Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

In the last 5 years investing in the energy transition has become mainstream.

So much so that by 2022 investments in the theme reached a record-breaking $1T, or 2.3x the 2018 figure. The highest growth was registered in electrified transport (aka EVs and other vehicles), according to the latest Bloomberg’s Energy Transitions Trends report.

Welcome to our newsletter with insights on metals, mining and energy transition investing.

The reason is simple:

✨ To succeed, the energy transition needs more metals and minerals than we produce, a fundamental energy shift, and massive amounts of capital. ✨

THIS IS A VERY BIG SHIFT 😵💫

I have to confess, sometimes this very idea keeps me up at night…

Hey hey! I’m Paola Rojas. I’ve been investing for 17 years, and as a corporate advisor to miners and investors have worked on over $80m in deals. Most of my work has been focused on the metals and minerals used in the energy transition. But I digress. Let’s keep going!

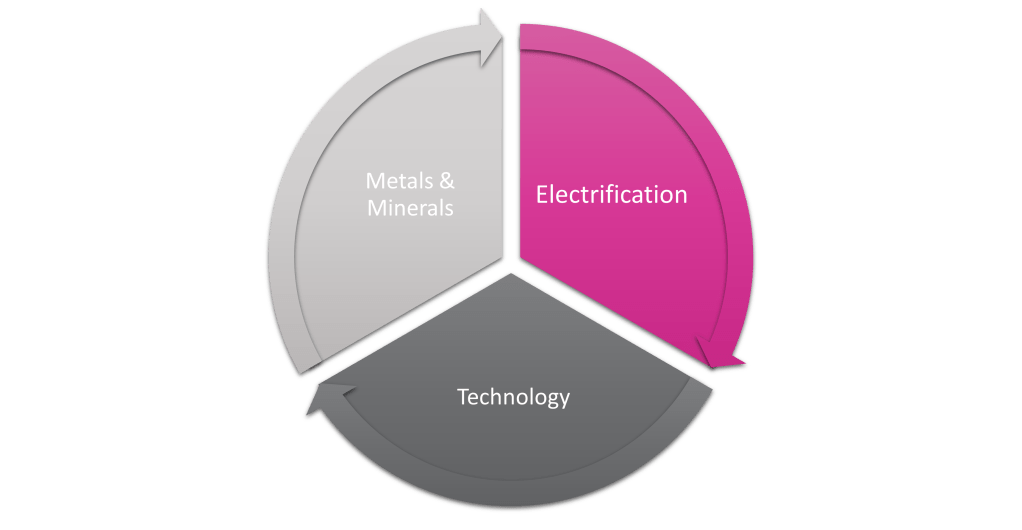

Here’s the triad:

Electrification relies on technology.

And Technology loves metals & minerals.

In fact, it can’t function without them.

This is a virtuous cycle.

Lithium and copper are central but also gold, silver, graphite, rare earths… and many more are hugely valuable and necessary.

And all of these materials need to be mined, extracted, and/or processed. Plain and simple.

(and can also be recycled… as long as enough has been produced and is available to be reprocessed)

How can we get there?

Net zero targets are broadly ambitious. Many think they are unachievable, even.

More than 70 countries (or ~76% of global emissions, including the biggest polluters – China, the United States, and the European Union) have set a net-zero target by 2050. While much progress has been made, at the current rate it just won’t happen.

So the efforts must expand significantly (and speed up).

On the bright side, generalist investors are joining the fray and eager to learn more. This week I took part in a panel on lithium and the Inflation Reduction Act at Citi’s Australia-New Zeland Annual Investment Conference in Sydney. The panel included the CEO of Pilbara Minerals, Dale Henderson, as well as a former ambassador to the US and we had a great discussion on how meaningful the impact of the IRA has been in terms of US domestic investment, M&A and adoption. Note that this was the only mining-related topic covered…

One of the challenges for capital allocators is reconciling vastly different sectors with dissimilar business models, risk-to-return tradeoffs and many more nuances.

So investors need to expand their understanding of the whole battery supply chain, how each piece relates to the rest, and how the relationships between all these pieces are evolving (and becoming more intertwined than ever).

But EVs are not all. Translating the supply chain more generally into business sectors, we can cite these:

✅ Mining & Metals

✅ Automakers (including cars, but also buses, trucks, etc)

✅ Renewables

✅ Infrastructure

✅ Nuclear energy

I call these ‘buckets for an energy transition portfolio’.

Lots more investment is needed to make sure not only that we have the materials that will eventually go into EVs and batteries, but also new technologies for these vehicles, grid expansion, renewable energy generation… and so much more. Some examples: BHP puts the investment required for copper at $250B by 2030 (that’s only 7 years away!), while Benchmark Mineral Intelligence sees lithium’s share in the range of $54-116B.

The sectors above will benefit the most as EVs expand in adoption. And adoption is speeding up: This year, the IEA expects over 14m EVs will be sold.

I’ve been doing this for a hot minute (that’s a cool story for another day, and includes solar panels, sustainable architecture and salt lakes) BUT… here’s the thing.

🤩 You can do it too.

Whether you’ve never invested or have some experience and want to go deeper, we have something for you. I got a bunch of resources on my blog and my socials, including:

✨ lithium 101

✨ reasons to invest in lithium, copper, graphite and mining in general

✨ crucial concepts for mining investors such as resources vs reserves, economic studies

✨ how to get started with Thematic ETFs, what the leading players are seeing ahead and a lot more.

These resources can help you understand the basics and prompt topics for further investigation.

Start however you can but getting started is crucial (even if all you do is learn and the investing side comes later).

PS: Share this newsletter with a friend if you’re keen to start.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.