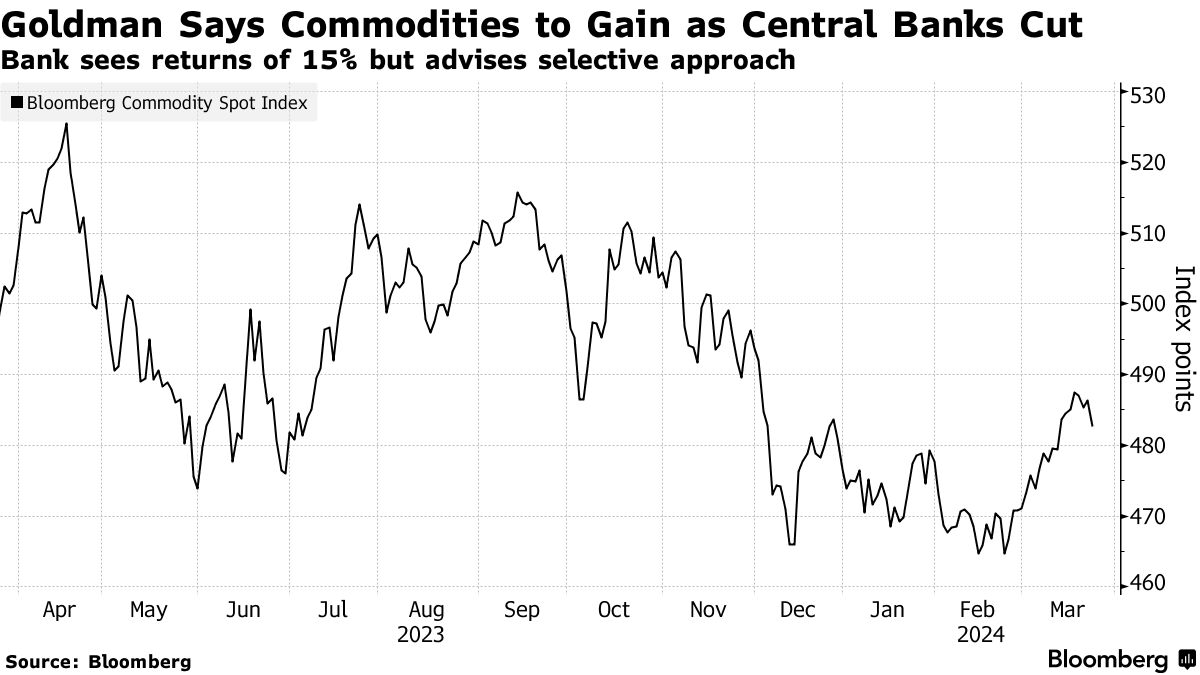

Goldman Sachs released a note recently that caught our eye.

From where they see commodities at the end of the year, to which will benefit the most from lower interest rates.

I promise you want to read this one, investor:

They reckon commodities may return 15%, as interest rates continue to fall.

Among winners, they see:

- copper

- aluminum

- gold

- oil

Some select sectors may even deliver 20%.

But wait, before you jump in…

The wins won’t be universal so we must be selective*.

(we knew that, didn’t we)

Investors must consider both cyclical and structural factors.

Frank Holmes also chimed in and expanded on $GS insights.

(*also see US Global’s periodic table of commodity returns ahead)

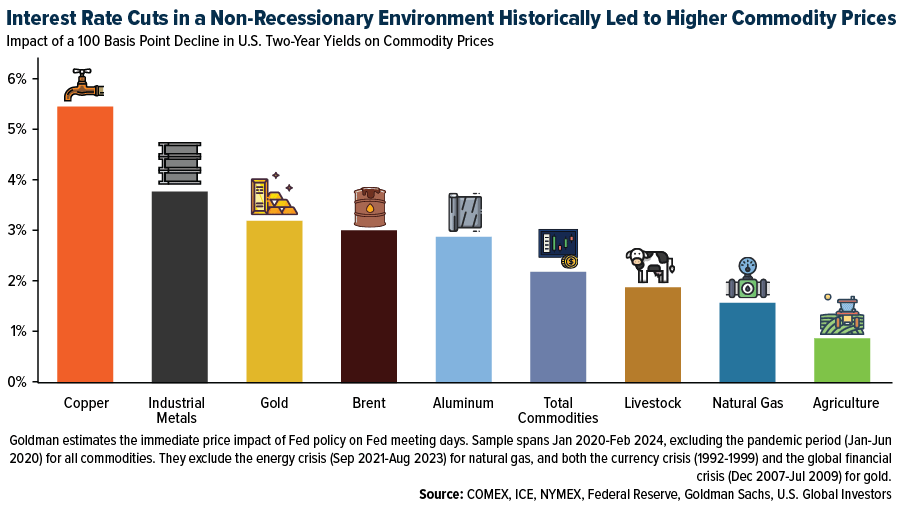

Here is the impact of a 100 basis point decline (or 1%) in various commodities.

The first insight is clear:

The most capital-intensive rely HEAVILY on debt financing so this makes perfect sense.

GS reminds us that investors are likely to come back as safer assets start producing lower yields.

They say:

Rate cuts in non-recessionary environments ‘lead to higher commodity prices, with the biggest boost to metals (copper and gold in particular), followed by crude oil’.

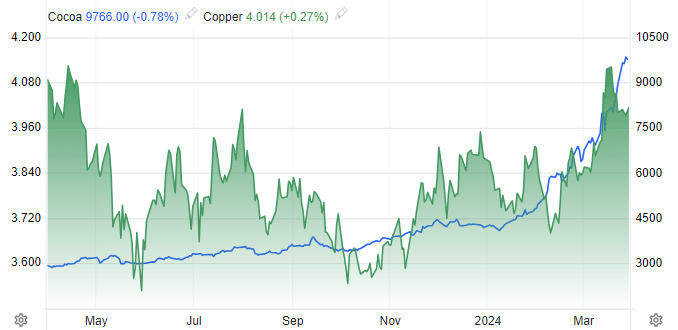

So far, this quarter we’ve already seen modest improvement.

But before we could celebrate, this happened 🤣

(cocoa beating bloody copper!)

In any event, by year-end the bank forecasts:

- copper $10K/t

- gold $2.3K/oz (a nominal record)

- aluminum $2.6/t

$GS is certainly not alone in the bull corner.

Other bulls we’ve covered recently:

- Carlyle Group (with former GS Jeff Currie)

- JP Morgan (highlights gold’s upside)

- Friedman

- Freeport

- Glencore

(will add links to these posts at the end in case you’d like to expand)

GS also says that in the midterm, they have a ‘constructive view on gold underpinned by eventual Fed easing’.

This should wake up ETF buying, they theorise.

On the flip side, they remain bearish on:

- nickel

- cobalt

- lithium carbonate

Saying it’s ‘too early to call a decisive end’ for these metals.

There’s more pain ahead for us, friends.

I’m staying away from nickel at the moment, tbh.

And that’s it for today!

The bull case is getting stronger for copper and gold. Chances are we’ll end the year in a much better place.

Extra reading

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.