Morgan Stanley released a research note a while ago.

It comes packed with a revised price and supply estimate for copper, plus insights on gold and stocks.

You’ll find plenty of *nuggets* within, investor:

Given the massive disruptions we’ve seen in copper supply, they now expect:

- shortfall of 0.7mt (~2.6% of demand)

- higher deficit conditions throughout decade

- prices of $4.38/lb for 2024 (up 8%) and $4.41/lb for 2025

But before you start celebrating…

In the note, $MS also says:

‘we hesitate to chase stocks at this juncture’ as copper plays continue to outperform the commodity.

(still their top picks in a sec)

But after all, the note is entitled ‘Everybody loves copper, and despises iron ore’…

Let’s zoom out for a bit:

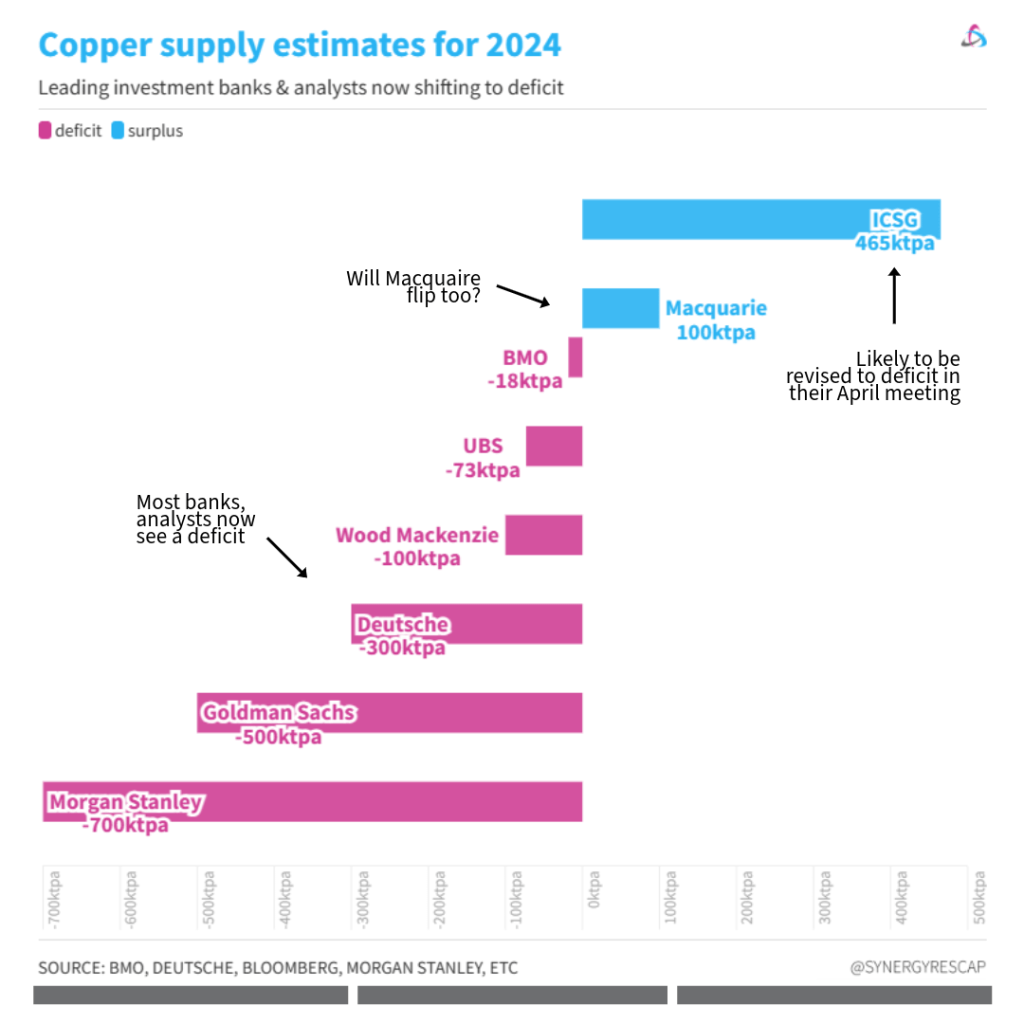

In mid-2023, the forecast was a slight surplus for this year and next.

Things have DEFINITELY shifted.

Deficit is now (nearly) unanimous.

And here’s how the stress is flowing downstream.

Copper smelters are feeling the crunch with lower availability of concentrate.

They are reducing treatment charges (less income for them). A wild swing from $84/t to $9/t!

Some in China have (reportedly) agreed to cut production.

This will impact the refined copper market.

I reckon we’ll reach the prices Morgan Stanley expects before the end of the year.

But regardless of when it comes, this is a BIG inflection point.

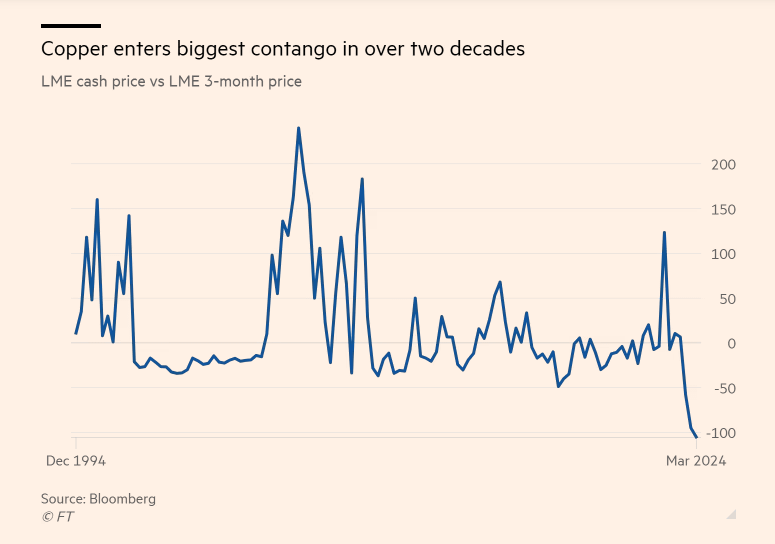

Future copper prices are getting higher than spot, bringing the biggest contango in over 20 years.

The main risks the bank cites for their current position are:

- harder landing from the weak property market and deflation in China

- interest hikes in the rest of the world*

What about other metals?

Here’s what they said:

$MS sees:

Gold and silver

- w/upside due to strong physical demand and falling yields.

Aluminium

- may find support as a substitute for copper.

Battery metals

- Among all, they prefer nickel. A bit surprising, isn’t it?

Here are some of their picks:

Among copper stocks, Morgan Stanley sees as:

Overweight

- $TECK target $55

- $IVN target $18

Underweight

- $SCCO they view as expensive

- $NEXA lingering operational uncertainty

(some from me in PS)

Meanwhile…

Morgan Stanley’s own stock plunged as they are facing a multi-agency probe into how the investment bank vets its wealth management clients.

Ouch.

And that’s it for today!

The copper party is getting crowded, and it seems it’ll last way past midnight. Are you guys coming over?

*Here’s more on the potential effects of falling interest rates

PS: juniors to keep an eye on, with copper/gold exposure and potential upside

- $SEND Argentina, finding nice drill intercepts

- $OCO Mexico, steaming away, could be a transformative year

- $ABRA PFS out, markets should finally recognise value

- $PERU with a new drilling program

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.