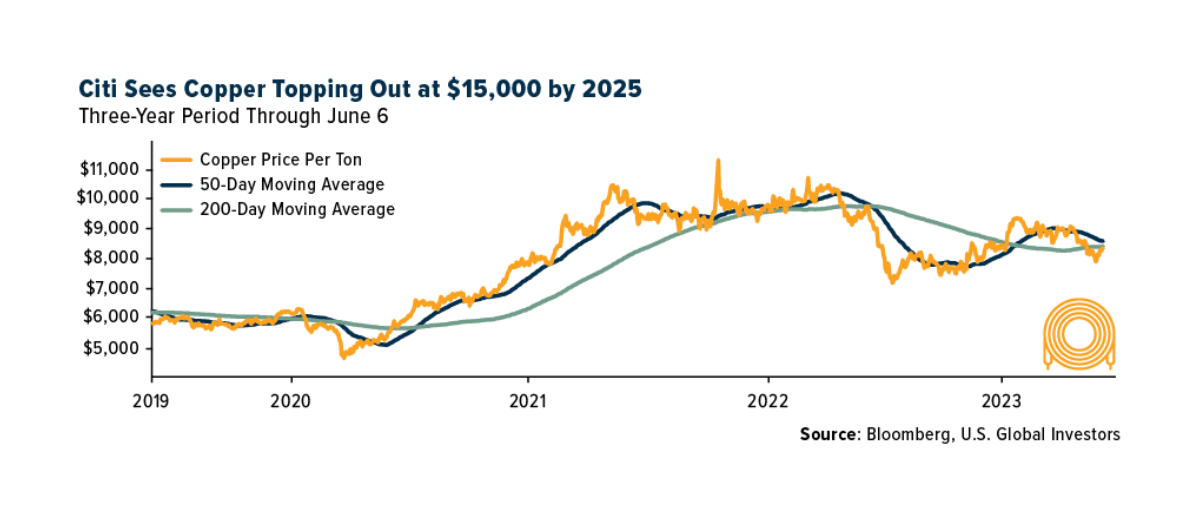

Citi sees copper on track to reach $15K/t by 2025.

This crucial metal has been subdued since an ATH last year.

Yet Citi’s outlook points to a once-in-a-lifetime opportunity for investors.

Here’s what you need to know:

To start, Citi believes investors will be piling into the copper market.

Heavily.

They think this will happen on an unprecedented scale over the next few years.

(as EVs and renewables expand in adoption and uses)

Copper is a popular proxy for global economic activity.

This year, prices have disappointed on weakening demand from traditional sectors and China’s slow recovery.

For reference, in 2022, Goldman, BlackRock and Trafigura said we’d see much higher prices.

📊 @USFunds

But copper is rising as the preferred commodity for investors looking to add (or increase) their exposure to the energy transition.

(US even made it critical)

As soon as the global scene starts to improve, capital is likely to flow quickly.

This will set the stage for…

Grid operators and carmakers to buy in.

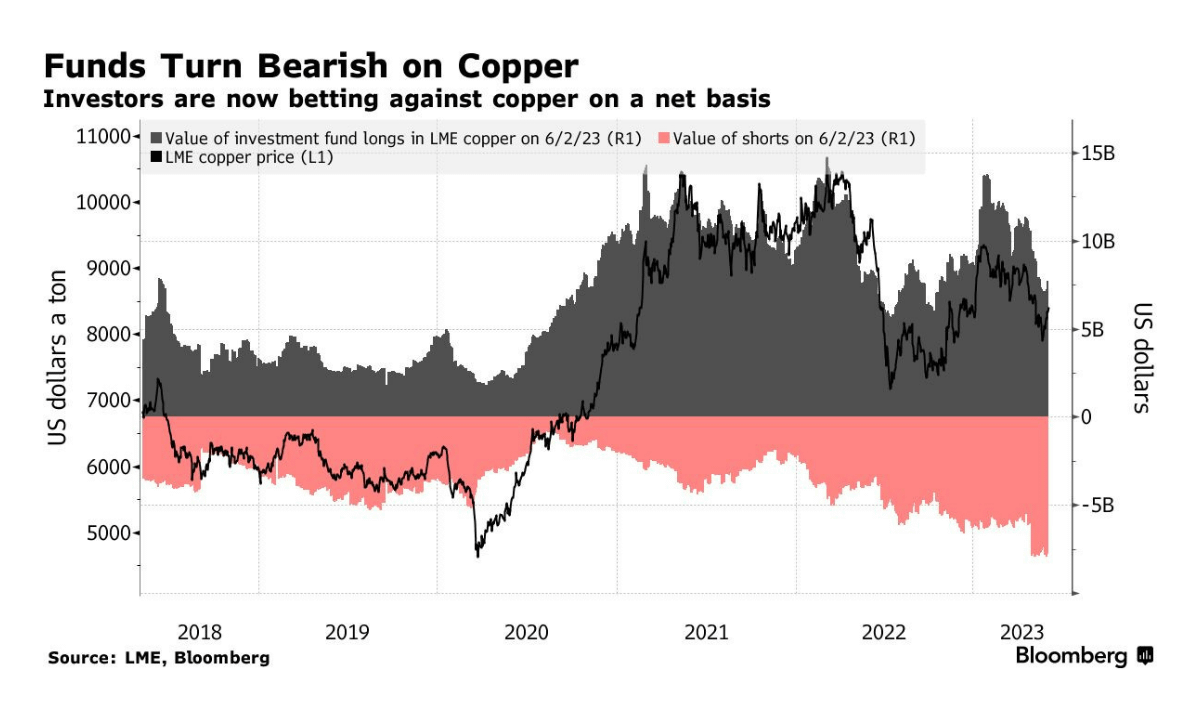

Growing allocations by index tracking and hedge funds could bring net bullish positions to 4mt by 2025, a sharp reversal from the current bearish stance.

(for reference, ~1/5 of global supply, and 2x a prior peak in 2021)

Hedging from car makers could add an extra 1mt in long positions, flushing the futures market as demands runs ahead of supply.

Citi reckons this will push copper to a record high.

Having said that, sentiment now is sour.

On a net basis, investors turned bearish (first time in 3y on the LME)

But let’s not miss the forest for the trees:

📊 @markets

🔹for a decarbonization trade, copper is the only truly liquid commodity

🔹growing warnings that the industry will fall short in coming up with extra supply as the energy transition gathers pace

🔹investors would be more bearish w/o the promising long-term demand outlook

Prices have been terribly flat for the year, but other metals have suffered much more:

- aluminium -6.8%

- zinc -20%

- nickel -30%

But of course, we shouldn’t forget risks:

Short term

🔹Further dips and volatility

Long-term

🔹Rising prices → its role as the best electrical conductor to be challenged by new cheaper conductive materials

To sum up:

🔹EV makers buzzing around to source materials, including copper, via more deals than we’ve ever seen (at least publicly).

🔹Citi sees copper rallying within 6-12mo, at $12-15K/t

🔹Unprecedented gap between demand and mine supply over the next 5-10y

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.