Copper is the most important metal.

While prices have been weak recently, this remains true:

No copper, no energy transition!

Hence, here’s your “Copper Investing 101” to help you start or expand your exposure:

You may be already investing in lithium or other minerals. Copper must be the same, right?

Not quite.

It has unique characteristics.

Whether you’re new to mining or not, understanding the nuances will benefit your portfolio.

1) Location, location, location

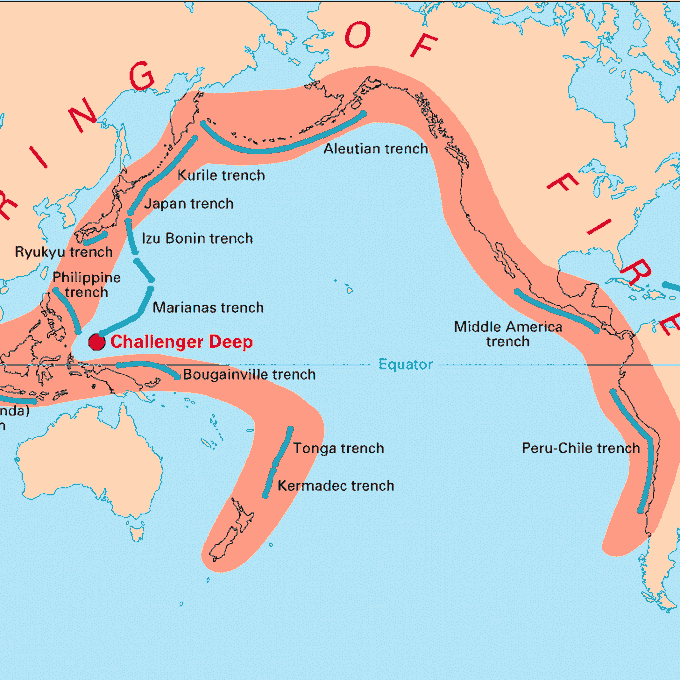

Copper is found around the world but most deposits are in the circum-pacific belt.

This ties up with their genesis. The region is also known as the ‘ring of fire’ due to its volcanic activity.

📊 @USGS

Here’s a quick exercise:

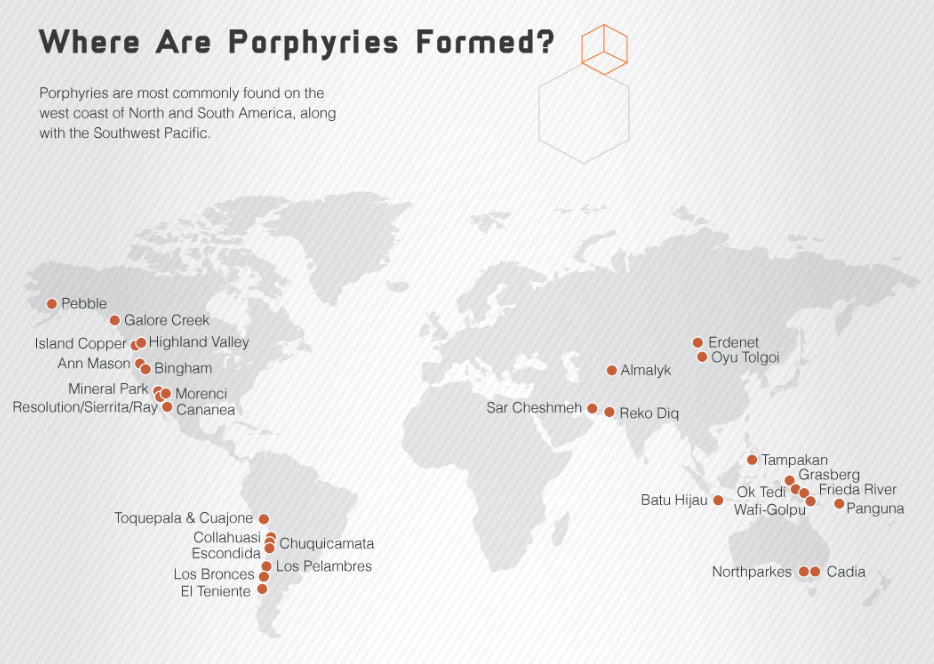

Compare the previous map to this one with some of the largest mines and deposits.

Unsurprisingly, many deposits and Chile and Peru, the 2 largest producing countries overlap perfectly with this ring.

$BHP $FCX

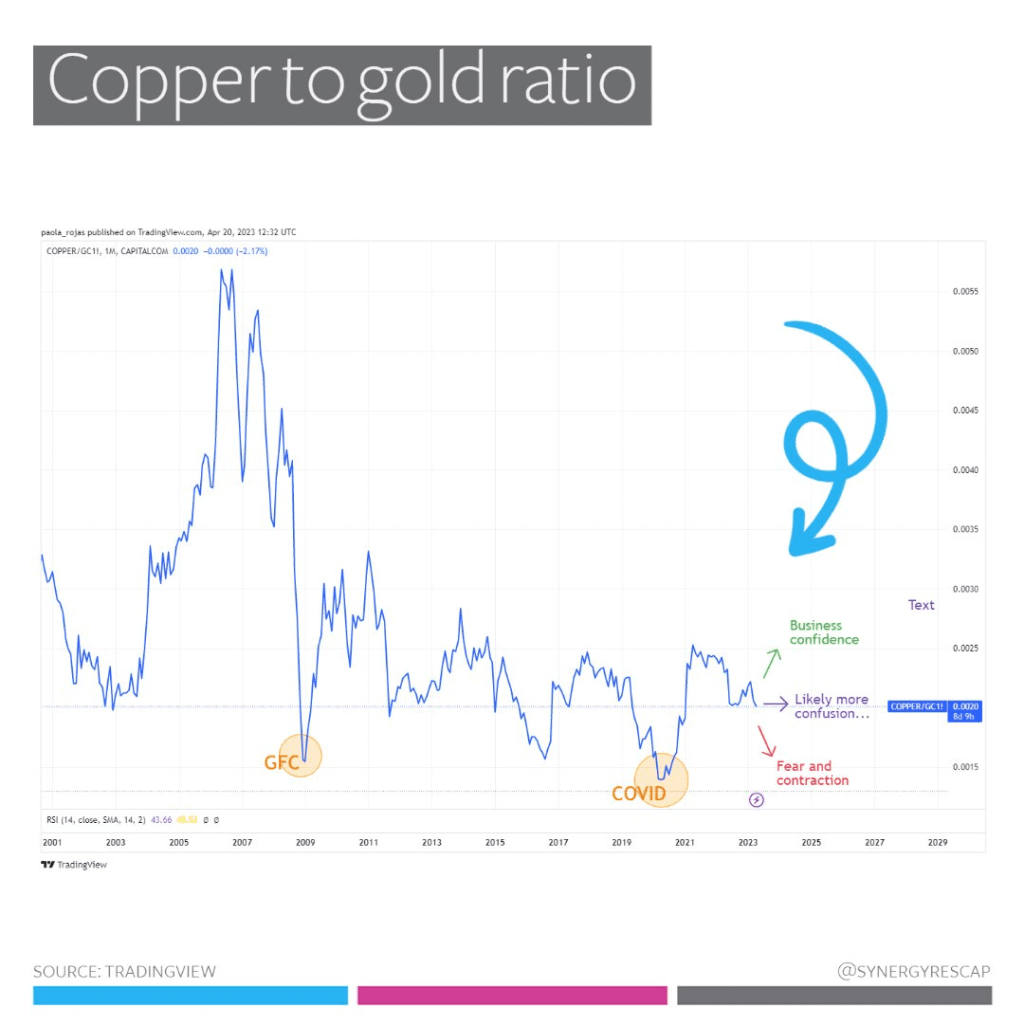

2) Commodity prices → macro

Copper is the bellwether metal for the global economy. Thus, rising prices point to industrial confidence.

Investors must form a view of their outlook before gaining exposure via:

- Explorers and developers

- Miners

- Futures

- Royalty, etc

In addition, further clues can be inferred by looking at the relationship between copper and gold.

Given gold is a flight-to-safety asset, their interaction is meaningful.

When ratio:

- rises → business confidence (even over)

- sideways → confusion

- falls → contraction

3) Copper can be a primary or secondary mineral in a deposit

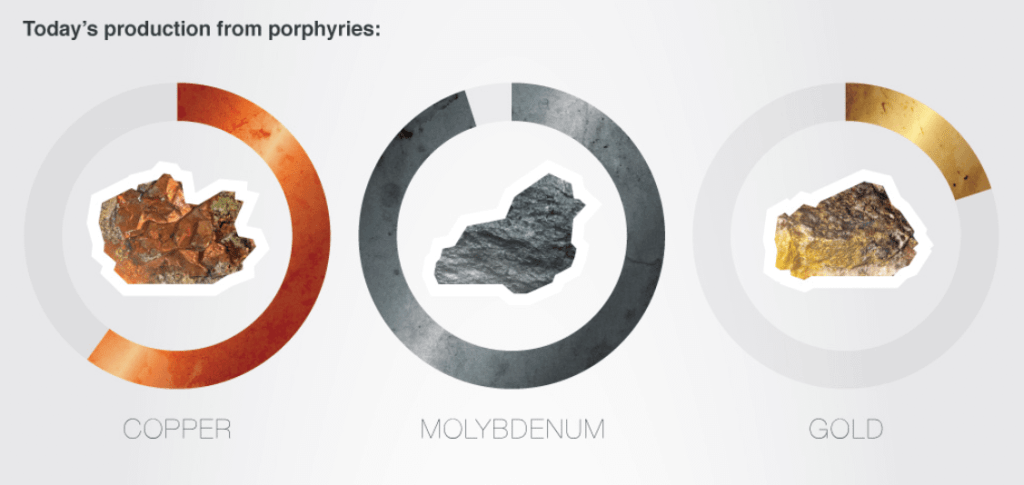

Porphyries are copper-dominant, and the world’s major source of copper (~60%) and molybdenum, and a significant source of gold.

Copper can also be found as part of gold-dominant deposits such as VMS and epithermal.

The distinction mainly impacts grade and expected size.

Secondary minerals can contribute significant cash flow to mines. Typically these are referred to as ‘credits’.

Hence, if you are a precious metals investor you may inadvertently be already exposed to copper!

4) Economic grades vary w/deposit types

Each has an associated grade range that can be economic, i.e. mined at a profit.

For copper:

- Porphyry: 0.25-1%

- VMS: 1-2.5%

- Epithermal: up to 2%

- SEDEX: 0-1%

- Intrusion: 0-1.5%

- IOCG: 0.5-1.5%

- Magmatic: 0.5-3%

Read more about grades here:

Porphyry copper deposits are:

- massive in size

- low to medium in grade

- host copper, gold & molybdenum

- hydrothermal deposits related to igneous intrusions

- dominant mineralisation is Cu, Mo sulphide in fractures, stockworks, veins and disseminations

📊 @bhp

Other types are:

- smaller

- shorter LOM

- typically higher grade

- host copper alongside other precious/base metals, such as $TRBC

In addition, when copper is secondary, credits are less relevant in the economics of the future mine, yet still considered.

5) Capital needs are HUGE

While gold-copper deposits can get away with a CAPEX of a few hundred million, copper-dominant (porphyries) tend to need a lot more money.

Billions, typically. $GLEN has a few.

This makes their financing risk much higher.

And this ties in with…

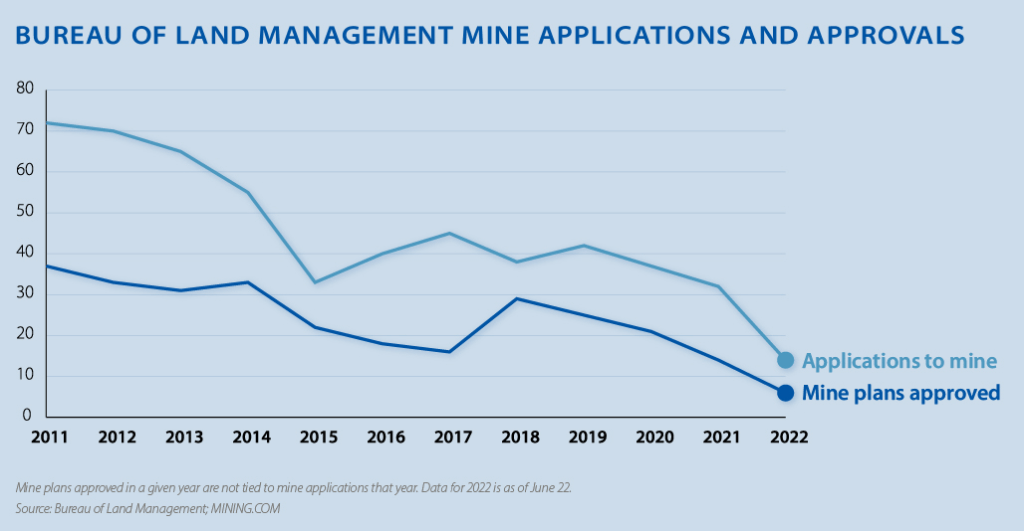

6) Permitting blues

Larger mines typically also must endure longer processes, more scrutiny and lots of NIMBY.

While the US is especially difficult as with Resolution $RIO – it happens elsewhere.

Some companies like $NWC resorted to underground-only operations

And that’s it for today.

Long-term upside potential is available for copper investors across the battery supply chain, the grid and more.

But copper is not gold or lithium. Understanding the nuances will ensure a successful experience.

Want to learn more about porphyries? Here are some extra resources:

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.