For investors and the whole copper supply chain, there are a myriad of challenges ahead.

Wood Mackenzie published an insightful report. Here are the most salient points:

• Copper Demand Growth:

WM estimates that demand for copper will grow by 75% to 56 million tonnes (Mt) by 2050, highlighting the crucial role of copper in the energy transition and decarbonisation efforts.

While the investment required for new mines is well understood…

The implications for other links in the supply chain are less clear and even more challenging.

Effectively two forces are at odds here.

The China conundrum.

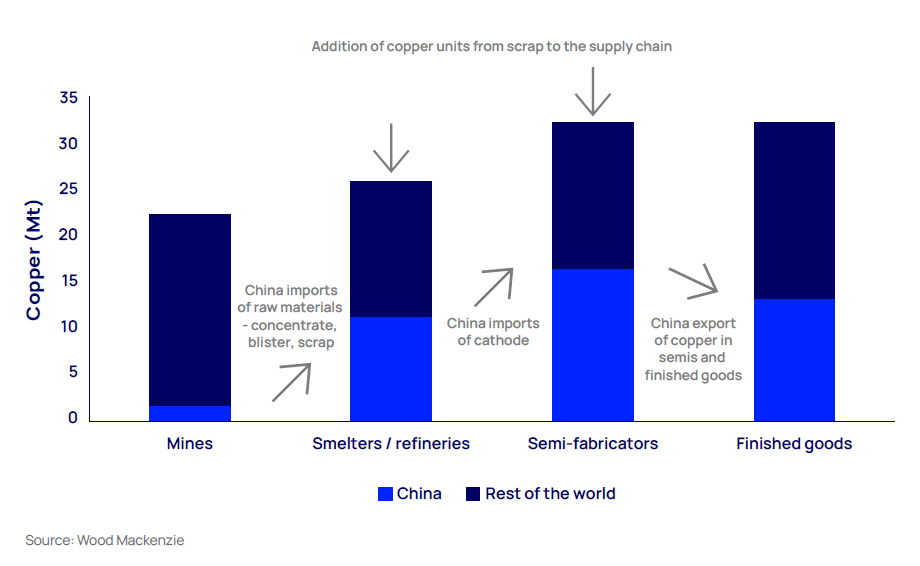

• China’s Dominance in Copper Supply Chain:

China dominates downstream processing and semi-manufacturing sectors of the copper supply chain.

This presents a major challenge to global supply security.

(and not only for copper, but one problem at a time!)

This supremacy is making it difficult for other countries to dissociate from Chinese investments in these areas.

Programs like the IRA and others in Europe continue to make strides and put millions of dollars in subsidies, and increasingly include downstream uses.

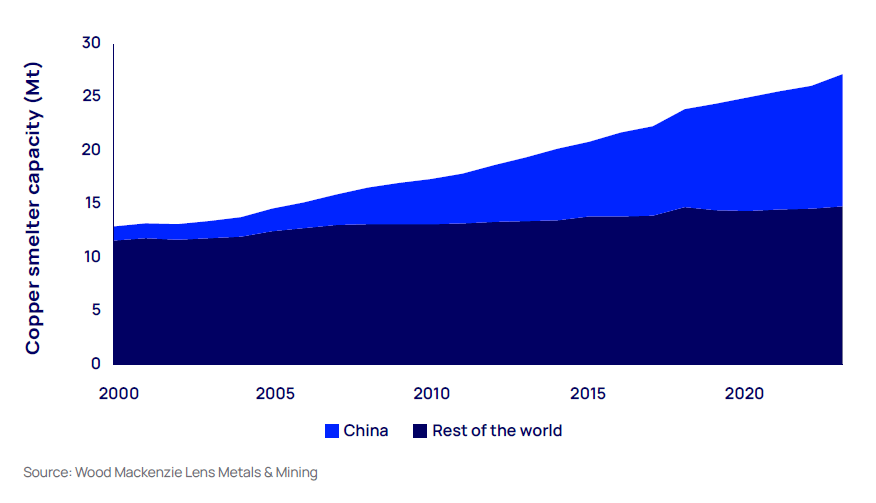

• Investment Trends in Copper Supply Chain:

China also dominates investment in the copper supply chain, with significant investments in new mine supply, smelting and refining capacity, and fabrication capacity.

This has barely changed over the last 20 years.

• Challenges in Decoupling from China:

Nearly US$85 billion in new smelting and refining capability would be needed to displace Chinese supply.

Yet there are doubts. Is it even possible?

Financing these massive endeavours is hard.

In addition, environmental concerns, and resistance to new projects pose additional challenges to achieving this shift.

Copper mines, especially large porphyries can run into strong community opposition. But smelters? NIMBY².

China uses 17Mt or 50% of global demand for copper.

WM estimates about 3.3Mt is exported in finished goods and surprisingly the same capacity the country has added over the last 5 years.

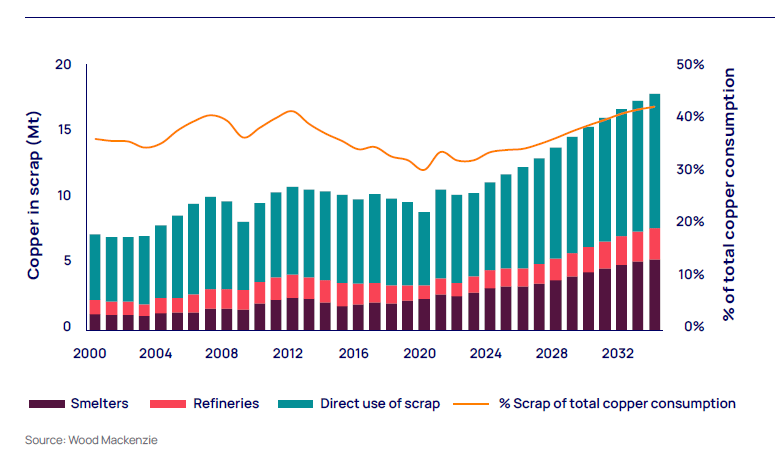

• Emerging changes in the market:

Not all is doom and gloom

- new smelter capacity in India, Indonesia, DRC (the largest in decades, 1.6Mt combined)

- investments in foil plant capability (related to EVs)

- secondary market/scrap (especially in the US

These changes, while small, are positive.

But China will not go quietly into the night. They drop treatment charges to compete, hence other alternatives are likely to be much more expensive for miners.

Want to leave China out of the loop? It’ll cost you.

To conclude

- Securing supply is a global endeavour

- Geopolitics are increasing trade complexity

- Decoupling from China = slower and more expensive transition

- Pragmatism and sensible compromises will be needed to reach net zero without unbearable costs to taxpayers.

By the way, this is a topic I’ve talked about often.

We even discussed it with Lucho in a podcast episode.

Here’s a short clip with the gist of my position:

And that’s it for today!

We know that ‘No copper, no energy transition’. But the copper equation doesn’t work without China. That’s the reality, whether we like it or not.

You can get the report here.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.