Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

I am the daughter, sister, niece and cousin of geologists, mining engineers and mining consultants. I’m the granddaughter, great-granddaughter, and great-great-granddaughter of miners and prospectors. And most of them? fully focused on copper. So you could say that ‘copper runs through my veins’.

I knew what a copper porphyry was before I knew how to spell it. This is not your traditional dinner conversation for a kid but I guess this is what you get when your dad was a geo!

The largest miners have been sounding the alarm for some time. Over the next few years, supply will be likely balanced (which goes in line with prices remaining subdued), but as we get into the next decade things are poised for a shift.

‘The world’s going to need probably about two times as much copper over the next 30 years.’

— Mike Henry, CEO BHP

And that’s what we’ll talk about today. In this issue, we’ll also announce the winners of the 20K follower giveaway!

Welcome to our newsletter with insights on metals, mining and energy transition investing.

I think all mining investors (or those contemplating the sector) need at least a basic understanding of copper as an investment, and more specifically how these crucial variables affect it:

- Location and jurisdictional risk

- Commodity prices and the economy

- Capital intensity, size and permitting blues

This information will help you predict and prepare for positive (and negative) impacts on your portfolio and also prove valuable in finding investment opportunities.

Location and jurisdictional risk

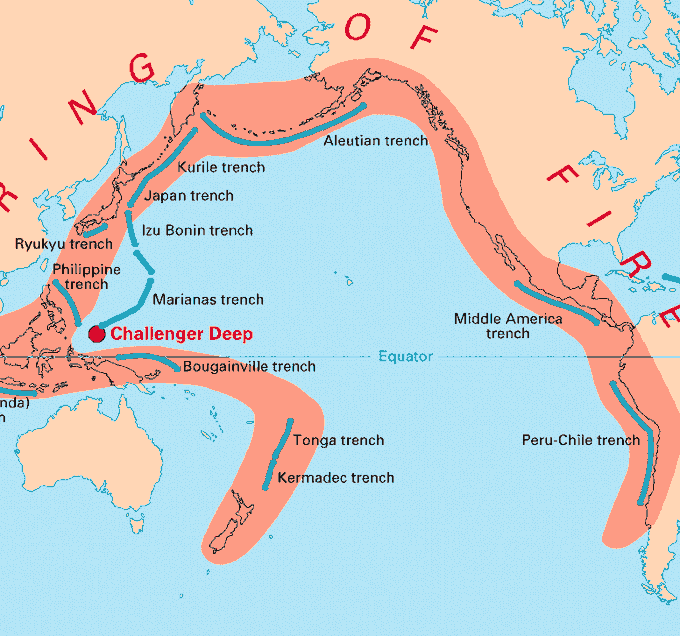

Porphyries are the world’s major source of copper and molybdenum and a significant source of gold. They are found around the world but most deposits are in the circum-pacific belt, also known as the ‘ring of fire’ due to its volcanic activity (makes sense, huh?).

But of course, nations found in this belt vary wildly in terms of their attitude towards mining, legal systems and overall political risk. And we typically see safer jurisdictions carry a risk premium both in terms of acquisitions and share prices. You’ll see a connection in a second as we look at two recent news in the world of copper.

Commodity prices and the economy

Copper is the bellwether metal for the global economy. Thus, rising prices point to industrial confidence. Investors must form a view of their outlook before gaining exposure via:

- Explorers and developers

- Miners

- Futures

- Royalties, streaming, etc

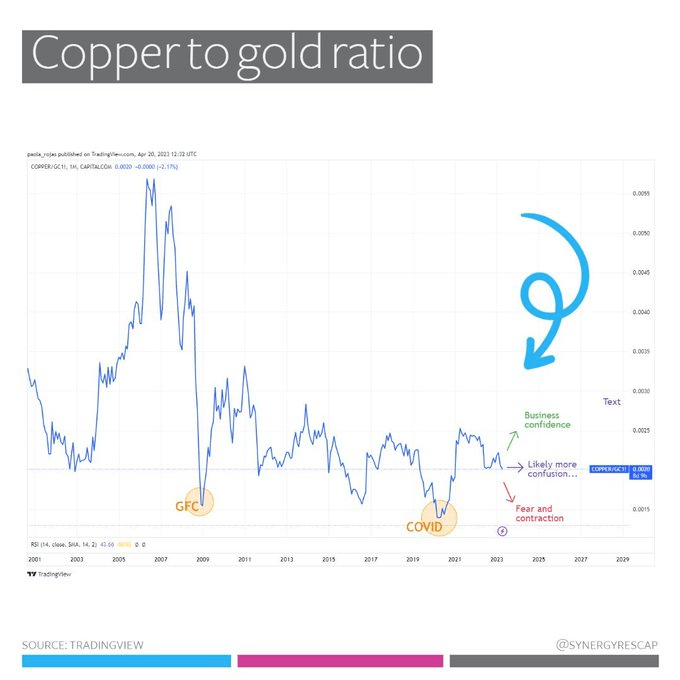

In addition, further clues can be inferred by looking at the relationship between copper and gold. Given gold is a flight-to-safety asset, their interaction is meaningful. When the ratio:

- rises → business confidence (even overconfidence)

- sideways → confusion

- falls → contraction

Capital intensity, size and permitting blues

Typically, copper mines are seriously large. While gold-copper deposits can get away with a CAPEX of a few hundred million, copper-dominant (porphyries) tend to need a lot more money. Billions, typically. $GLEN has a few. This makes their financing risk much higher.

Larger mines also must endure longer processes, more scrutiny and lots of NIMBY. While the US is especially difficult as with Resolution $RIO – it happens elsewhere, from Spain to Panama. Some companies like $NWC resorted to underground-only operations

This is of course a simplification but it’s a good place to start.

Copper is also often in the news (you’ll hear Lucho and I discuss it in our podcast regularly) given its lead role in industry and manufacturing. This week there were some big headlines. On one hand, we heard that Rio Tinto, the second largest miner in the world partnered with Codelco, Chile’s state-owned copper producer (responsible for the bulk of the country’s share) to find more copper in Atacama (incidentally, where my dad was originally from). At the same time, Panama is moving to ban new mining as protests erupted due to the contract extension for First Quantum‘s Cobre Panama copper mine. Some we win, some we lose.

In our next issue, I’ll expand on how location and jurisdiction risk impact investments in metals and minerals. As geopolitics gets more complex due to war and ESG concerns, the puzzle gets trickier for investors seeking to gain participation in the battery supply chain and the energy transition in general.

Copper porphyries are central to a healthy global supply and investors will benefit from a deeper understanding.

If you enjoyed this, please share it with a friend. The energy transition requires more savvy, committed investors and supporters joining in, to fully enable it.

That’s it for today.

A popular tweet from last month

Keeping track of what resonates is a great indication of investor sentiment. This one got a lot of attention!

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Winners of the 20K follower giveaway:

Thanks for participating! You’ll receive your eBook via a Twitter DM from @synergyrescap, so please be on the lookout to make sure you see it.