Warren Buffett is bullish on copper.

Wait… what?

Yes.

I reviewed materials and video from Berkshire Hathaway’s annual shareholders meeting in Omaha.

So here’s how:

Berkshire Hathaway is a sprawling empire that holds dozens of businesses, both privately owned and listed.

Yet the jewels of the crown are 3:

• Berkshire Hathaway itself, the insurance business + investments

• BNSF Railway https://www.bnsf.com/

and one more…

Meet Berkshire Hathaway Energy.

This is a directly controlled entity.

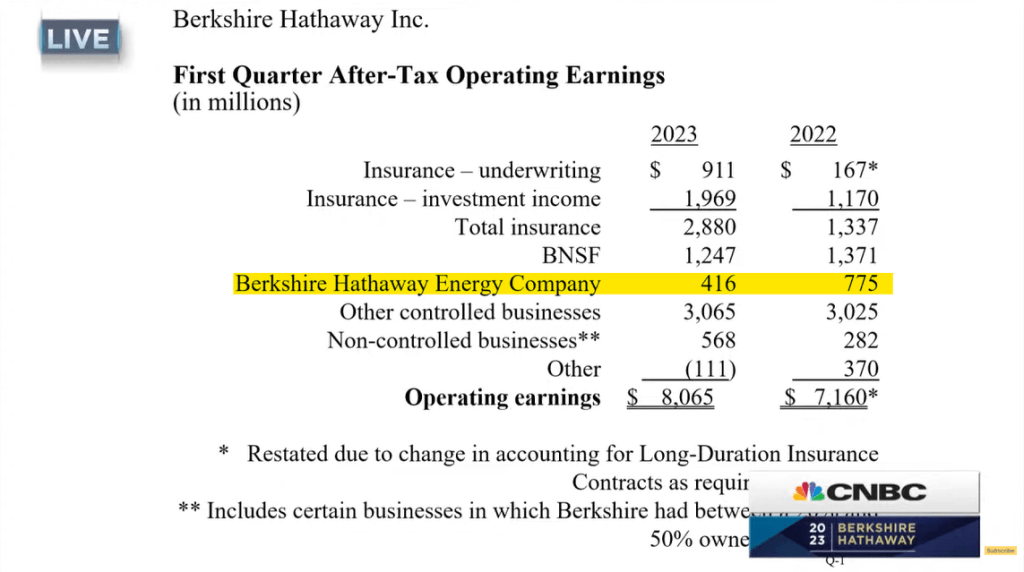

Berkshire Hathaway Energy‘s operating earnings after tax were $416B in the 1st quarter of 2023 (vs $775B in the same period in 2022) or 5% of all BHI earnings.

Why is this relevant?

To answer we need to break down BHE.

BHE has a similar structure as BHI.

It holds a variety of businesses but BHE is fully focused on energy including renewables, non-renewables and transmission.

In transmission they own:

NV Energy

PacifiCorp

AltaLink

BHE US

https://www.brkenergy.com/energy/transmission

The phrase below is proudly displayed in this website.

The operative word here for us is ‘grid’. We’ll get back to that in a second.

Let’s review each company in more detail:

NV Energy

Developing Greenlink, a transmission initiative to transform Nevada’s clean energy by tapping into resource-rich renewable energy zones throughout W/N Nevada and increase reliability.

Est cost $2.8B

PacifiCorp

Plans ~2,365 miles of new high-voltage transmission lines through 2027, an investment of ~$11B.

PacifiCorp already placed in-service 575 miles of a new $2.3B transmission line in the Energy Gateway project.

AltaLink

Essential capacity as Alberta moves to renewable energy.

In 2015, AltaLink’s 350-km Western Alberta Transmission Line became the first in-service DC line in Alberta, adding 1,000MW of capacity to Alberta’s electric system with the ability to increase to 4,000 MW.

BHE U.S. Transmission & BHE’s JV

$3.2B of transmission assets in operation or under construction in Texas and Kansas.

BHE U.S. Transmission and its strategic partners also were chosen to build a new transmission line in California.

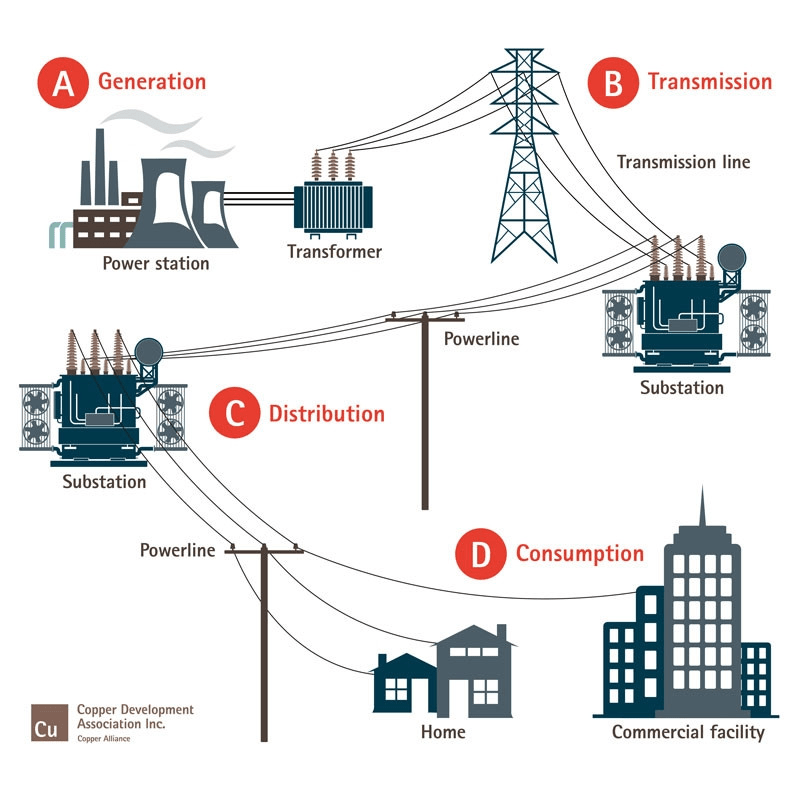

So we’re talking about the grid (in US/Canada).

Guess what goes into it.

You know this one.

COPPER!

🔗 https://copper.org/environment/sustainable-energy/grid-infrastructure/

Here’s a snippet from @thinkcopper on the US network.

🔗 https://copperalliance.org/wp-content/uploads/2022/02/ICA-IR-IndustryGrid-202202-R2.pdf

So did he come out and say it?

🧐

No, he didn’t.

Anticlimactic, you’ll say.

So BHE may not be investing in copper directly.

But wait… here’s the thing…

They need & will continue needing a lot of copper.

In fact, heaps (a technical term btw 😁).

And I believe they are gearing up for what’s coming.

Greg Abel, BHE chair, has been selected to succeed Warren!

Someone with a deep understanding of energy and the grid.

And they are keen on other related critical minerals and metals too, not only for the grid…

BHE was investigating producing lithium carbonate from geothermal in California, in 2020:

But plans fell through:

https://www.reuters.com/markets/us/us-steps-away-flagship-lithium-project-with-berkshire-2022-10-05/

That’s it for today.

The greatest investor of all time may be the biggest copper bull we’ve ever known.

Even if he doesn’t say it openly.

After all, ‘actions speak louder than words’, don’t they?

But don’t leave yet…

You may also enjoy this thread where I break down JP Morgan’s recent views on copper.

OK, now I’m done!

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.