Top investment banks assumed they knew what was coming for copper in 2024.

But things have changed over the last few weeks.

BMO, Deutsche Bank and others say we’re in for a surprise:

During LME Week in October, sentiment was gloomy.

ICSG even forecasted a surplus of nearly half a million metric tons.

Large mine ramp-ups at Kamoa-Kakula in DRC $IVN, Quellaveco in Peru and QB2 $TECK in Chile were supposed to flood the market, as they’d reach full capacity.

In addition, new copper supply would be coming from Russia and the DRC as the year rolled on.

But then China comes in… as they do.

Although the rest of the world looks weak and property completions in China are still expected to slow down, things there have improved.

Chinese 2024 copper demand looks much stronger than expected, with grid and energy transition continuing to attract healthy investment.

So, over the last few weeks:

- China improved plus

- significant supply disruptions

- maiden guidance from producers lower than expected

In more detail:

$FM Cobre Panama

After securing a renewal of their licence, protests erupted. The government decided to revoke the contract for the $10B mine.

First Quantum initiated international arbitration.

380ktpa or 1.7% of global supply is off the pipeline indefinitely.

$RIO $VALE $AAL issued their 2024 guidance with ~250ktpa reduction.

Largest, Anglo:

- partial closure of Los Bronces in Chile (btw did work there w/dad)

- lower output at Quellaveco

- $1.8B capex cuts by 2026

Adding others, BMO says total drop is 750kt, or 3% of global supply.

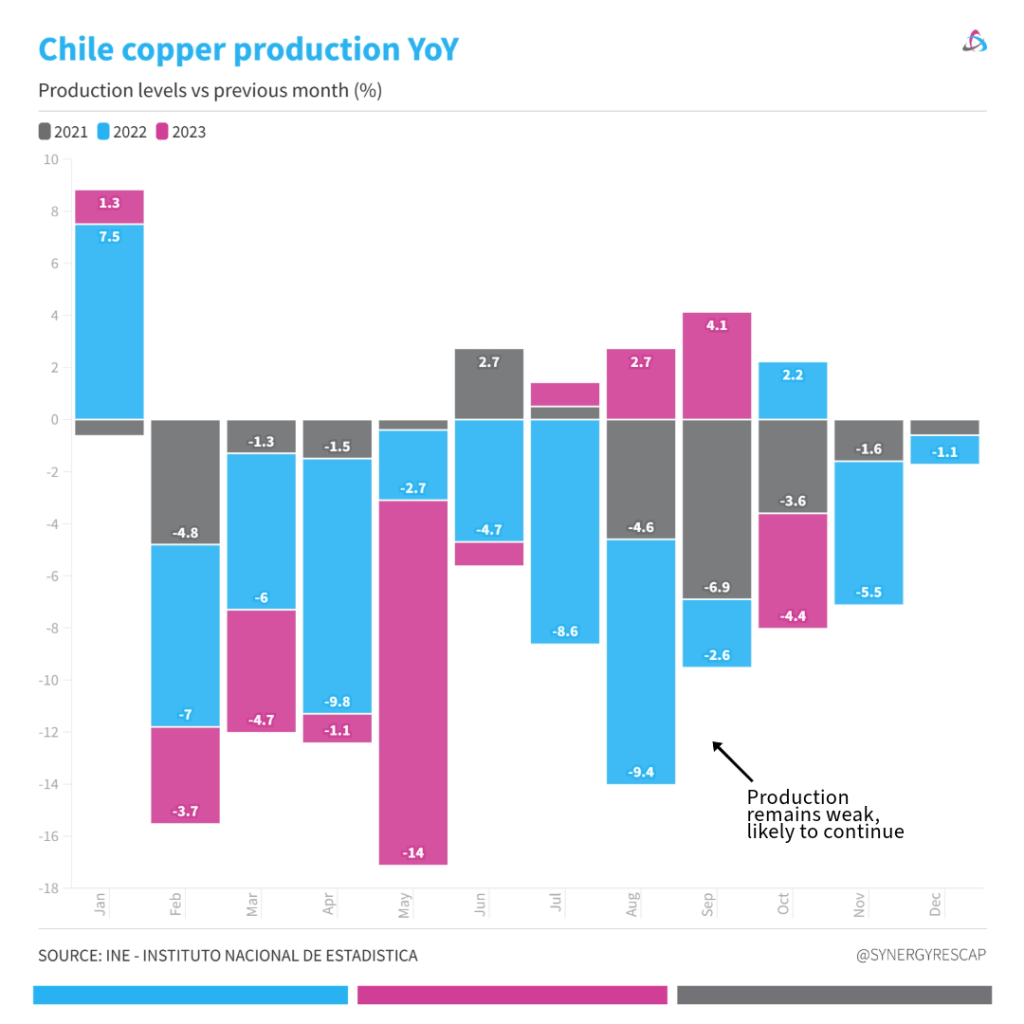

Copper production in both countries, Chile and Peru, first and second producer respectively, remains weak.

In Chile, after 3 months of improvement, data for October came lower, with output falling -4.4%.

Mining investment in Peru looks set to close the year down, you.

Furthermore:

Deutsche sees costs escalating by 30%, with an implied incentive copper price of $9,400-10,600/t (which is 10-25% above spot levels).

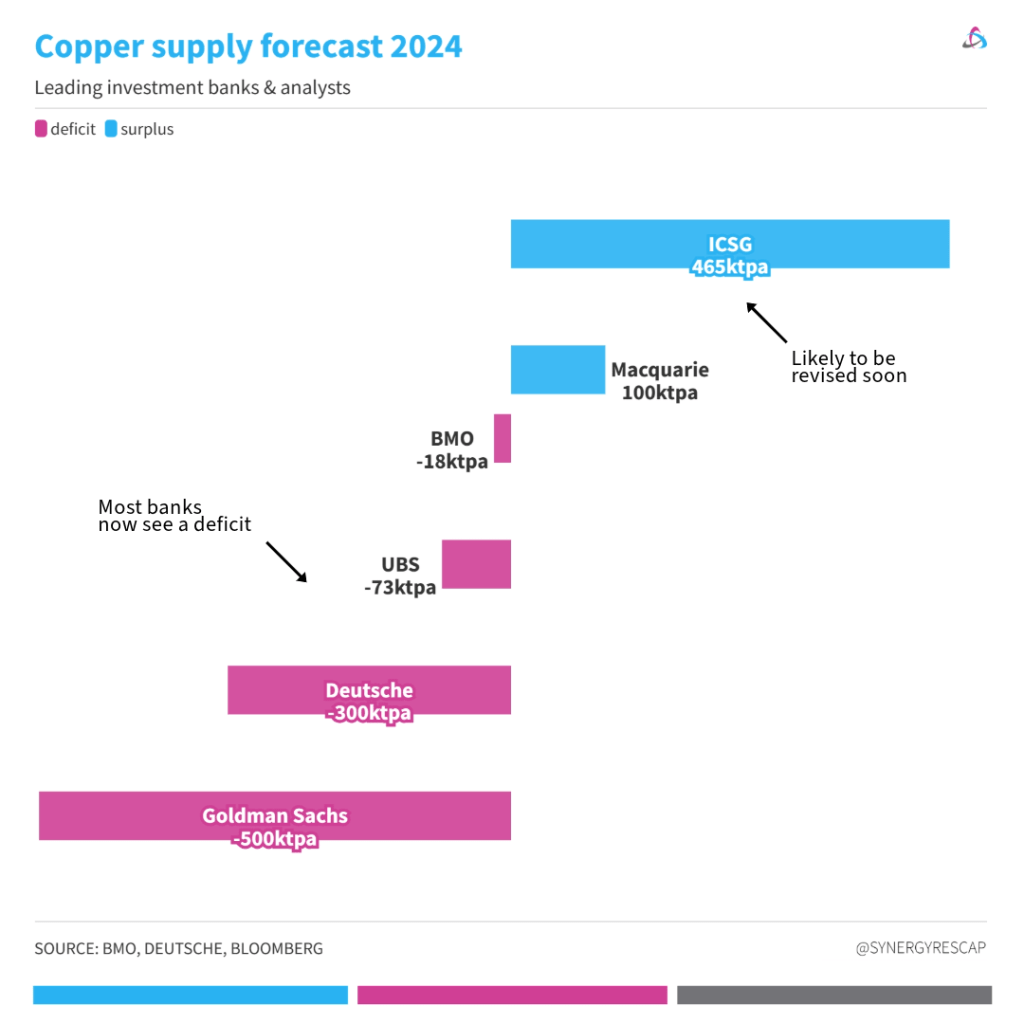

And they forecast a ~300kt deficit (from a small surplus previously).

Jefferies also expects a significant deficit.

BMO is a bit more conservative.

They see the market to be ‘essentially balanced’ in 2024, with low inventory and prices at a premium to the cost curve.

Goldman Sachs has been bullish for much longer (we heard Jeff Currie repeatedly say so). They now see a deficit of half a million tons (like ICSG but opposite!).

Aurubis, Europe’s largest copper producer, has also been optimistic.

All of these point to exactly how fragile the copper pipeline is.

True intrinsically (grade issues, depth, etc) but when you add on social and political issues, it all can shift quickly for this already big market.

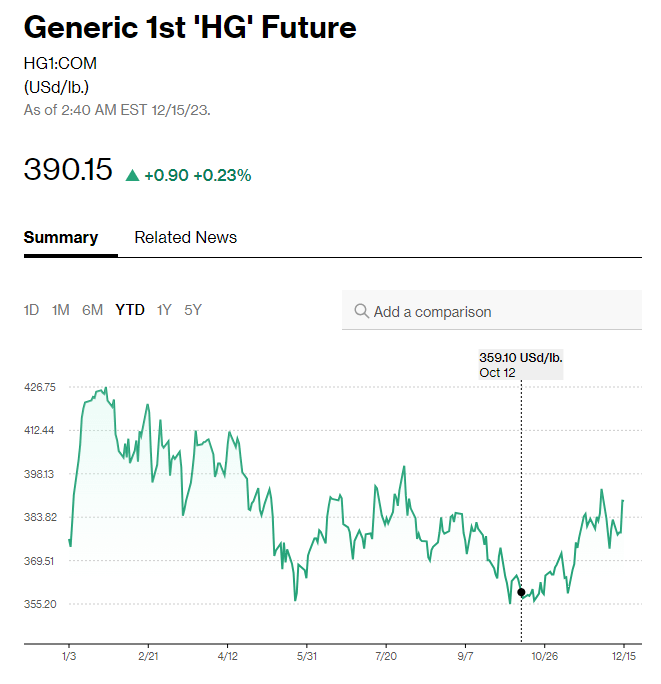

Price has recovered since the issues started with Cobre Panama in October.

And that’s it for today!

Signs point to a much better year for prices which is crucial to foster investment. The long-term bull case remains and much needs to be done to secure supply.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.