Gold hit a new all-time high in July.

Newmont, Agnico and Barrick are the world’s largest gold miners.

Together represent over $120b in market value.

Here’s what they expect ahead (and the extra perk of holding gold producers):

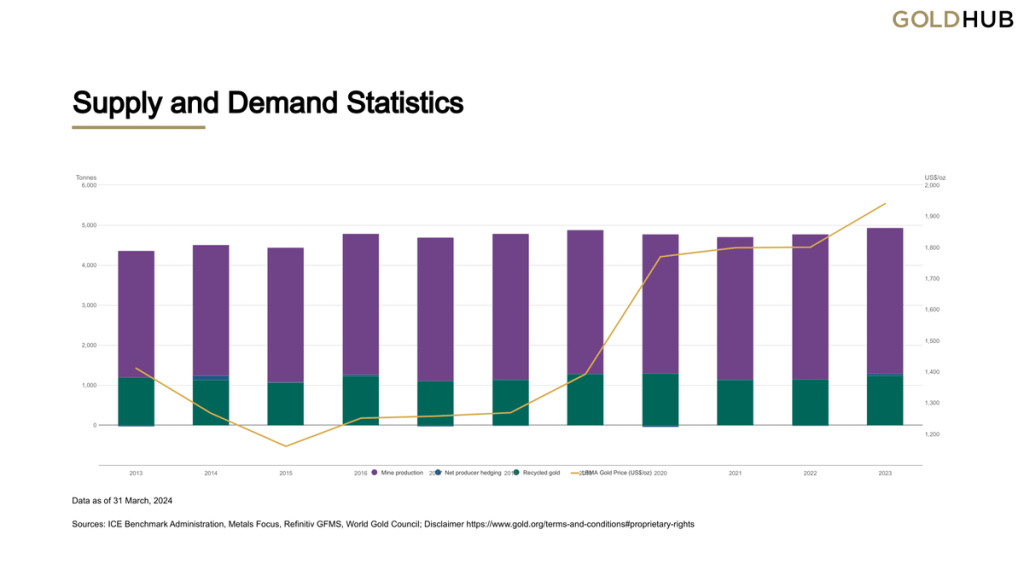

Gold production globally in 2023 was over 3,000t. China, Australia and Russia were top 3.

Over the last decade, production has been stable, despite the important price lift in recent years.

We rarely see such a subdued reaction in other commodities.

But gold is different…

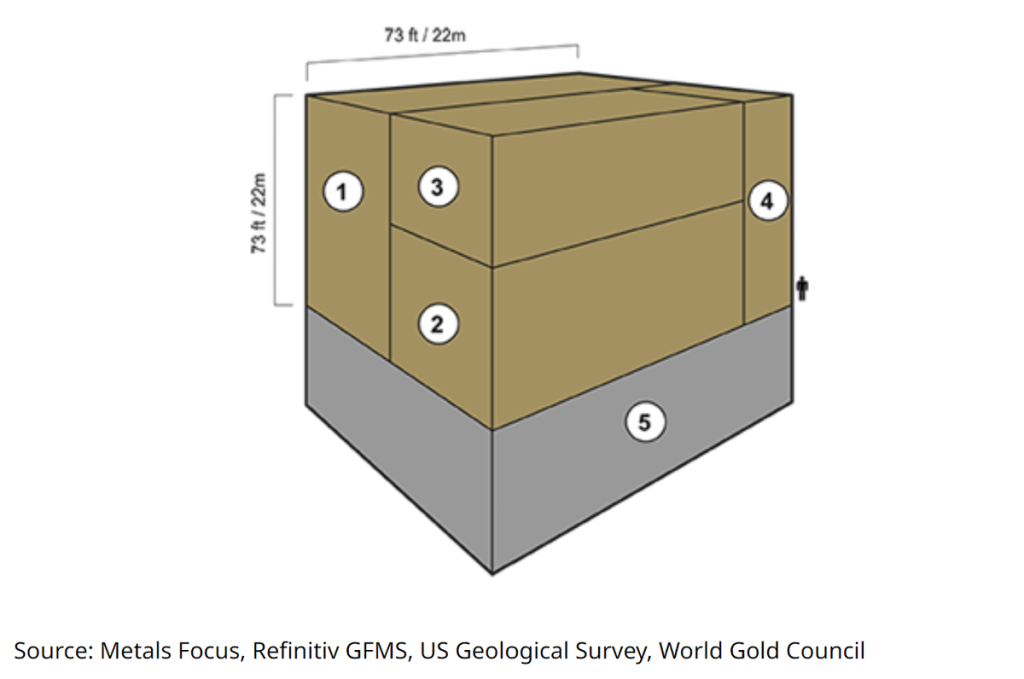

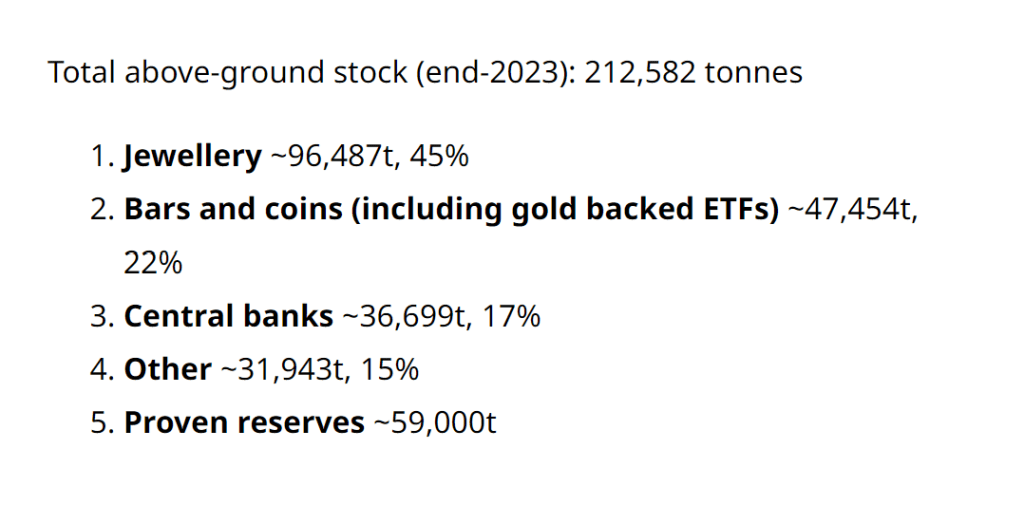

Gold is virtually indestructible.

Hence, unlike other metals, it doesn’t get used up as much.

If we consider all production throughout history, it would neatly fit in a cube, 22m per side.

As geopolitical tensions rise, gold is punching up, strongly (I remember $400 gold!)

Rising worries, central bank purchases and overall flight to safety seem here to stay.

Gold producers see this continuing, and are in turn, expanding their reserve base and production.

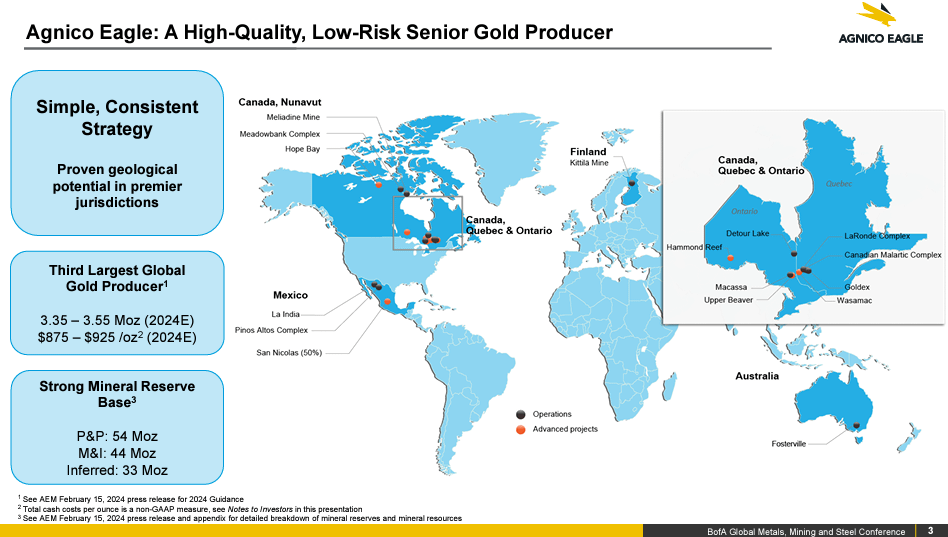

Agnico is the 3rd largest gold producer with 106.8t and has a strong mineral reserve base.

54 Moz in reserves, plus resources.

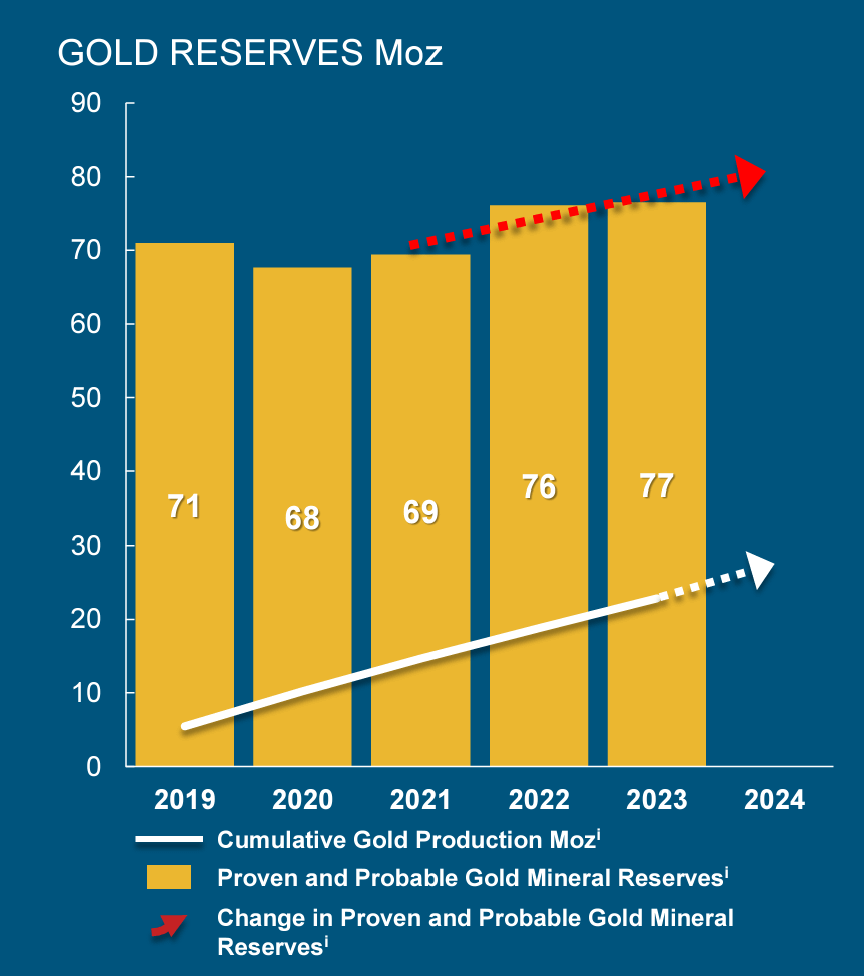

Barrick is now the smallest (in market value), 2nd in production, but they are not staying put.

It produced 126t in 2023 and has been pushing hard to expand its gold reserves.

Currently, they have 50% more than Agnico (proven and probable 54Moz vs 77Moz).

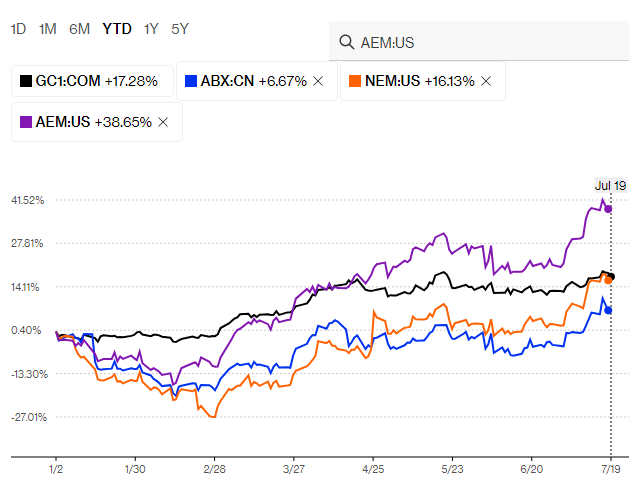

All 3 stocks track the metal closely.

But Agnico* $AEM is excelling (they’ve been my main gold producer for years).

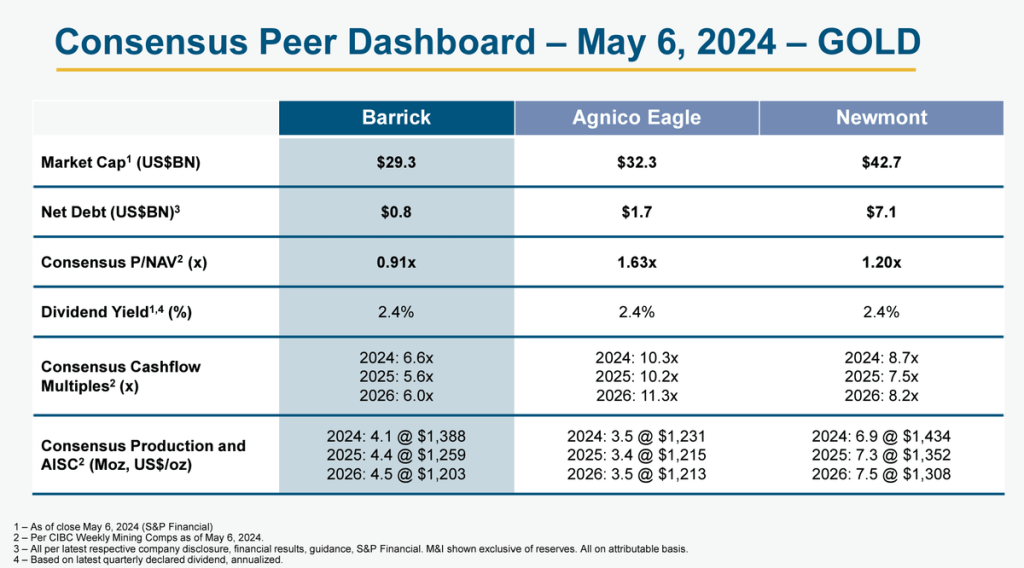

In terms of financials:

Barrick has substantially less debt than the other 2 peers.

Re consensus AISC, CIBC sees Agnico at the lowest and Newmont as highest, all $1,000+ under spot.

And here’s the side perk of holding gold producers (this is not true for every single one):

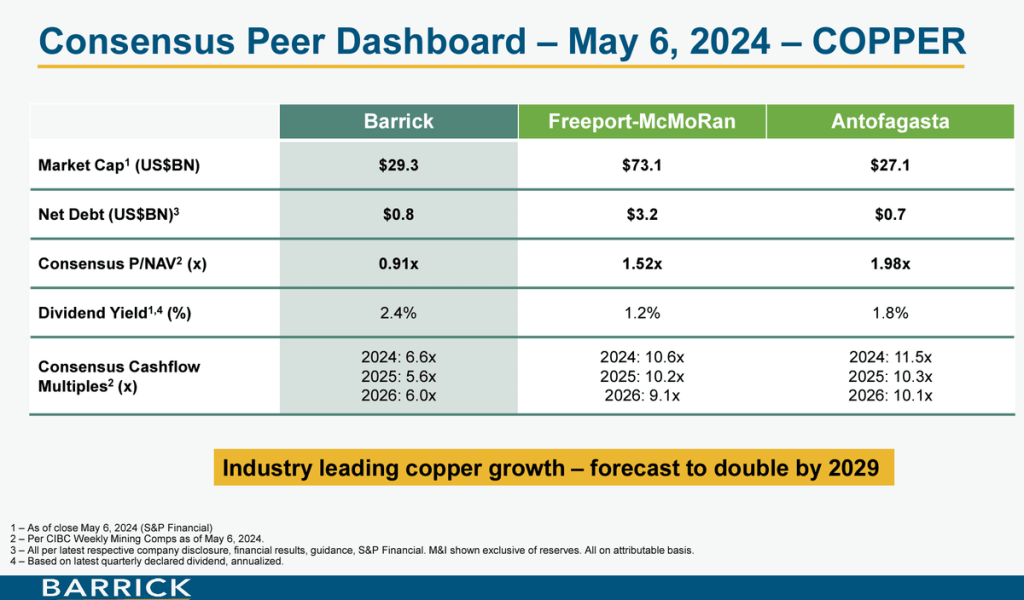

Copper exposure!

Gold is associated with copper in many deposit types**. So depending on choice, it can be considerable.

For copper, the consensus peer group for Barrick shifts to Freeport and Antofagasta $ANTO . *My thread on $FCX at the end

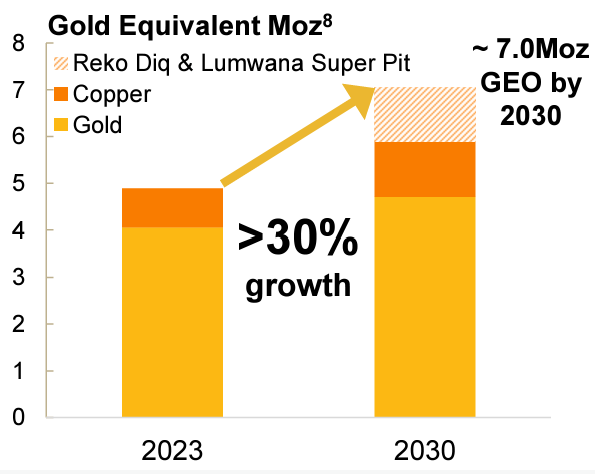

Barrick $GOLD sees substantial growth in its reserves in gold but nearly doubling in copper (including production), if Reko and Lumwana come online.

(Feasibility studies are currently underway for these 2)

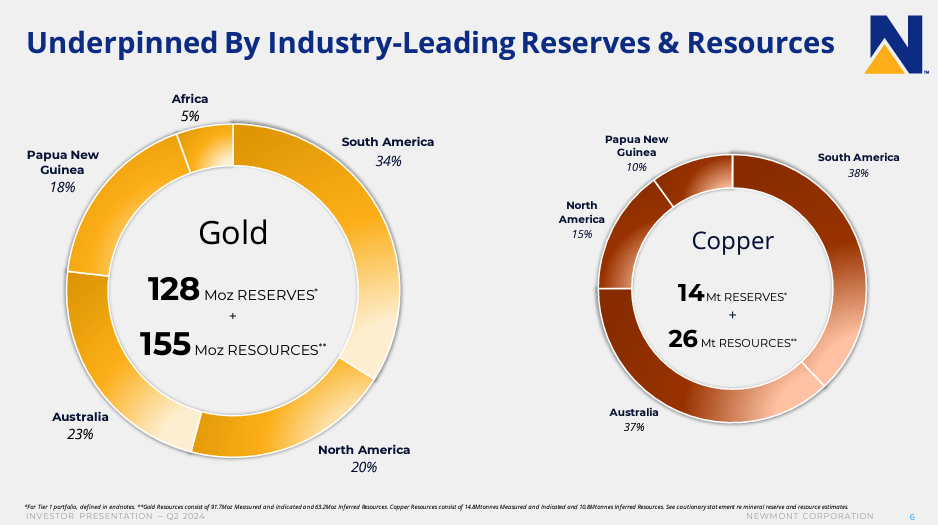

Back to Newmont, it produced the most gold, 176t and is the largest at $54B

- their gold reserves are nearly 2x Barrick’s

- copper is central to its identity (unlike the other 2).

- 14Mt in reserves (equivalent to 10+ years of Escondida’s production)

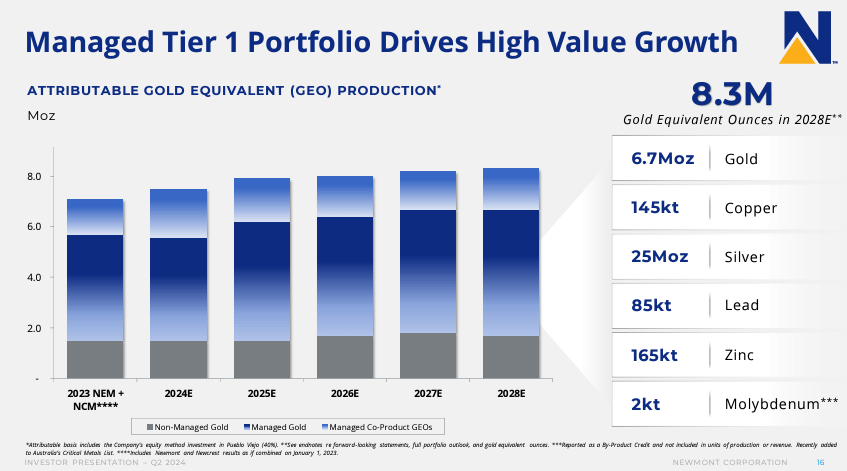

Yet most of Newmont’s planned output growth is expected to come from gold.

It expects to reach 8.3Moz GEO by 2028 vs Barrick’s 7Moz GEO***.

Agnico is not as vocal on copper but they seek to grow there too.

They closed a JV with Teck, where they’ll fund $580MM of the capex of San Nicolas, a VMS copper/zinc deposit in Mexico.

The project is in the permitting phase.

Once operating, it will produce 63,000 tpa Cu

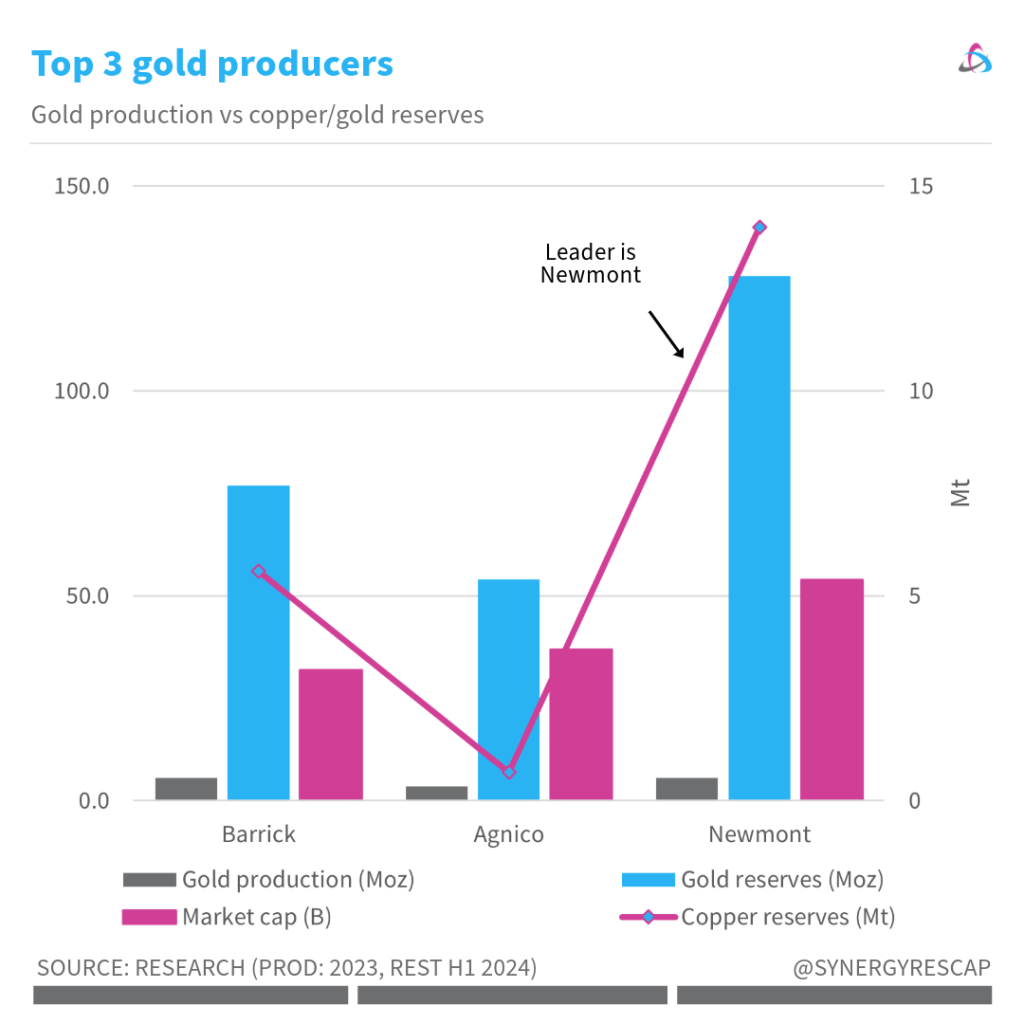

To sum up, here are Newmont, Barrick and Agnico’s:

- Gold production

- Gold reserves

- Copper reserves

- Market cap

In one chart for easy comparison.

*Links mentioned previously, right ahead

That’s it for today!

I reckon gold producers will pay even more attention to copper, as the energy transition speeds up. More reasons to hold.

My note on Freeport $FCX

- *we hold

- **See grades per deposit type for those including gold with other minerals

- ***Gold equivalent ounces

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.