The top 60 automakers are worth ~$2.1T.

The top 15, led by $TSLA, account for 79%.

As the sector races to secure supply of lithium and other metals, EV-related investments skyrocketed.

The leaders are putting serious $ at play.

Here’s your recap of deals and the rationale behind them:

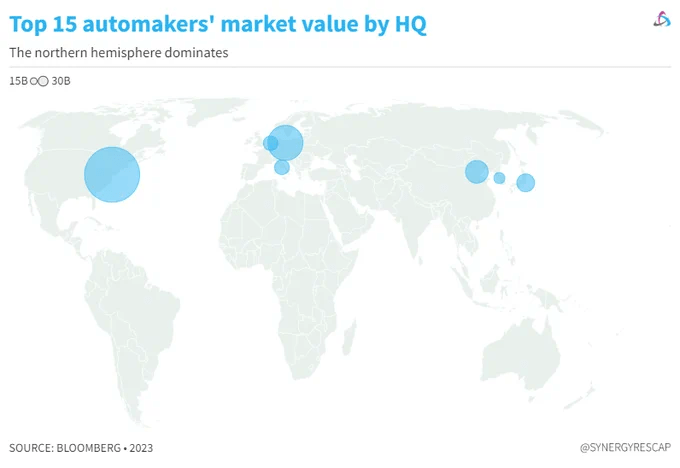

Unsurprisingly, the top 15 pack is dominated as far as number of companies goes, by traditional automakers.

Entrenched players fighting to adjust to a new world.

But in terms of value, things are more even given the sheer size of Tesla.

These companies have been actively securing materials for their supply chain, in the form of:

- Investment

- Offtakes

- Equity

This is frankly, unprecedented, both in terms of volume and strategic shift.

The most relevant deals are:

GM → $LAC + US

In Jan $GM invested $650m, now largest shareholder.

Thacker Pass gets them exposure to a US asset that benefits from the IRA + exclusive access to 40kt LCE* (2026e)

Asset had delays, a strong local partner likely helped move things along.

Others w/ $GLEN $QPM

VW → batteries + equity

In March it announced ‘partnering w/miners’, building a gigafactory in Canada.

Set up PowerCo to make batteries & buy stakes in miners for greater control, and bringing down costs.

In June, backed $1B nickel acquisition in Brazil with Glencore.

Ford → Nemaska Lithium

In May, $F and the Quebec-based lithium developer entered into a long-term lithium supply agreement.

(offtake for future supply of the chemical)

13,000t of lithium hydroxide/year**.

They also have agreements w/ ioneer, $BHP, $LTR

*LCE price is ~$34K/t

**At today’s LME 31 Aug futures price 35K/t, this offtake would be equivalent to~$461MM pa

Mercedes → ‘willing to invest’

In March they said they were able and keen on investing directly in mining companies.

They already have an agreement with Canadian-German Rock Tech Lithium for 10,000t of lithium hydroxide, enough for ~150,000 EVs.

Stellantis → copper + nickel

In Feb, paid $115M for 14.2% of McEwen Copper, private Argentina-focused, related to $MUX

In July, 19.9% of $KNI, early-stage nickel explorer focused on Norway, to ‘support European battery needs’

40% of $AXN WA nickel/cobalt production over 5y

Tesla → lithium refining

In May, $TSLA broke ground in their $1b investment for a refinery in Texas.

The 1,200+ acre site will be the location of the first industrial deployment of an acid-free lithium refining route.

Plus deals w/ $PLL $LTR etc

Porsche → Group14

In 2022 they backed a new concept, lithium-silicon batteries.

Led a $614M Series C round alongside Microsoft’s Climate Innovation Fund and others.

BYD → betting on Chile

A $290M lithium cathode factory in Chile allowed them to receive preferential Li prices.

The government is stepping up efforts to encourage downstream investments (looks like it’s working).

Plus 3 new factories in Brazil.

BYD is the 2nd battery maker.

Toyota → JV + US supply

Looks to be moving slower than the rest.

But still showing progress w/fellow Japanese conglomerate Panasonic (PPES formed in 2020 to compete with CATL).

Agreed w/ ioneer for the supply of 4kt LCE pa for 5 years (production expected in 2025)

These deals are HUGE.

But this bit helps all:

Tesla opened its North American Charging Standard.

By mid-2023:

- Ford

- GM

- Volvo

- Mercedes

- Rivian*

- Fisker*

- Volvo*

- Polestar*

announced adoption.

(will take time to implement, yet a winning move)

*not top 15

That’s it for today!

I said back in Feb that deals would get more aggressive.

I think they absolutely have.

Don’t see that stopping anytime soon.

(especially at these low valuations)

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.