Investment in the energy transition beat another record in 2023, up 17% on the previous year.

Renewables and the grid are a fundamental piece of the theme.

Here are clues and stock ideas on how you, as an investor, can participate in both:

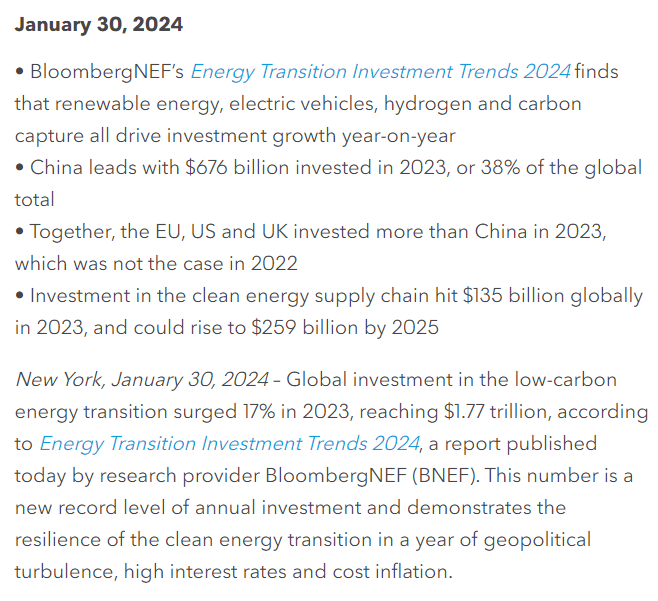

Global investment in the energy transition hit $1.77 trillion in 2023

A new high.

Broken down:

- Power grid: $310B

- Renewable energy: $623B

- Electrified transport: $634B

While transport is widely discussed, renewables and the grid contribute jointly the most.

📊 @BloombergNEF

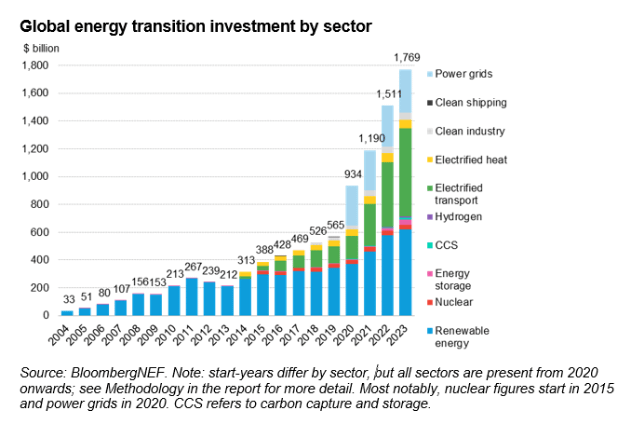

The clearest outcome of these MASSIVE capital outlays:

Renewables could overtake coal as the largest source of electricity as soon as this year.

(I personally believe it will take longer but it’s possible)

Looking into a few selected countries, some surprising patterns emerge, though.

Coal, oil and gas contribute significantly to many, and the investment required for the transition will be steep.

In addition, investing in renewables and infrastructure leans heavily on tech, where private equity and venture capital play big (and a sector usually closed to small investors).

Funds

- Breakthrough Ventures

- EarthshotVentures

- Presidio Ventures

But other options exist.

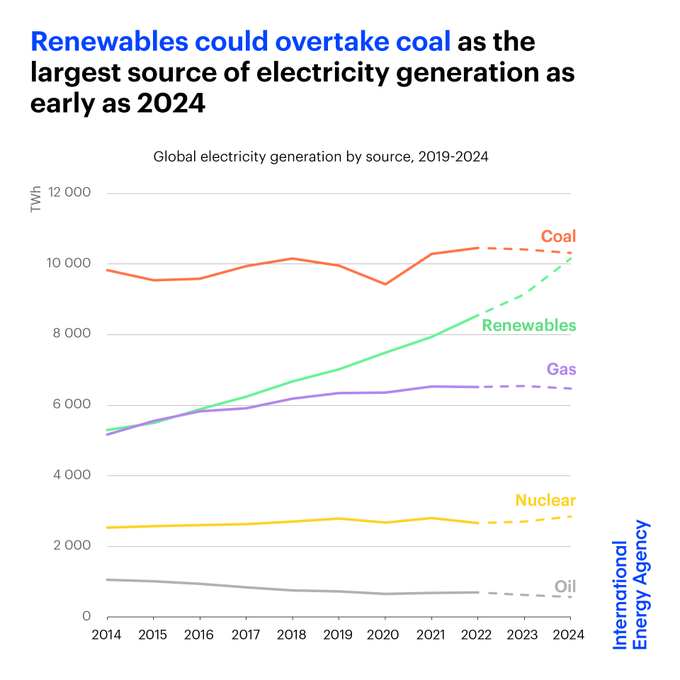

Rio Tinto sees both steel and copper at the core of decarbonization.

(Plus $BHP shares the view, the 2 largest miners)

They expect total commodity demand growth to reach 3.9% CAGR for the period 2022-2035, with equal growth in traditional uses and energy transition.

For context, here are the quantities $RIO foresees for use in:

- wind turbines

- solar panels

- EVs

That’s some serious growth on both copper and steel (plus other metals).

The top 3 renewable sources contribute the most to capacity:

• Solar, wind and hydropower

Solar PV and wind are rising in what could be their biggest growth ever.

(with solar taking two-thirds of such growth)

Let’s cover some practical research ideas:

• Wind

Expected to add 28% of new renewable capacity

Consider:

How big would you like to go?

- Utility-scale

- turbines +100kw in size

- farms connecting to grid

Connectivity

- distributed wind*

- off-the-grid systems

*Easier to analyse, no need for wind experts

Where?

- land-based

- offshore wind farms

The latter has grown given it is less intrusive being ‘out of view’, more efficient than onshore due to higher speeds and lack of interferences (objects).

(although it’s not free from controversy either)

Thus, investors can deploy capital via wind-farm operators, utilities, ETFs, green bonds, turbines and tower manufacturers, electronics, and other components.

For instance, turbine makers Siemens $ENR

Additionally, dissecting the largest holdings of popular indices and ETFs

• Solar

Investors can participate in generation, equipment or related tech, or via ETFs. In addition, financial innovations also exist (although may be more difficult to access depending on your residence).

Options include:

- $RAYS on the ETF side

- $CSIQ

• Hydropower

Countries like Brazil rely extensively on hydro and are increasing capacity, but China dominates, on a global scale.

Investors can participate mainly via large infrastructure in countries where it’s preeminent, or internationally via ETFs.

• Geothermal

A much smaller, niche option.

Investors can participate via utilities that include it as part of their generation.

Fun fact: I worked for a year with a newly formed small cap, looking for prospective sites for geothermal. They are now part of Innergex $INE

• Bioenergy from biomass

Can be for heating or fuel, plus carbon capture and storage BECCS.

Bioenergy can either mitigate or increase greenhouse gas emissions.

Investors can participate via hydrogen** plays like $PGY (green preferred).

**Hydrogen types:

- Grey: from natural gas via steam-reforming, generates greenhouse gas emissions during production

- Blue: also steam-reforming, but captures and stores carbon emissions

- Green: no emissions, uses renewable energies in the production process

📊 @ACCIONA_AU

Finally, you can also participate via electrified transport, which is now the largest individual contributor, as I mentioned.

That’s all for today!

Use this post for ideas to kickstart your research into the topic.

Even if you don’t believe renewables are the ‘world’s saviours’, having an allocation given strong fundamentals, is wise. Things are speeding up…

📊 @IEA

But wait, before you go…

Keen to ‘dig deeper’?

- The Mining Investor Toolkit will help you invest more confidently and protect your portfolio.

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Please assume stocks/companies mentioned publicly are held and/or clients, and our content may contain affiliate links. By reading or sharing this, you agree to our full disclaimer.