Major players such as BHP and RIO have been saying this for a while.

The amount of metals and minerals required for the energy transition is massive.

Only 1 thing to do: more investment.

Here are 5 basic strategies to start (or expand) your allocation:

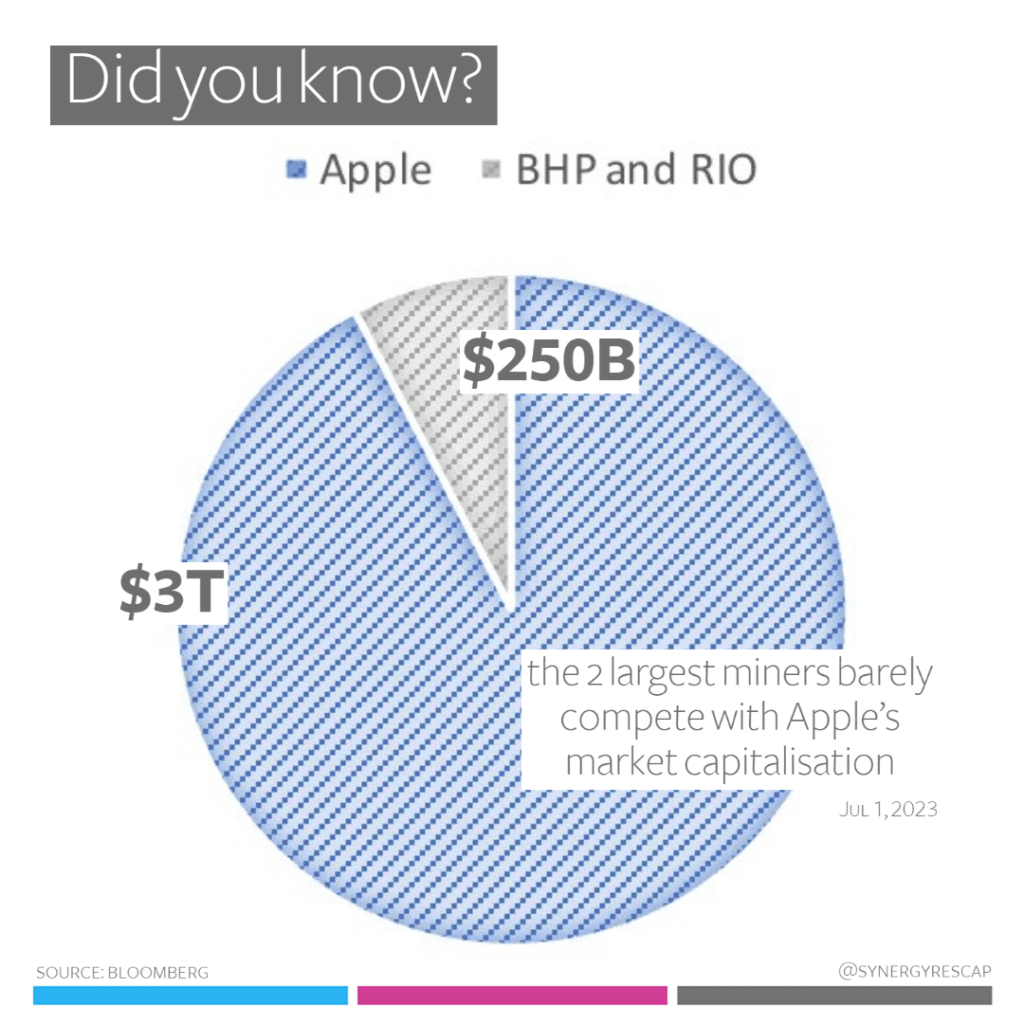

For reference, even the largest miners can’t hold a candle to big tech.

Earlier this month, $APPL reached $3T while these titans were only $250B combined.

(I’m including a full breakdown of BHP/RIO’s outlook in a sec)

Now, let’s talk about these strategies.

1) Miners and explorers

Investing directly in mining and metals is my preferred choice given this is the crucial bottleneck.

The easiest for new investors is via large producers like $BHP, $RIO, $GLEN

But many more options exist.

And an allocation to exploration is ideal.

2) Automakers & Battery Tech

They buy materials, moving the wheels of the sector.

Near-term producers will be relying more on offtake contracts for future production to fund construction and less project financing so these relationships will become *rock solid*.

3) Clean energy includes nuclear* plus renewables such as solar, hydro, wind, etc.

Depending on your risk appetite:

From generation, transmission, and distribution, to related techn/ services.

Examples:

- $RAYS

- $BAM

- $CCJ @ARKinvest 🧐

*Nuclear fits, even if controversial.

4) Infrastructure

This is Warren Buffett’s choice.

You can perhaps look into $BRK (as BHE is a privately owned entity) and even local/national utilities such as $AGL in Australia.

I’d recommend reviewing their generation stats for the proportion of clean/fossil fuels used.

5) Several thematic ETFs have direct exposure to all of the above.

This gives new investors an easy way to get a balanced allocation.

Examples:

- $LITP

- $BATT

- $URA

(I wrote about leading ETFs here)

While choosing a specific bucket can give you a quick entry (especially for ETFs) you can also zoom out and try a strategy that includes several.

Also, note there’s overlap between buckets.

(I will cover more inclusive strategies in future threads)

That’s it for today!

Decarbonization needs a fundamental shift in how we produce, store and use energy, and to get there we must first invest in the materials required.

Buckets:

- Miners and explorers

- Automakers

- Thematic ETFs

- Clean energy

- Grid

*BHP/RIO’s outlook includes:

- steel

- copper

- nickel

- potash

- aluminium

- lithium,

- cobalt

And you can read my summary here:

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.