Glencore is the 3rd largest mining company and valued at $70 billion.

They are betting BIG on growth.

Given their 2040 outlook, particularly for copper, hard to fault their investment strategy.

Here’s what they see ahead and what we can all learn:

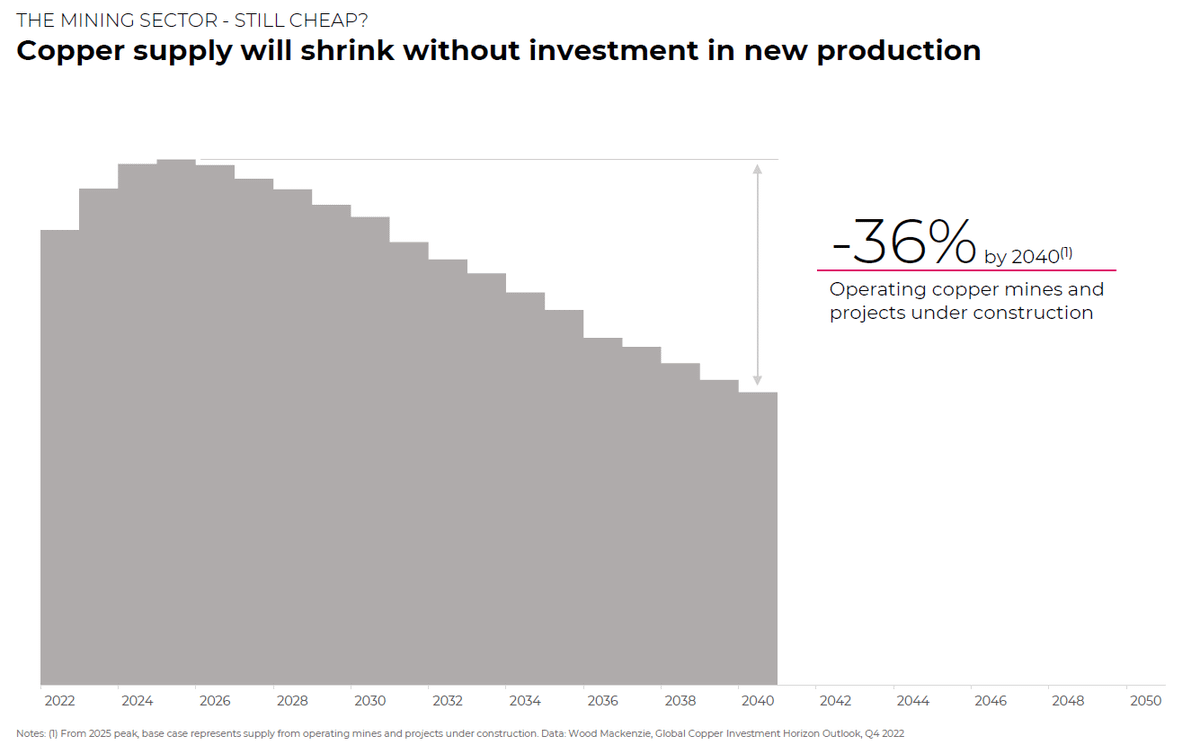

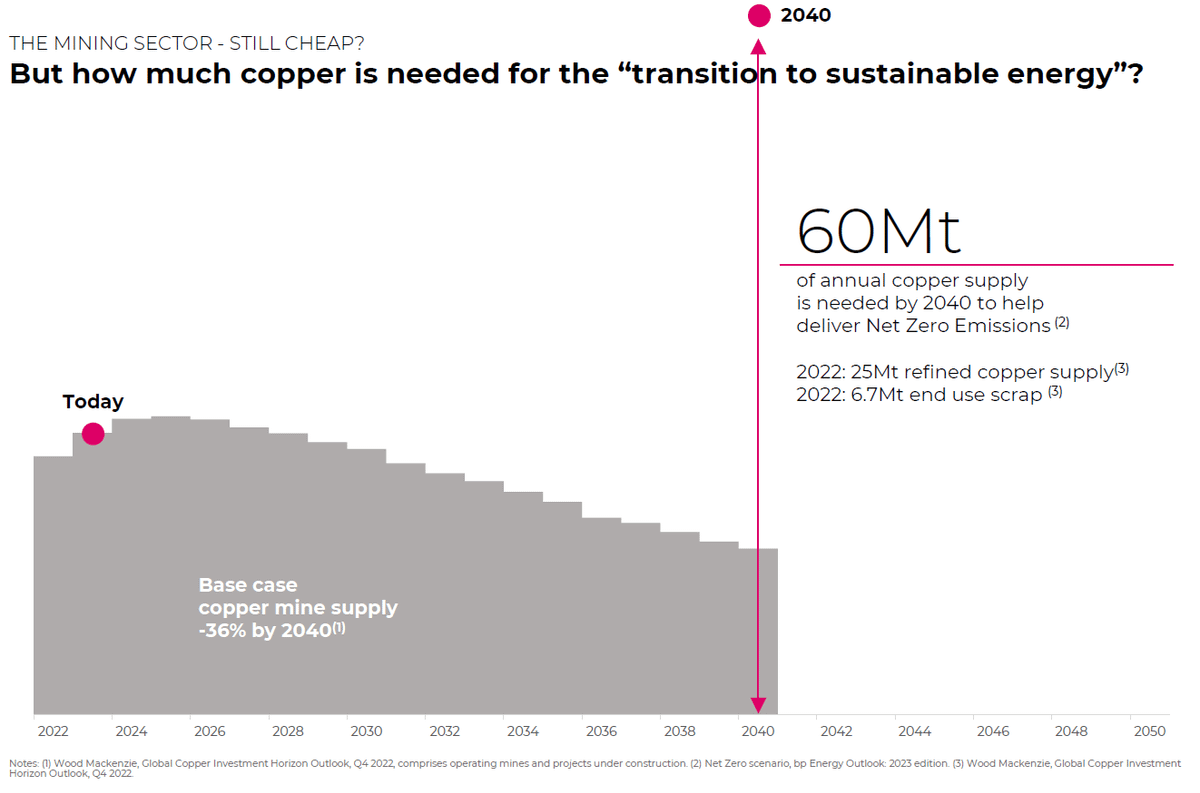

In their base case, $GLEN views copper production falling -36% by 2040 (from 2022 figures), when considering ONLY operating mines and projects currently under construction.

By the same year, they believe demand will reach a massive 60Mt (that’s a gap! 🔪🐊)

📊 @WoodMackenzie

Incidentally, that is nearly double JP Morgan’s figure for 2033.

So Glencore sees the copper supply getting much more strained. Those 7 years look… shall we say… interesting…

(figure includes scrap)

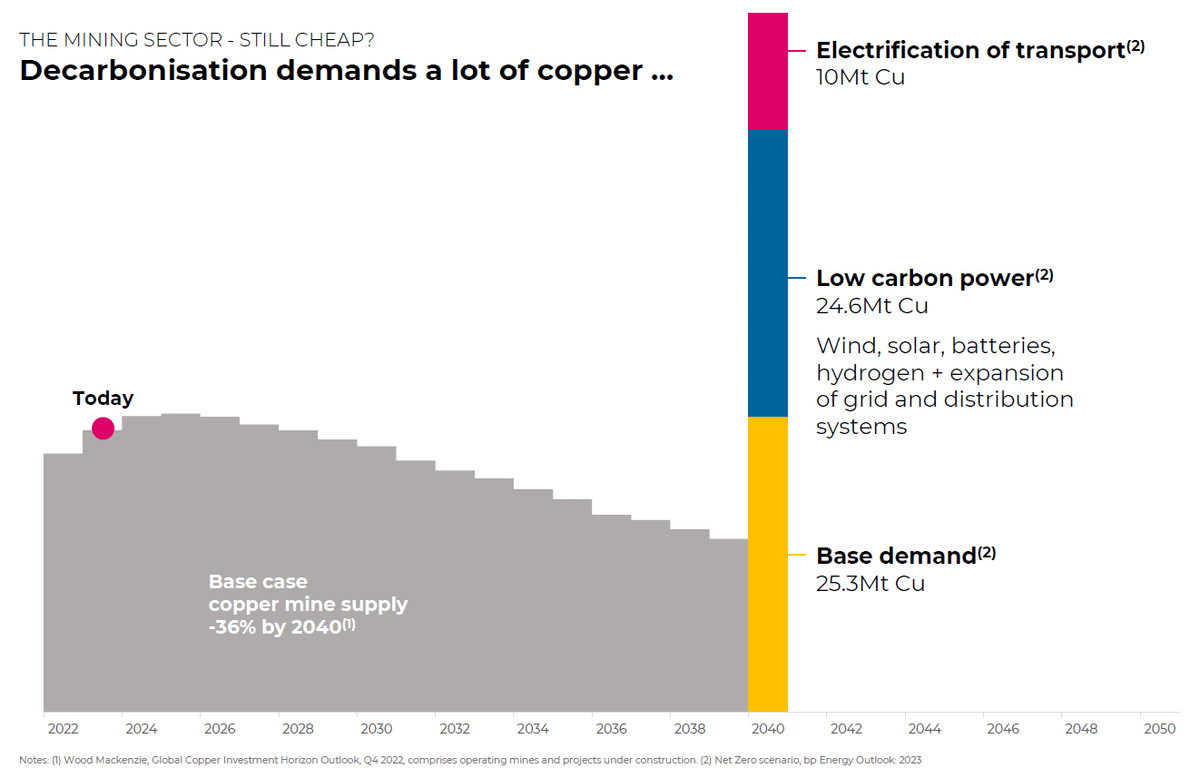

Now, which sector is set to be more relevant for copper demand?

When breaking down the 60Mt demand figure, here’s what they see:

- Base demand: growing to 25.3Mt*

- Low carbon power: 24.6Mt*

- Electrification: 10Mt

📊 @bp_plc

*This is nearly equal to the full market in 2022 🫢

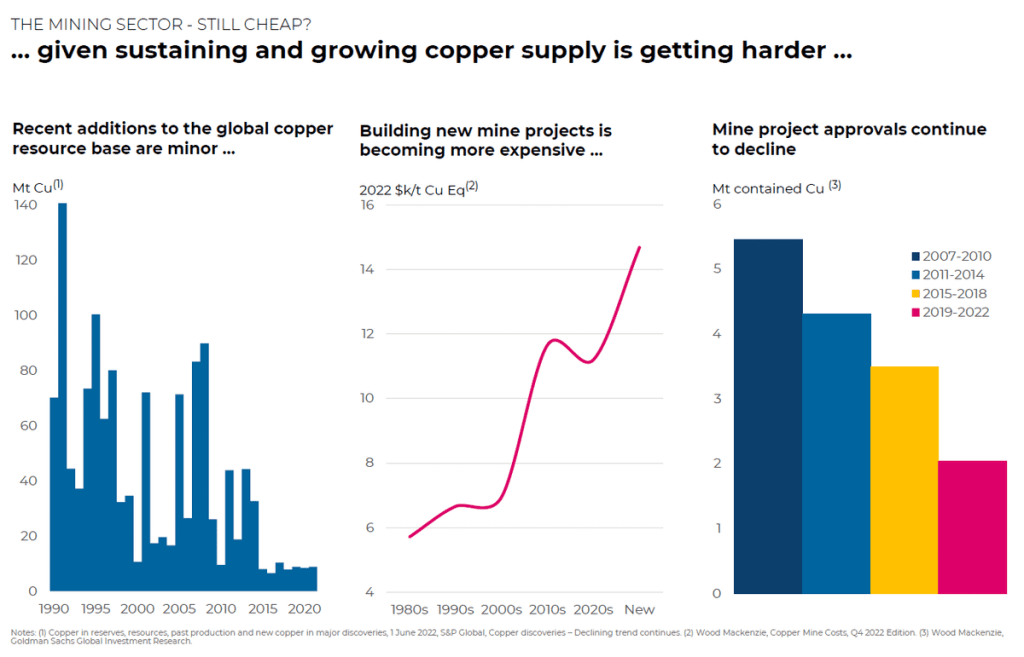

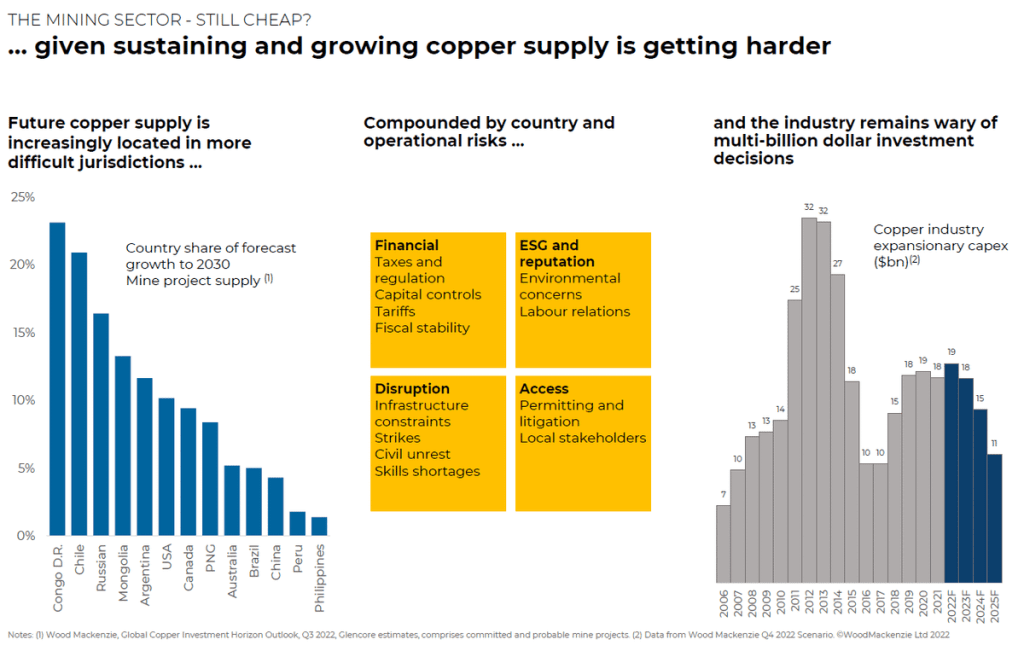

Since decarbonisation needs copper and generates demand for EVs, clean energy and batteries, challenge remains sustaining + growing supply.

All due:

- few additions to global copper inventory

- new mines are more expensive

- approvals take longer than ever, if even approved

Plus:

- growing share in trickier jurisdictions

- country and operational risks rising fast albeit everywhere

- given large CAPEX needed for copper mines, makes decisions slow and difficult (writing off one of those stings)

And here’s the nugget:

They conclude:

- compelling outlook: multi-decade pathway to electrify energy demand

- growing competition: China, IRA, geopolitics

- challenges vs opportunities

- new capital at play as downstream industry participants, governments, generalists start to join in

Hence…

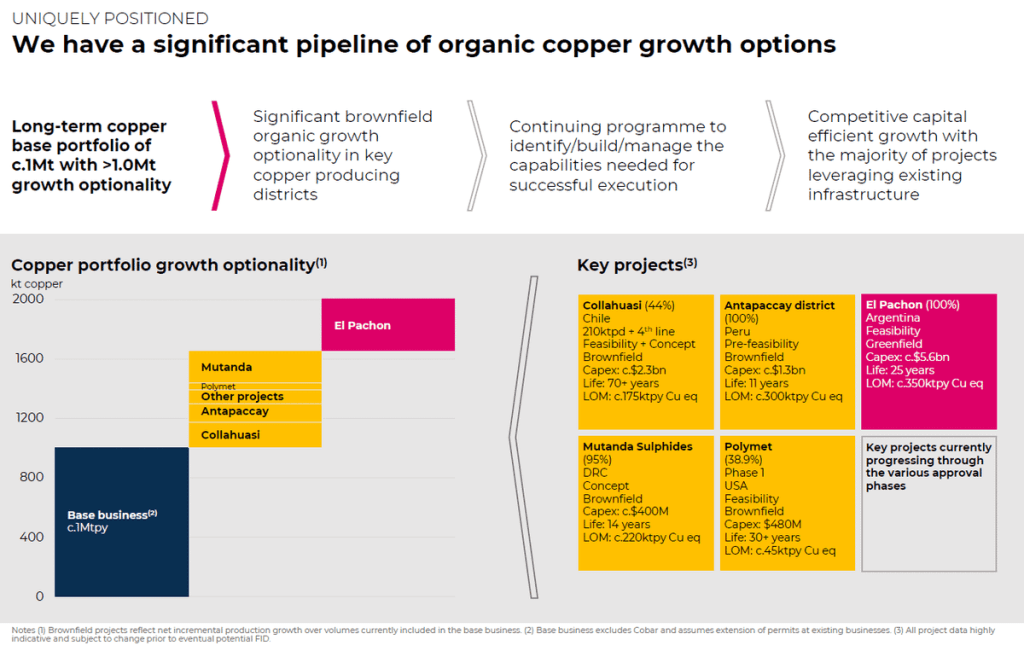

Given their views, they are setting up.

Their project portfolio has gotten stronger since the Xstrata merger, via both brown and greenfields.

Reinvestment & organic growth across copper, zinc, nickel, cobalt, and vanadium in:

- USA

- DRC

- Chile, Peru, Argentina*

Also…

Big acquisitions:

- Alunorte

- MARA from $PAAS (Been there, dad managed it for BHP)

- Polymet

- Were courting $TECK all year seeking a comprehensive deal yet were only able to nab most of the coal for ~$7B (which they are set to spin out w/existing coal assets in 2025)

I’ve talked about Rio, and BHP among others regarding their copper outlook.

Although Glencore’s view has a longer analysis period than others I’ve seen the fundamentals are similar.

With copper spending most of the year below $4/b, many wonder if everyone got it wrong.

But the thing is, getting short-term prices right is challenging.

In a recent panel on battery metals, someone asked us ‘how can we make more accurate predictions‘.

I joked with this 👇, and a fellow panellist noted how wrong estimates from last year usually are…

For investors, I believe it’s more important to get the long-term direction right and adjust periodically with consensus prices.

While these are still estimates, they reflect the ‘most informed guess’ we can have.

($4/lb likely 2y away)

For miners, costs rule.

(Copper and zinc looking good for Glencore)

And that’s it for today!

Glencore’s outlook is in line with the other big players, such as BHP and Rio. The task ahead is let’s say, interesting.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.