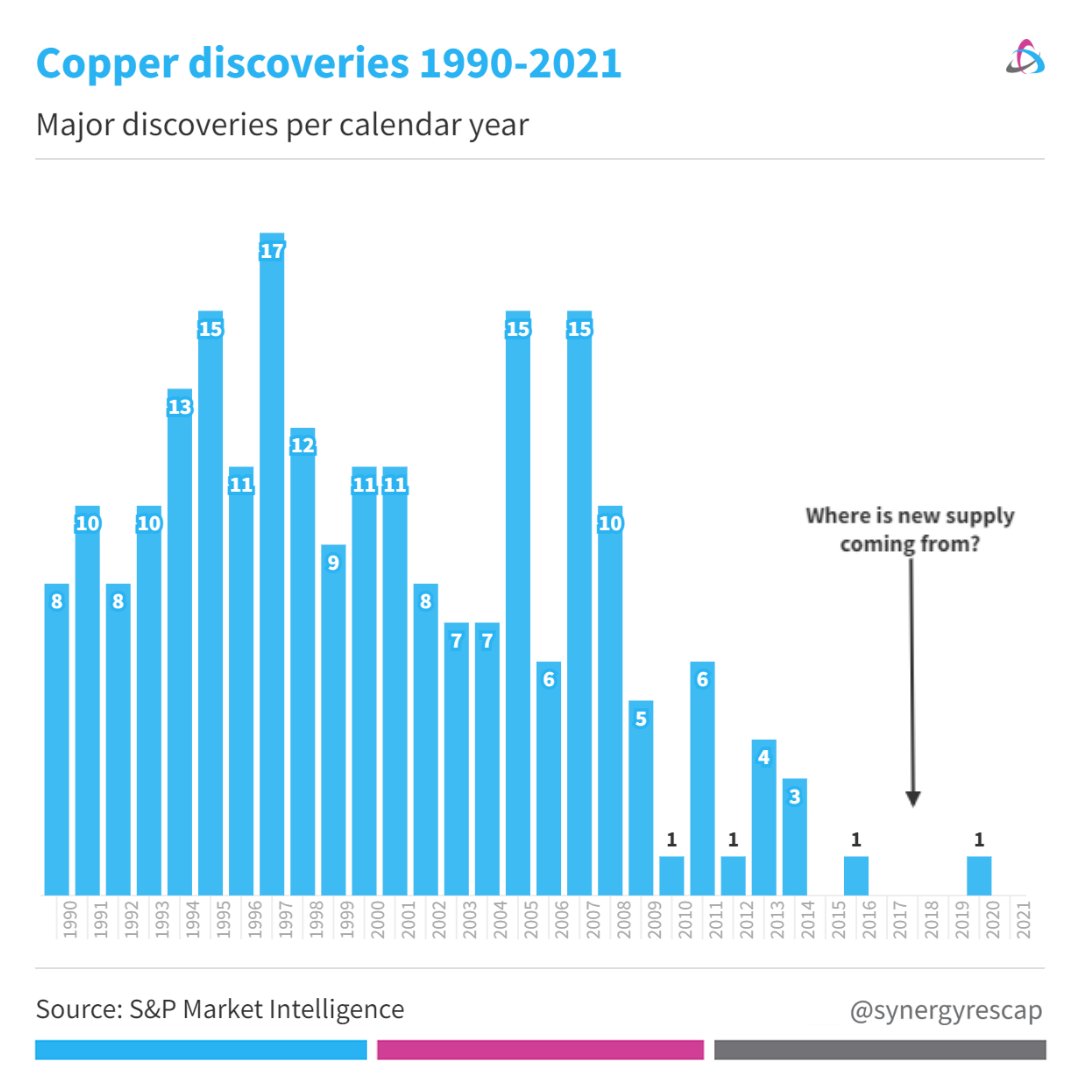

10-year forward supply gap:

• scrap usage partially offset declines in mine supply, yet gap ~7.4 MMT, with deficits accelerating.

• larger-than-normal but not unprecedented…

But, hold on…

What’s different now?

• Low pipeline of advanced-stage projects coming onstream delayed by:

• Tech: Declining grades, deeper deposits plus water scarcity.

• Other issues: Long permitting timelines, ESG, political and royalty environments.

📊 @SPGCIMetals | @synergyrescap

Copper price:

• Incentive price range sits at $8,500/mt ($3.9/lb) to $9,500/mt ($4.3/lb).

• Higher prices have brought more approvals over the last 2y, but…

• ~70% of projects were cheaper/easier (brownfield).

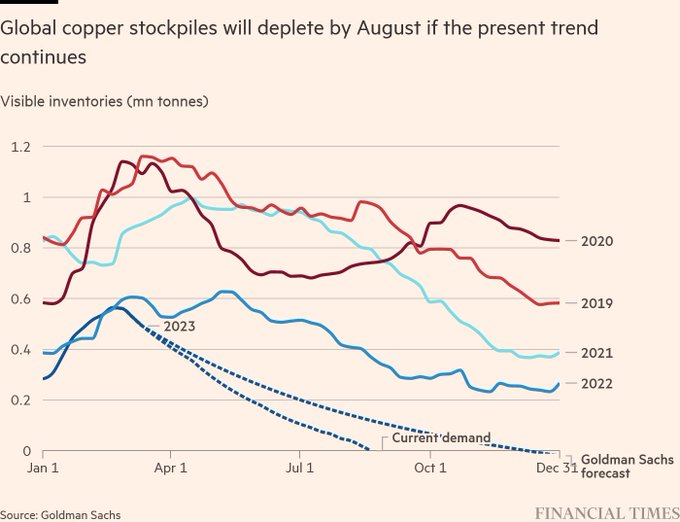

Main risks ahead:

• Lead times for large greenfield projects significantly extending

• Continued low inventories

All of this comes down to:

New capacity may not come online quickly enough to satisfy growing demand.

And that’s it for today.

There’s no decarbonization without copper.

Billions of dollars need to flow into the exploration, development and construction of new mines.

And quickly.

In a nutshell, copper is truly the king (even if it’s not being crowned this weekend)!

If this was interesting or useful to you, I’d truly appreciate if you could retweet the start of the thread.

Follow me @paola_rojas for more on metals, minerals and related M&As.

But wait!

PS: We also discussed this with Lucho Saenz in a recent podcast if you’d like a more nuanced discussion:

And…

And here’s another thread on copper you may enjoy!

Now I’m done. Have a great weekend!

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.