Hey hey! Copper prices suffered in July, ending the month around $4/lb as volatility continues to impact the markets.

But something major happened.

Just as the dust settled on the fast-to-fail BHP’s takeover attempt of Anglo (as they say in start-up land, if you’re going to fail, better do it fast), we heard of the acquisition of Filo Corp, a successful copper developer focused on Argentina-Chile.

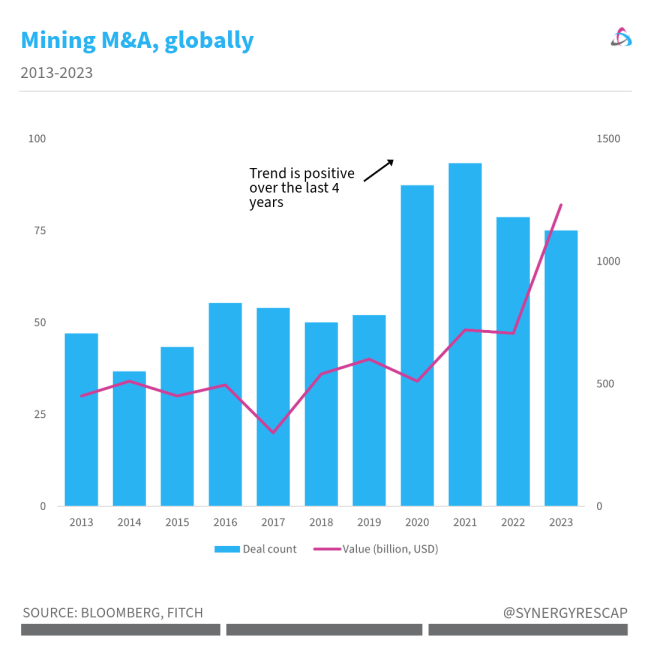

In perspective, these are excellent times for cashed-up players to move their chess pieces, and in this game, producers have the advantage. While it’s early to say definitively, we believe there is a high chance for 2024 to extend the positive trend of the last few years.

When rumours emerged mid-month regarding Filo, it seemed quite fitting and likely to close. And a few days later the announcement was made. Lundin and BHP will form a 50/50 JV to hold the Filo del Sol project and Lundin Mining’s Josemaria project. BHP will pay Lundin Mining US$690 million, valuing the deal at a cool US$4.1 billion.

The deal made sense to all parties here. The underlying asset is a copper porphyry and juniors are not well suited to develop these giants. A deal was coming, it was just a matter of when. In addition, changes in the political landscape in Argentina (with President Milei taking office last December) are making the country more appealing again.

In any event, another solid win by the Lundin family and team, as well as BHP (not as massive as Anglo but definitely vindication).

More broadly, we think this deal can act as a catalyser for more copper deals on advanced yet smaller targets. It looks highly likely that the path of least resistance, at least for now, lies among deposits like Filo (2.2 billion lbs Cu, reserves), Jose Maria (6.7 billion lbs) vs supermassive monsters such as the stalled Resolution (40 billion lbs).

Easier to finance, permit, more palatable for the NIMBY crowd and overall less risk. Food for thought.

Meanwhile…

Here’s the latest on this blog:

- 5 things to know when investing in gold stocks

- On the podcast: Are Chile’s new lithium policies attracting investment? feat. mining lawyer Daniel Weinstein.

- The most popular YouTube channels for mining investors

- The Energy Transition Investing Course (subscriber-only)

- ICYMI: my go-to questions to ask when a deal is announced

If you enjoyed this analysis, subscribe to our deal alerts* to receive it via email.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

*corporates and sophisticated investors

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.