ETF activity is on the rise.

Global ETF trading reached $53.8T in 2022, largest on record.

With such growth, thematic ETFs that focus on the energy transition are providing more alternatives for investors.

Here are 5 leading ETFs for you to consider:

Some clarifications:

- 5 buckets

- overlaps will always exist

- list had positive returns for the last 5y, 3 since inception

- though ETFs are best for beginners, experienced investors can use them to enter a new sector

(also my suggestions to find more aligned ETFs in a bit)

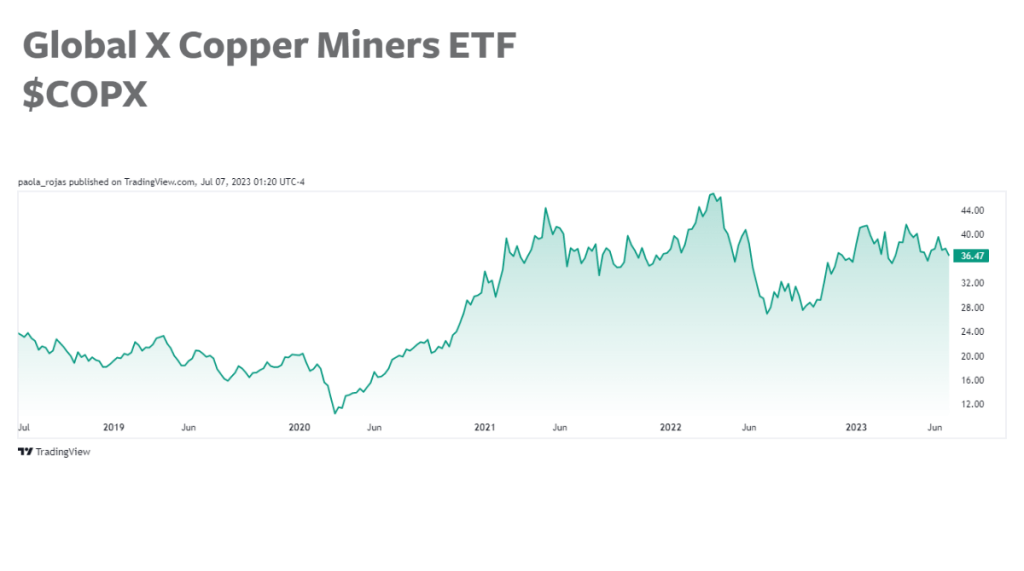

1) Mining & metals / Global X Copper Miners ETF $COPX

Targeted exposure to an essential input in EVs, energy storage, and infrastructure.

Net assets: $1.47B

Exp ratio: 0.65%

Top holdings:

- Lundin Mining

- Grupo Mexico

- Ivanhoe Mines

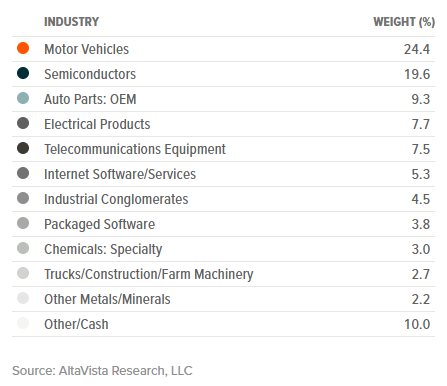

2) Automakers / Global X Autonomous & Electric Vehicles ETF $DRIV

Global exposure to EV makers and related technologies aiming to contribute to net zero targets.

Net assets: $0.905B

Exp ratio: 0.68%

Top holdings:

- NVIDIA

- Tesla

- Apple

3) Battery Tech / Global X Lithium & Battery Tech ETF $LIT

Invests globally throughout the lithium cycle, including mining, refining and battery production.

Net assets: $3.2B

Exp ratio: 0.75%

Top holdings:

- Albemarle

- Tesla

- Panasonic

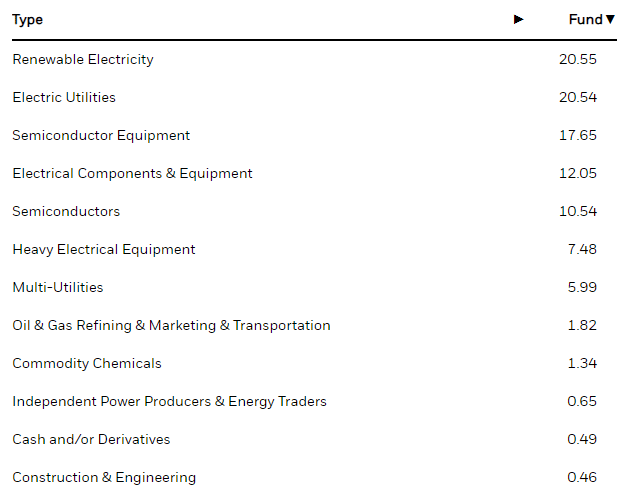

4) Clean Energy & Tech / iShares Global Clean Energy ETF $ICLN

Gives access to companies producing energy from solar, wind and other renewable sources plus related tech.

Net assets: $4.2B

Exp ratio: 0.4%

Top holdings:

- First Solar

- Solar Edge Technologies

- Enphase Energy

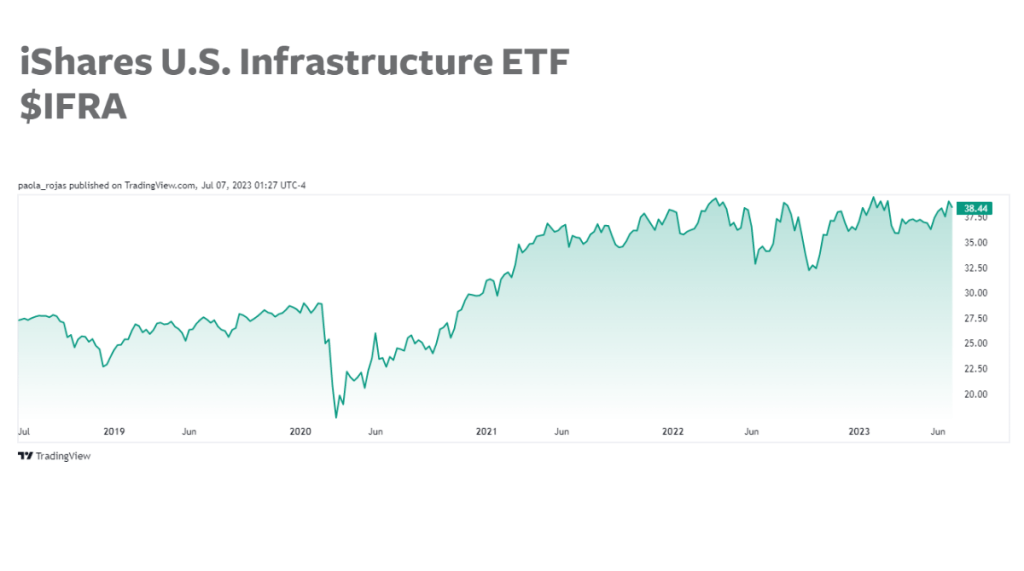

5) Infrastructure / iShares U.S. Infrastructure ETF $IFRA

Includes owners/operators of railroads and utilities, plus enablers, such as materials and construction, US-only.

Net assets: $1.83B

Exp ratio: 0.3%

Top holdings:

- Greenbrier

- NRG Energy

- MGE Energy

(sources to follow)

Now, I see these 5 buckets as ‘building blocks’ that can fit with different types of investors and criteria, and still be part of the energy transition theme.

While overlap exists, variety also allows for precise alignment.

Keen to identify more ETFs?

Ask yourself this:

Which buckets do you…

- Understand better?

- feel comfortable investing given your values, interests, and investment experience?

E.g. some don’t support nuclear or mining (scroll for something on that), others have jurisdictional preferences.

Once you know, I’d suggest…

Looking for options here:

- Mining: critical minerals, base/precious metals, uranium

- EV/Battery Tech: innovation, semiconductors, storage

- Clean energy/Tech: solar, wind, hydrogen, nuclear but directly

- Infrastructure: global/domestic,, utilities

(More on values/experience soon)

And that’s it for today!

To succeed, the energy transition needs more metals and minerals than we produce, a fundamental energy shift, and massive amounts of capital.

An exciting opportunity for investors.

Using ETFs to get started is a brilliant shortcut.

Dig deeper:

- 2022 for ETF https://www.nasdaq.com/articles/global-etf-market-facts%3A-three-things-to-know-from-q4-2022

- $COPX https://www.globalxetfs.com/funds/copx/

- $DRIV https://www.globalxetfs.com/funds/driv/

- $LIT https://www.globalxetfs.com/funds/lit/

- $ICLN https://www.blackrock.com/us/individual/products/239738/

- $IFRA https://www.ishares.com/us/products/294315/

QUICK NAVIGATION

Question to ask or topic to request?

Comment below and we’ll include it in future subscriber content.

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.