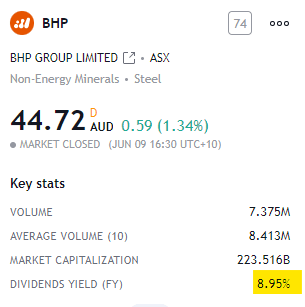

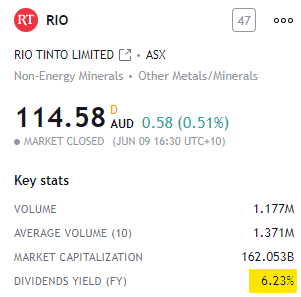

BHP and Rio Tinto are the world’s largest miners.

Together represent ~$250b in market value.

Recently, they shared outlooks at the Bank of America Global Metals, Mining & Steel Conference in Barcelona.

Here are your key takeaways, investor:

BHP views long-term fundamentals to be favourable.

Global commodity demand to be supported by:

– population growth

– urbanisation

– rising living standards

And they project the economy to grow 2.5x by 2050.

They stress that ‘a decarbonising world amplifies the need for mining’.

(Sorry, Elon but more mining is needed*)

And estimate a growing demand for commodities, particularly for:

1) steel

2) copper

3) nickel

4) potash

(they don’t produce lithium)

But here’s the crux:

The sector has been underinvesting for over a decade.

At some point, a reckoning is coming…

Capital will need to flow.

$BHP puts the total required investment for copper at ~$250b by 2030.

(that’s the same as the combined value of these 2 miners!)

But this is not news for them.

They have been saying this for a while.

They actually expect we’ll need 2x as much copper over the next 30 years, compared to the previous 30 years.

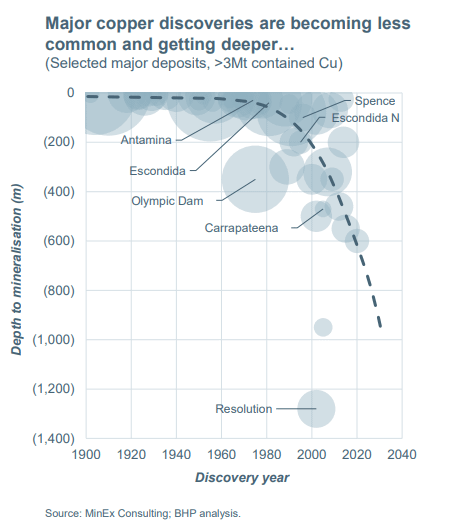

They know copper is hard to find.

They have some of the largest mines in the world.

(including Escondida -dad was part of the discovery team and I visited as a kid-.

Major deposits are less common and are being found deeper and deeper.

(deeper = more expensive)

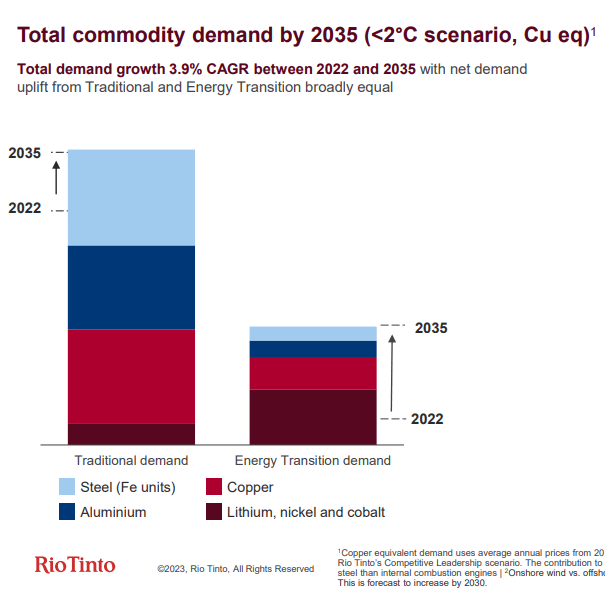

$RIO also sees a strong future.

They expect total commodity demand growth to reach 3.9% CAGR between 2022 and 2035 with equal growth in traditional and energy transition.

Including:

– steel

– aluminium

– copper

– lithium, nickel and cobalt

They are not alone…

To put it in perspective, JP Morgan sees this figure at 2.5%, albeit only for refined copper.

Either way, this is BIG.

Also, Rio sees both steel and copper at the core of decarbonization.

And to put these figures in context for investors, here are details for quantities used in:

– wind turbines

– solar panels

– EVs

You’ll find links to both $RIO and $BHP presentations at the end of this thread if you’d like to read the fine print and dissect each assumption.

And that’s it for today!

Both BHP and Rio have a leading role in driving this unprecedented growth. As demand expands, we’ll likely see more investment and M&As from these majors.

PS: their dividend yields are still tasty

*Elon Musk said in Tesla’s latest AGM that we’d be mining less – that ain’t happenin’ 😎

Presentations, @bofa_business conference:

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.