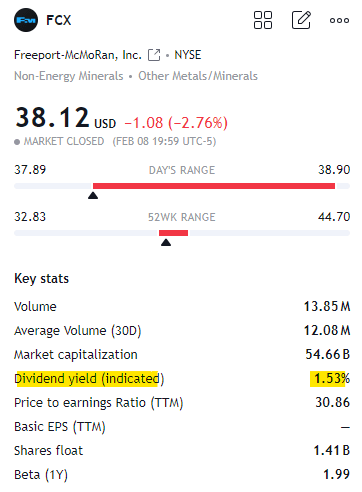

Freeport McMoran is the largest copper producer in the US and worth ~$54 billion.

Yet it flies under the radar.

You may have just seen them in the news (due to CFO Kathleen Quirk being appointed as new CEO), so…

Here’s an overview plus their outlook for the commodity:

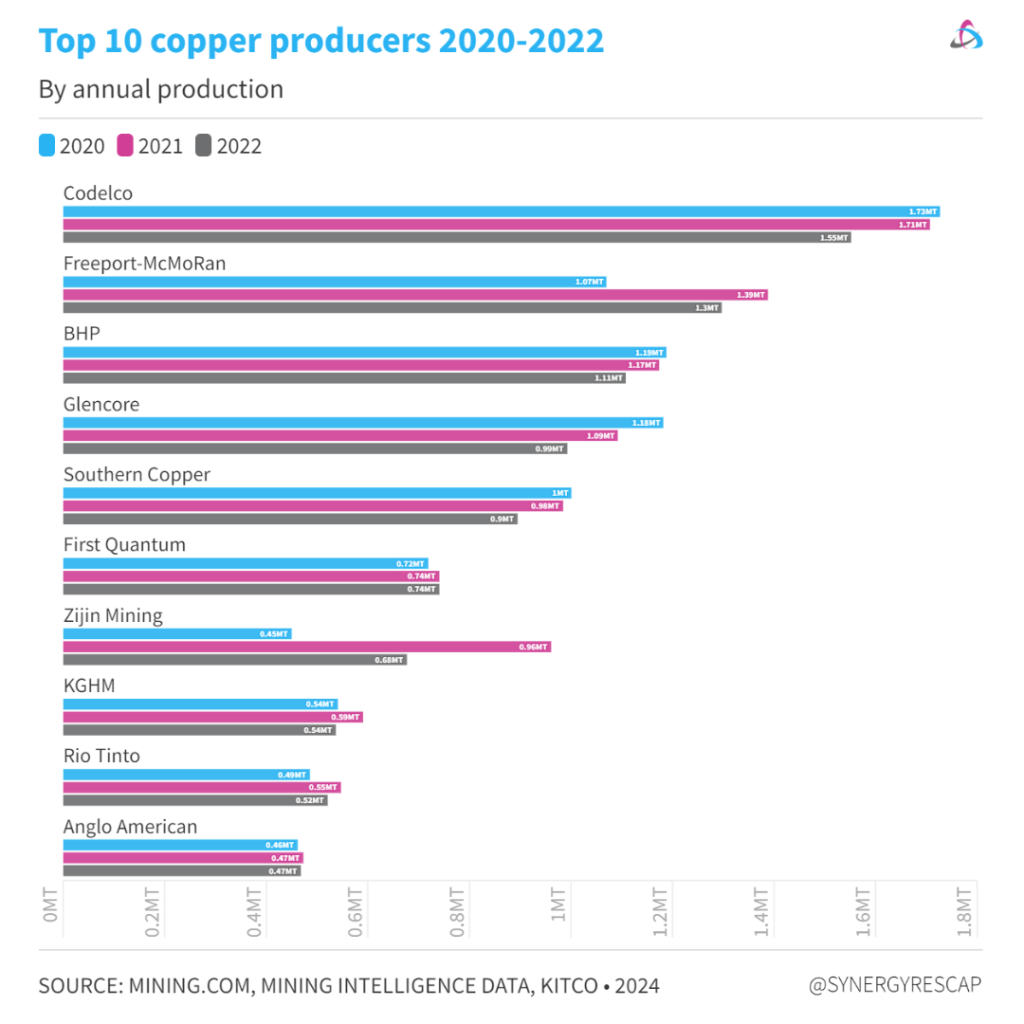

Freeport produced more copper than BHP in 2022, or about 9% of mined production*.

While being much smaller in market value.

Is this an opportunity for you, as an investor?

Let’s see how they stack up.

📊 @CostmineIntel | @synergyrescap

$FCX operates globally.

It has:

- US → 7 copper mines, 2 molybdenum (w/moly, gold and silver credits)

- South America → 2 copper mines (w/moly and silver credits) in Peru & Chile

- Indonesia → copper, gold and silver in the massive Grasberg district.

But here’s a twist:

Back in October, despite these results, it said it planned to slow expansion plans due to inflation and slumping prices for copper.

This was a widely held sentiment at the time.

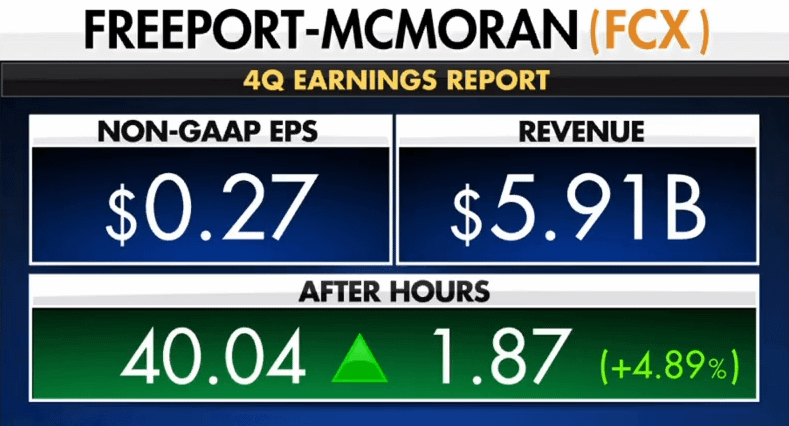

Freeport had strong results the previous quarter, and as it turns out the next too (4Q shown here).

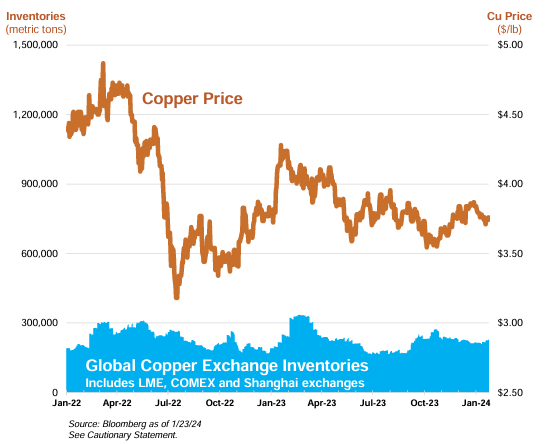

Fast forward to late 2023, copper outlook is up

- global demand remains resilient

- supply growth reduced

- low inventories

- analysts revising 2024 estimates*

Market to tighten further by 2025

- energy transition

- incentive pricing

Copper price outlook increasingly positive.

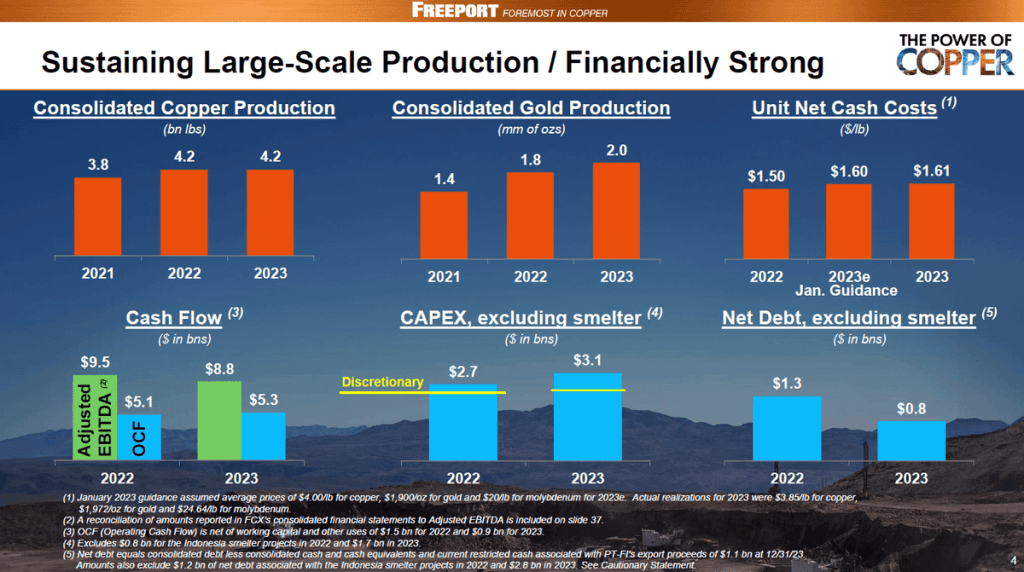

$FCX 2023 results are on point:

- consolidated copper production steady

- higher gold production

- minor increase in net cash costs per unit

- reduced net debt*

*exc smelter

Fmr CEO Richard Adkerson commented that demand weakness in Chinese real estate was offset by investments in the grid, green economy, manufacturing.

Demand actually grew. And of course, China remains the lead-in measure and takes half of global demand.

Friedland feels similarly.

EVs are a big part but also investments in:

- carbon reduction

- alternative energy

- grid (noting that ~70% of copper goes into generating, distributing or using electricity)

- tech

All in a world becoming increasingly electrified, global growth, tech centers, AI.

In Jan, Adkerson said that the price of copper is currently driven by macro factors such as a strong dollar, fed policy and interest rates.

But when looking at industry-specific issues, it gets murkier (indeed!).

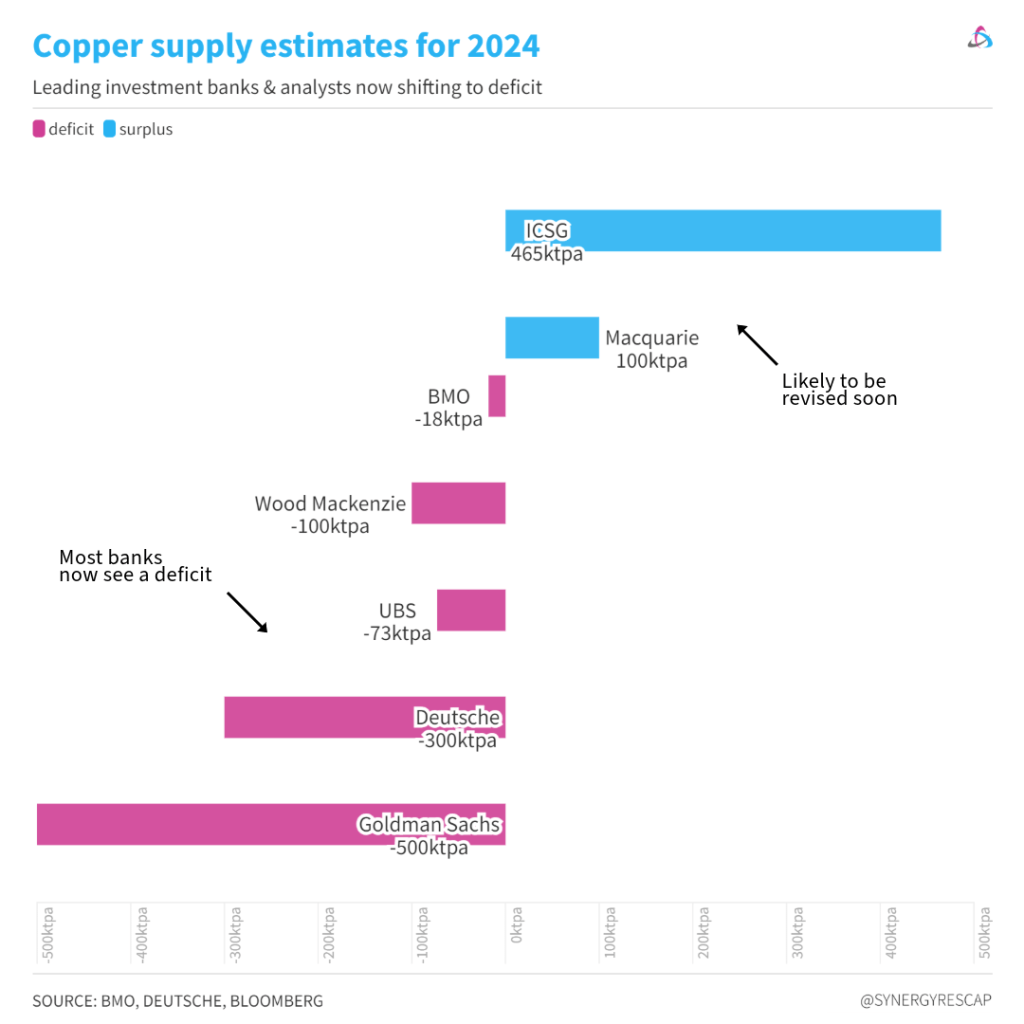

2023 was expected to be in surplus, yet ended in a small deficit.

He has also commented on the structural mismatch between supply and demand:

- prices too low

- now in shortfall*

- needed price reversal

- severe supply challenges

- higher development costs due to inflation

*Goldman Sachs et al revised estimates summarised below.

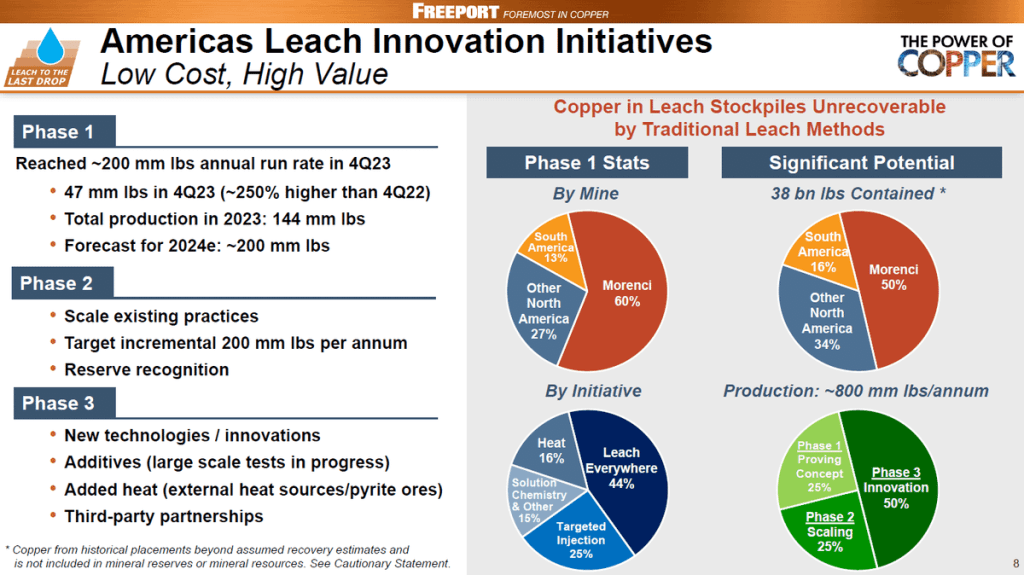

While others are delaying decisions with these multi-billion endeavours, $FCX is preparing prudently for a shortage.

They expect no near-term declines in their production so investing calmly, adding low-capital copper buy-ins through advancing technology (such as leaching).

And that’s it for today!

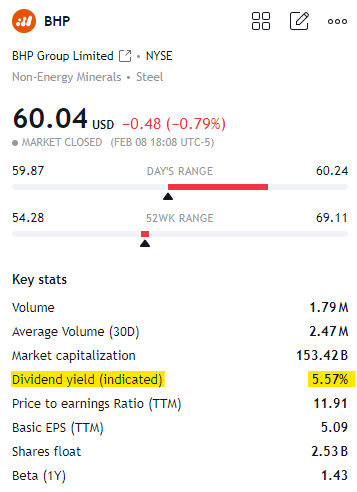

$FCX is a solid option for copper, cheaper than other majors and seemingly with more upside potential (221% vs 33% over the last 5 years). However, their higher P/E ratio and lower dividend yield may convince you to stay with BHP.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.