Sprott* manages several mining ETFs, and regularly puts out extensive research.

They recently released a lengthy report on the minerals needed for the energy transition, with valuable insights for investors.

Here are your key takeaways:

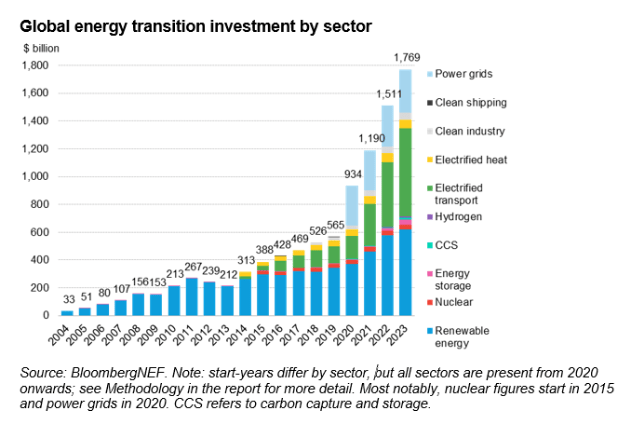

In 2022, investment in the energy transition surpassed $1T and getting on par with those made in fossil fuels. By 2023, the figure climbed to $1.7 trillion.

This is astonishing.

But, not enough.

Investment needs to average $3.9T from 2023-2030 to reach global net-zero 2050 targets.

Policymakers acknowledged globally that clean energy is the way forward.

On top, the Russia-Ukraine war painfully highlights that energy security is even more strategic.

Both amplify the momentum.

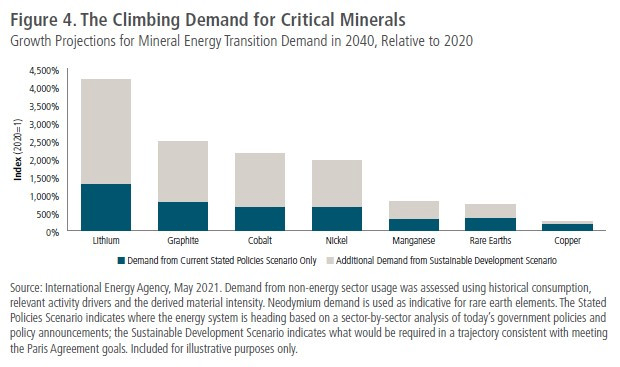

Growth for materials, with lithium in the lead, will speed up.

Technologies that underpin decarbonization rely more on metals and minerals than existing systems.

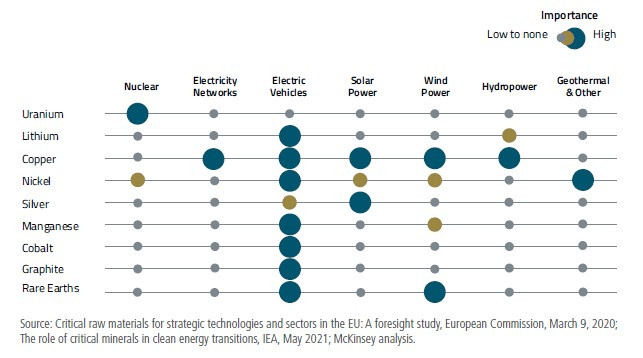

- Nuclear → uranium, nickel

- Solar, wind, hydro, geothermal → copper, nickel, silver, rare earths REE

- EVs → lithium, graphite, copper, nickel, silver, REE

The kicker?

All energy usage systems → copper (aka the king)

This growth will benefit mining companies involved in the discovery, extraction and processing of metals and minerals.

(and the investors who back them)

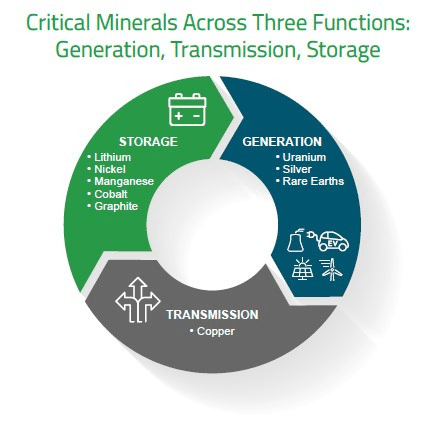

Sprott classifies these materials into 3 functions:

1) Generation

• Uranium

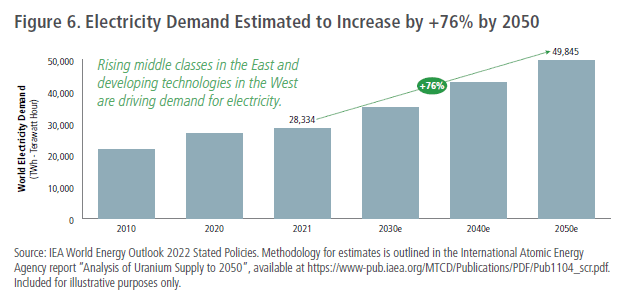

Electricity demand is forecast to climb.

Nuclear offers the highest energy capacity with the lowest emissions.

While renewables contribute none can provide the steady baseload power that nuclear implies.

A shortfall of uranium is expected.

• Silver

As the most conductive metal, it’s essential for solar panels, helping generate electricity. Also used in EVs

• Rare Earths

17 elements (mostly produced in China) used for their strong magnetic properties, in most EVs as part of the drivetrain, and wind turbines

2) Transmission

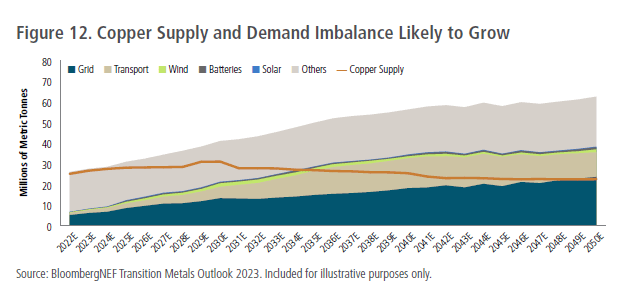

• Copper

The transition relies on carbon-free electricity, in power grids and vehicles, and systems producing & storing it use copper.

Solar, wind, bioenergy, need it as well as EVs.

To reach net zero, demand may increase 142% by 2050 (vs 2022).

3) Storage

EVs are a driver of demand for:

• Lithium

This market is expected to grow from $7B** in 2023 to $22B by 2030.

Despite being widely available -USGS estimates resources at 98mt, 25% in reserves-, demand is forecast to outpace supply in 2028.

And also, these markets:

- Nickel

- Cobalt (est $1B investment required, 70% of supply from DRC)

- Graphite

All are expected to miss demand and create growing imbalances.

And here’s the nugget:

They say the post-pandemic era marks the beginning of a new supercycle for commodities.

Given mining equities tend to move with spot prices over long periods, this should:

- position miners in an era of sustained investment

- lift their share of GDP

→ Steady demand growth

And that’s it for today!

The energy transition needs these metals and minerals, and investors who position themselves intelligently should see significant capital appreciation over the long term.

- Source: Sprott report, A New Era: How Critical Minerals are Driving the Global Energy Transition. 2023.

- **Sprott manages $21 billion in assets as of September 30, 2022

- *estimated

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.