The junior #mining sector operates with a broken business model.

If you know me, you probably heard me say this before.

Extreme risk with intrinsic low odds that only a gambler would consider advantageous, NIMBY, ambivalent politicians, exotic locations, the list goes on. And all wrapped up in a package that is conceived, for most players, to rely on equity capital with no revenue throughout the life of the business.

It’s surprising that it’s a somewhat functioning sector. Even more challenging, considering its fundamental importance as the ‘nursery’ of the mines of tomorrow at a time when the stakes are high given the role mining & metals play in the energy transition.

I was born into this so you could say I had no choice! But I love the sector, and this has kept me up at night for years.

Maybe it’s time we finally start not only talking about this more openly, but actively looking for solutions instead of listing so many new exploration companies every year, spinning out assets with the ‘hot commodity’ into new vehicles and raising capital in perpetuity while diluting everyone.

A significant transformation needs to take place. To reach net zero targets the required investment cannot come only from current mining investors, as these pools of capital are simply not large enough yet. Generalist investors are crucial.

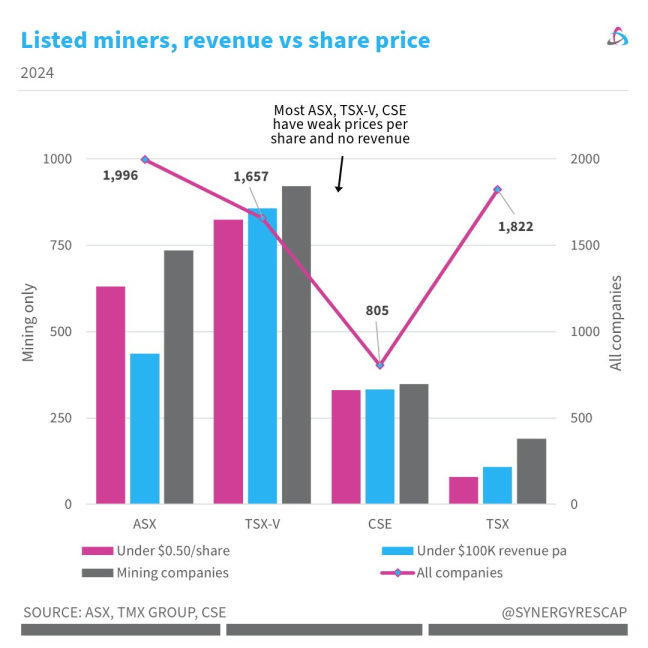

And large generalist investors tend to avoid companies without income. A while ago we analysed 50 of the largest institutional investors in the US, with a focus on their lithium exposure. Unsurprisingly, they only held producing companies and even at record commodity prices, a minuscule portion of total assets under management.

I’ve been looking for other business models for some time and we’re chasing some promising possibilities. More broadly some models that already work such as prospect generators like Legacy Minerals (note: here in Australia some don’t like the label, which makes zero sense to me), exploration alliances with majors or related such as royalty/streaming like Empress Royalty Corp.

But there’s more that can be done. Plus not all exploration companies can be prospect generators.

I don’t know if I will find something enticing enough. But I am still looking.

If you are too, would love to hear your thoughts in the comments or DMs.

That’s it for today.

Every week we share our views on metals and mining stocks on socials and this blog. Subscribe here for highlights or join our distribution list for investment opportunities.

Before you go…

- Keen to reach +30K people? Let’s book an exploratory call

- Seeking acquisitions? Have a sneak peek of our deal flow pipeline

Synergy Resource Capital is a boutique investment and corporate advisory firm focused on natural resources and technology, and based in Sydney.

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.