Rare earths are in fact, not rare.

This niche mining market was recently valued at $2 billion/pa, forecast to grow by 6x by 2030.

But geopolitics are complicating it all for investors.

Here’s your REEs 101 (whether you seek to enter or better understand this unique sector):

1) More than one

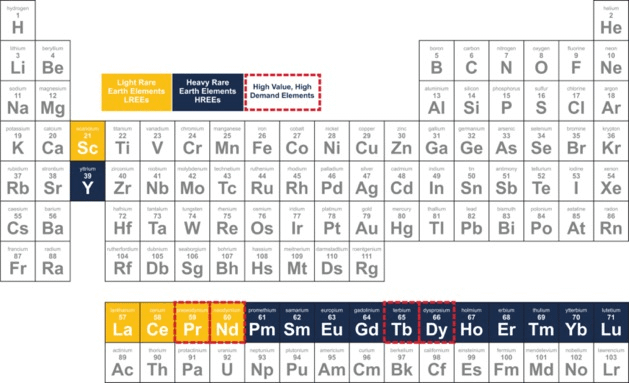

When we say rare earths we mean not 1 but many elements.

So unlike copper, which has one home in the periodic table, REEs have 17*.

Given that they appear in nature mixed together, mineral deposits have most if not all in different concentrations.

Yet…

The most sought-after are:

- Praseodymium Pr

- Neodymium Nd

- Dysprosium Dy

- Terbium Tb

In addition, all these elements can be also classified as heavy or light. This will be relevant in a sec.

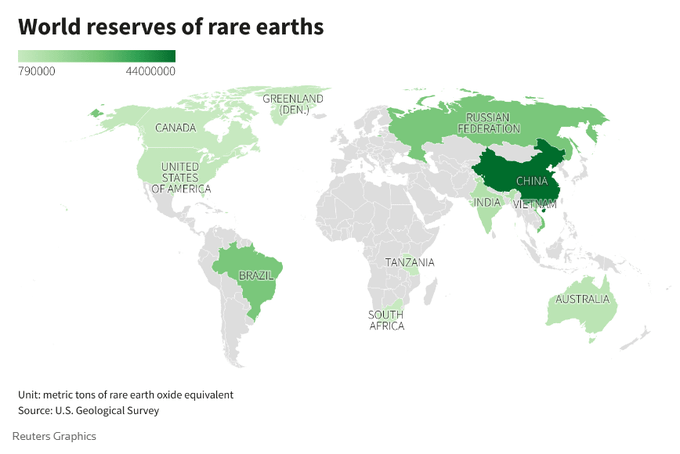

2) China dominates the market

Over 90% of supply comes from the country, and it also boasts the largest reserves.

The rest of the world has failed to bring enough REEs to balance things out, with a previous attempt back in 2010-1 when prices spiked on export controls.

And China is making aggressive moves in commodities it controls via export restrictions.

Back in July, it was gallium and germanium.

In October, graphite.

And then, a couple of weeks ago, REEs.

Adamas says ‘a blanket ban on rare earth exports from China is highly unlikely’

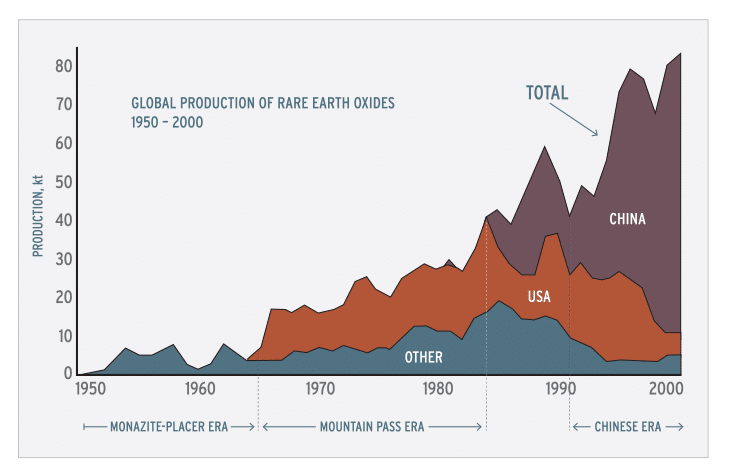

This wasn’t always the case, though.

Until 1960, other countries controlled the market, with the US coming in strong as Mountain Pass in California became a primary source.

By the mid-1980s, western production started falling as China rose exponentially.

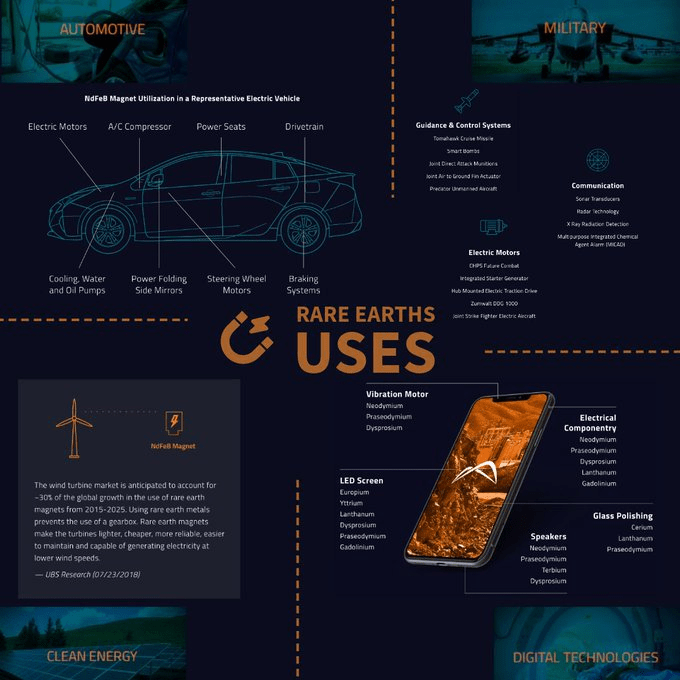

3) REEs are crucial to many technologies:

In 2018 the USGS already highlighted the importance of REEs in a report on minerals and metals critical to the US’s economic and national security.

Its many uses in:

- EVs

- Clean energy

- Military

- Digital technologies

Light REEs are typically used in permanent magnets, data storage and wind turbines while heavy REEs (facing shortages) are used in TV screens, solid-state drives, and also in magnets.

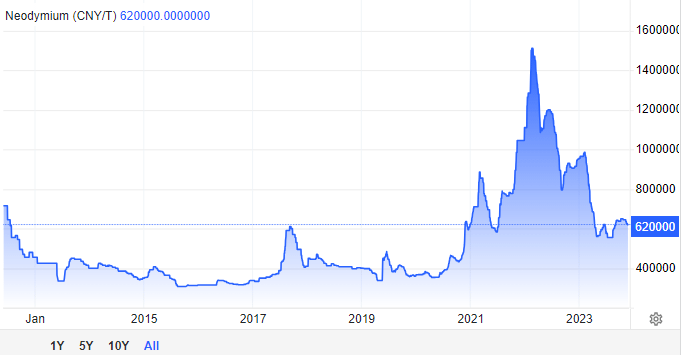

4) Price is opaque

There are no public exchanges for REEs and China’s grip means they can effectively manipulate the price.

Forecasts in economic studies can be unreliable if they include the 2010-2011 spike.

To complicate things further, prices vary wildly among elements.

This could eventually improve as it has with lithium, if the market grows enough. For transparent pricing, critical mass is required.

But for now, sources such as Argus Rare Earths and Adamas Intelligence provide info, although most are part of a paid subscription package.

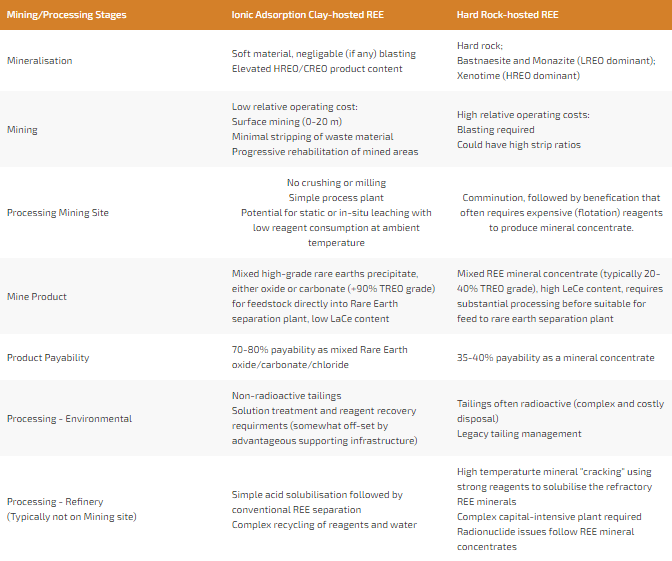

5) Two main deposit types

Can be found as hard rock or clay-hosted.

Hard rock are typically higher grade but processing is more expensive.

TREO* typical grades

- Clay: 0.04–0.3% (typical, 550-700ppm)

- Hard rock: > 0.7%-3%

Other characteristics: large tonnage, close to surface

Beneficiation, aka concentration, from clay linked to kaolin (for HPA).

More 👇

6) Bonds are hard to break

These elements found together are tightly bound.

To be used, they must be split.

Process includes mining, crushing, milling and separation via solvents, a challenging environmental footprint. Final product must fit client specs

7) Grades don’t show the full story

Grades are reported as TREO* (total rare earth oxide), but worth considering:

- combination will vary

- valuable elements matter more

- not all may be recoverable via processing

*LREO/HREO light vs heavy

And that’s all for today!

We can think of REEs as ‘fairy dust’ that ignites the magic of a thousand different technologies.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.