Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

How often do you find terribly undervalued development plays that you can buy for peanuts, have been substantially derisked and have financing already lined up -or are close to doing so-? Turns out, not very often.

You can ask Gina Rinehart, Australia’s mining tycoon who recently shelled out nearly $1 billion to get a 19.9% stake in Liontown Resources. By the way, LTR’s Kathleen Valley project has total lithium reserves of 68.5Mt.

‘Reserves are formally defined as a subset of resources, and even current and potential resources are only a small subset of ‘all there is’.’

—Lawrence D. Meinert, USGS

Of course, it all ends up coming down to how much risk you’re willing to take. I get it. It’s not for everybody. But it’s doable. And given that explorers rely so heavily on equity capital, more investors should be armed with the best possible tools to make investment decisions. And that’s why we’re here.

Pick the best time

That particular deal is a fascinating case. We’ve discussed it in an episode of our podcast recently. It was not cheap but the project is slated for production in 2024 plus Gina can afford to come in so late in the game because the move serves Hancock’s overarching strategy.

Ruining Albermarle’s acquisition may have been just a side effect (or a bit of a nationalist play, which I tend to believe).

If your wallet is let’s say ‘less bulky’ than Gina’s, your best shot is targeting projects earlier in the Lassonde curve (don’t know what that is? Keep reading). If you do your due diligence well you can make outsized returns while keeping your entries at a manageable level (spoiler alert: it’s not easy to do but worthwhile).

This connects to my first lesson in investing:

In another lifetime, in another continent, in another job… and very early in my investing journey, I was negotiating stock compensation with a client. I had already gotten stock and options from a new client, a company that had just IPOed. I thought I’d try getting a similar deal with my favourite client, a much larger and established firm (i.e. stock price was substantially higher). But it was not meant to be and the reason was simple: the whole thing wasn’t worth the effort for both parties because the amount of shares we’d get was quite small hence the potential upside was minimal.

This whole experience led me to the ‘relevant lot’ concept, which is crucial to getting meaningful outcomes in investing. Ensuring getting as many shares as possible with our available capital is paramount. Being right with not enough shares is as painful, if not more, than being wrong.

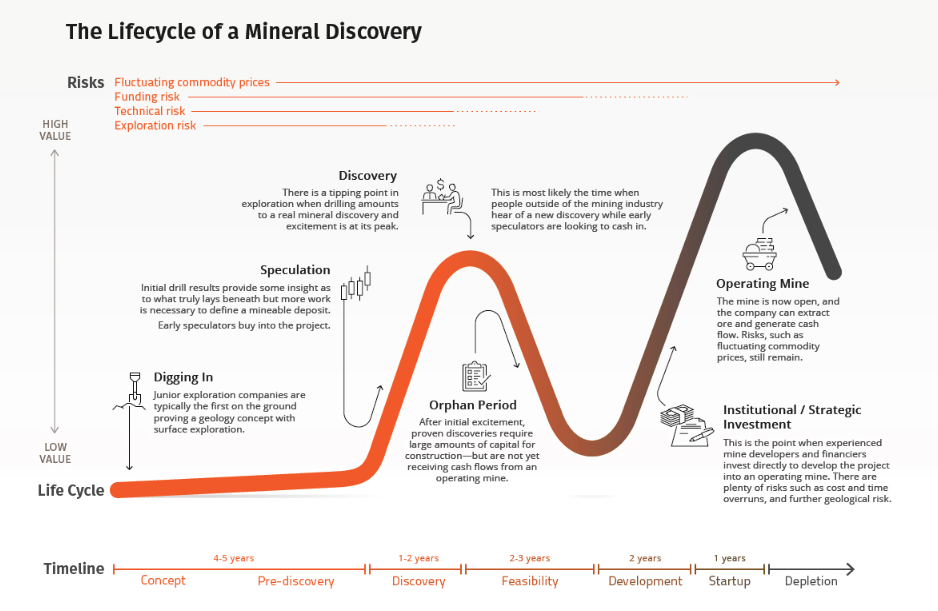

Lassonde Curve

Let’s take the Lassonde Curve I just mentioned. It’s a brilliant representation of the process most companies go through and visually shows why long-term investing is typically a better strategy to play this sector.

In the beginning, things are pretty ho-hum for a WHILE. This is why I often tell new investors keen on early explorers that 5-7 years is an ideal holding period that gives you higher chances of finding something meaningful. Less than that, and you’re basically hoping for a miracle.

When outstanding results come in, you see the speculation stage where everyone is talking about the stock, and price rises. You get hooked (come on, admit it, I do). And then the confirmation comes: it’s a discovery!

I’ve seen so many discoveries. Excillarating times. And typically resources will come in at some point after. Starting with inferred and then moving forward to higher confidence.

Sidenote: Are we speculators or investors? Have to say, I understand why people use this term but I don’t like it that much. In my mind, it has a negative connotation. But I digress.

The curve also explains what happens to companies after discovery and during their feasibility studies. Being an orphan is not pretty by any measure. Stock is unloved as most true speculators got out as they didn’t have a long-term view (or they religiously follow the wave) and any resource expansion has virtually no effect on price.

The next phase is the ‘big boys club‘. The company needs BIG NAMES in their registry. Retail and small sector participants and corporates can’t cut it anymore. This can feel like a painful process and I see why many investors choose to exit. This is, incidentally, where Gina dropped her billion.

And here’s why

Before production, you have 2 ways to get a sense of value: the company’s market cap which typically moves with the curve or any available economic studies. I’ve written about studies before here plus some comments on value in a previous newsletter issue.

But in short, any significant mismatch between the two can point to opportunity and focusing on indicated or measured resources will help. You’ll pay a lot less for resources! So riskier, yeah, but better ‘bang for buck’. There are even ETFs that include explorers in their holdings if you don’t want to pick individual stocks.

This is of course a simplification but it’s a good place to start. Now if you really want to expand your due diligence skills, understanding exactly how resources and reserves differ is an invaluable skill that any serious investor needs to grasp.

If you enjoyed this, please share it with a friend. The energy transition requires more savvy, committed investors and supporters joining in, to fully enable it.

That’s it for today.

My last thread

Here’s my most recent thread… it’s getting a lot of attention.

In recent related news…

- $SQM, 2nd largest lithium producer sees weak pricing yet long-term strength

- ExxonMobil $XOM is exploring for lithium in brines in Arkansas

- Japan’s Sumitomo potentially looking to invest in the US

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.