Graphite is the most overlooked battery mineral.

Sure, lithium gets a lot more eyeballs, but it makes sense for investors to pay attention to its neighbour.

In fact, a lot of sense.

Here are 5 reasons to consider adding graphite to your portfolio:

(plus a few promising graphite stocks by the end)

Hey hey! I’m Paola Rojas. I’ve been investing for 17 years, and as a corporate advisor to miners and investors have worked on over $80m in deals. Most of my work has been focused on the metals and minerals used in the energy transition. But I digress. Let’s keep going!

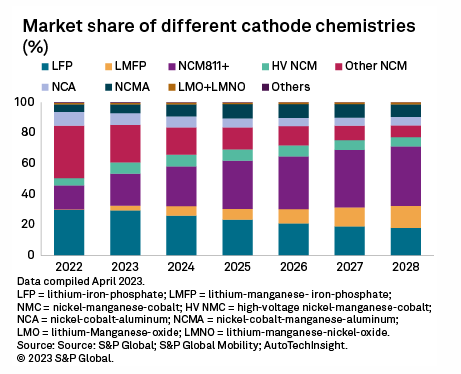

1. Among battery chemistries, NMC as a group with all variants considered, is the most popular.

And these are expected to grow in market share.

(while also reducing the use of cobalt but we’ll leave that conversation for another day)

📊 @SPGMarketIntel

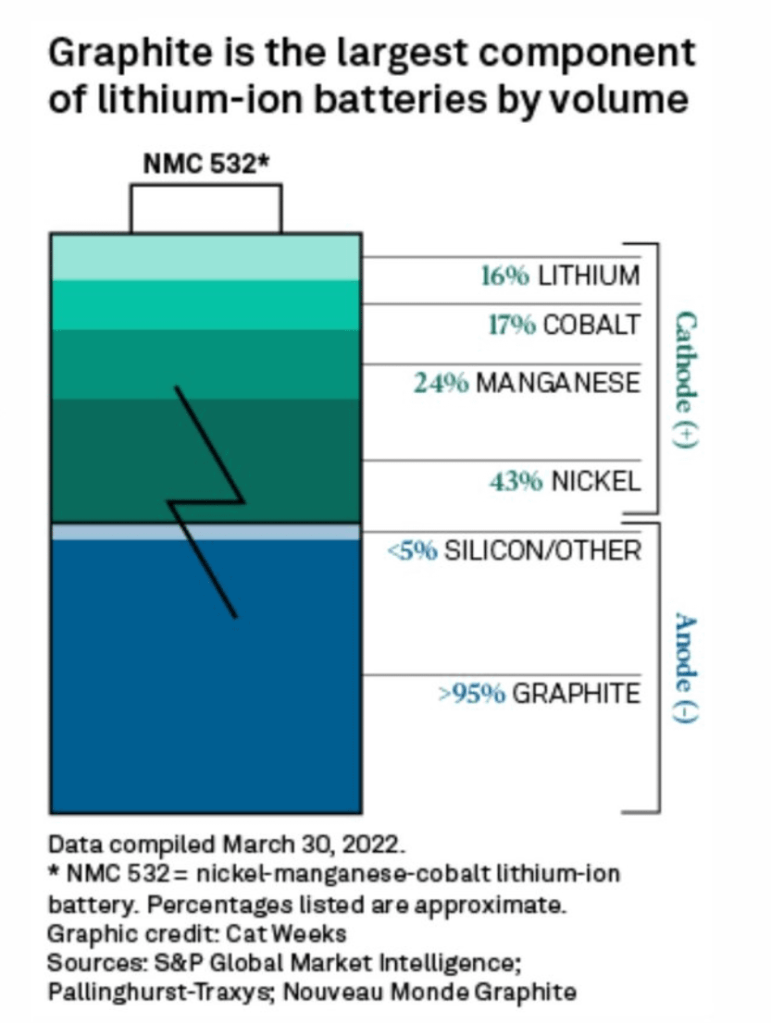

2. Graphite is the largest component of these popular batteries.

Here’s one example, NMC 532.

Virtually the whole anode is graphite.

If we carry this downstream, this ends up being 50-100kg of graphite per EV.

3. Concentration

Graphite production is highly concentrated.

The leader is a country the west ‘loves to hate’ and is hard to get exposure. Africa comes next.

Top

- China 850,000MT

- Madagascar 170,000MT $NEXT

- Mozambique 110,000MT $SYR

h/t @AgatheDemarais

4. Security of supply is a concern

We know what commodity concentration causes.

For instance, the US relies on imported graphite for 100% of its natural graphite needs.

The mineral was declared a critical mineral in the US, Australia and Canada.

📊 @VisualCap

5. Natural vs synthetic

While natural is expected to be in deficit 2024-5, synthetic faces challenges given how it’s made.

High-energy end-use markets prefer petroleum needle coke, so sourcing may become tricky.

ESG may cause a clamp down on carbon emissions, reducing demand.

Stock ideas:

Among graphite developers and producers, here are some research ideas across jurisdictions and markets:

- Syrah Resources $SYR

- Volt Resources $VRC

- Northern Graphite $NGC

- Graphite One $GPH

- Leading Edge Materials $LEM

- Nouveau Monde Graphite $NOU

And that’s all for today!

But here’s a crazy final thought:

Should we perhaps pay more attention to battery composition as a guide for a critical mineral portfolio composition? Just sayin’ 😉

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.