Time to read:

Hey hey! Copper had a stellar month. China announced a stimulus package that sent futures even higher, briefly reaching $4.7/lb on September 30.

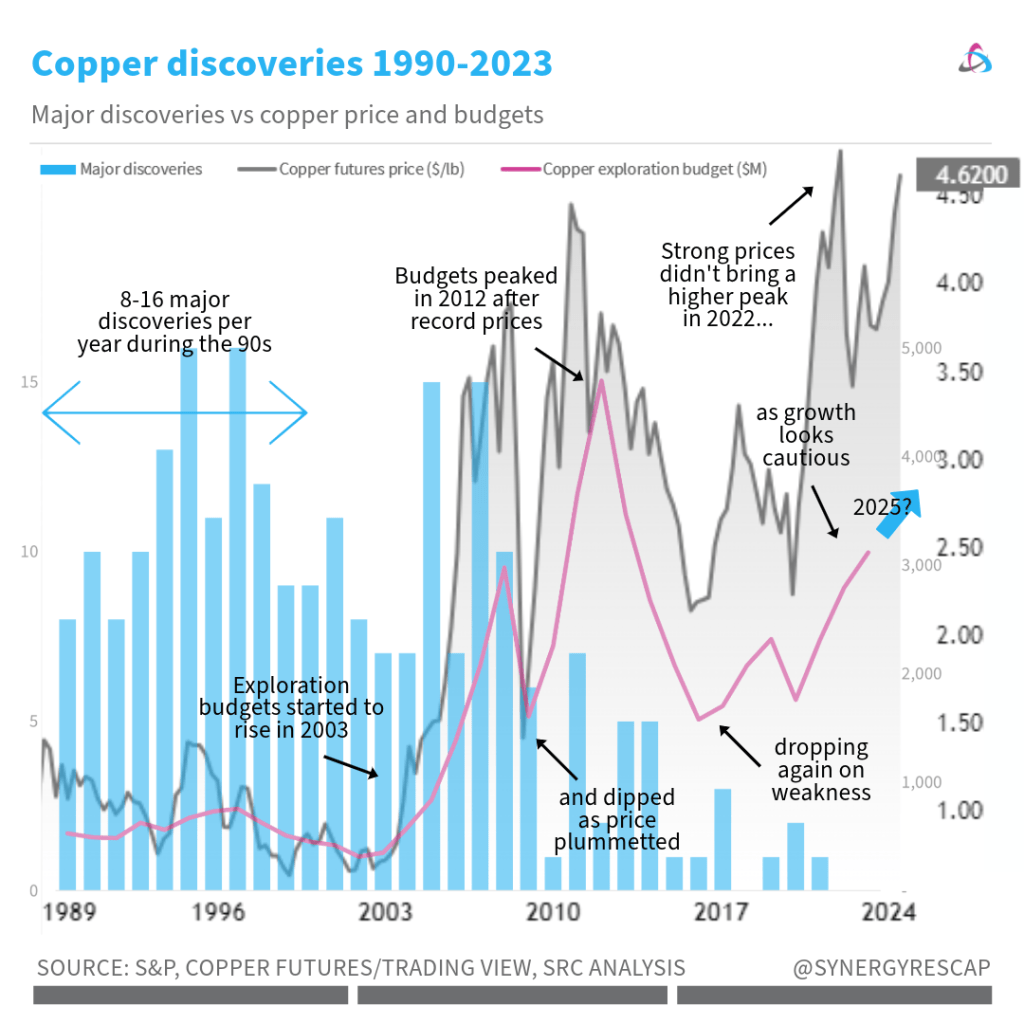

For this wrap-up, we looked into the relationship between copper prices and exploration budgets over 33 years (1990-2023). This analysis can provide insights into how miners and explorers may be investing in 2025.

Over the analysis period, a correlation is apparent, especially after 2003. When prices soar, budgets follow with roughly a year delay, and remain higher for 1-2 years; when prices weaken, budgets drop more quickly. Interestingly, the bullishness in 2022 didn’t match the scale of the 2012 spike, which we believe gives us a clue.

Among top news, Germany seeks exposure to more projects and downstream options with a new critical minerals fund. It’s promising to see more capital pools for the theme, but we remain sceptical of Europe’s commitments more broadly.

NIMBY remains a strong headwind for mining projects in the continent. Ask Rio Tinto… their proposed Jadar lithium mine still faces strong community opposition, despite the support of the Serbian government.

All in all, as long as capital is available, we should see a new rise in exploration budgets in 2025.

Given the sticky global challenges, we’d expect this lift to be mild, and it could be surgically targeted to small to intermediate deposits (think Filo, NGEx and others we mentioned last month) to better manage risks.

Meanwhile…

ICYMI, these are now live on this blog:

- Gold and the hidden perk of holding gold miners

- The copper vs China supply conundrum

- How the junior mining business model is broken

- Newsletter: An in-depth analysis of a news release from NGEx, a promising copper explorer and a review of the situation with lithium & lithium stocks

- Q&A: US-listed copper mining ideas (subscriber-only)

That’s a lot! But not we’re not quite done

In recent related news…

- CleanTech Lithium moving forward with ASX listing and Laguna Verde salt flat among 6 prioritised for CEOLs by Chilean government > read

- Chakana Copper drills high-grade silver at Mega Gold > read

- Agnico files technical report for Detour Lake mine > read

- Lancaster Resources holds 100% ownership of promising uranium projects in Canada > read

- Mines & Money 5@5 webinar showcasing ASX-listed Torque Metals, AuKing Mining, Tennant Minerals and QEM Limited > watch

After feedback and tests, we are tweaking our newsletter to better serve you all.

- Issues are now open without signing up (yet still sent via email to those registered)

- You get 2 types:

- a monthly wrap-up with more of an industry discussion (this one, part of Synergy’s in-house analyses) and

- a wider perspective piece/s discussing a specific topic or trend that highlights the role of mining & metals in the energy transition and where opportunities may be found

- We’ll keep the more detailed, in-depth how-tos for subscriber content

If you enjoyed this analysis, subscribe to our deal alerts* to receive it via email.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

*corporates and sophisticated investors

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.