Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

If you told me 2 years ago that nearly by 2025, the Russia-Ukraine war would still be raging with no sign of resolution plus new conflicts would be igniting in the Middle East, I’d have said no way. Yet here we are.

Don’t worry, I won’t be talking about my lack of war-predicting abilities as it would be a really short piece!

We’re here to talk about the role mining & metals play in the energy transition, some of the challenges ahead for the industry and the world in the current environment, plus where investors can find opportunities through it all.

Let’s get into it.

Hunger for metals

To start, let me briefly rewind to 2022/3. The largest players in the space realised the massive scale of this shift and knew they had to adjust to the new realities. We saw leading automakers such as General Motors and Ford collaborating with miners and battery makers far and wide, putting equity in several producers and even explorers (unheard of! especially considering most have zero revenue). All clearly recognising the challenge ahead. Here’s how BHP put it recently:

‘What is common across the 100 or so Paris–aligned pathways we have studied is that they simply cannot occur without an enormous uplift in the supply of critical minerals such as nickel and copper.’

-Huw McKay, former Chief Economist, BHP

Producing huge amounts was cited as the main obstacle and the reaction was strong, you could even say it was a bit of FOMO cycle (but at a large scale touching the economy not just markets). And don’t get me wrong, this remains a puzzle to be solved and we often comment on it on socials. But availability is not the biggest challenge anymore.

This unprecedented need for materials has one crucial characteristic. We’re talking about commodities that have benefitted from globalisation, since they historically relied on international trade operating somewhat effectively and in relative harmony. Because, let’s face it, mines are where they are and most of their related infrastructure must be emplaced nearby due to its substantial costs (both capital and operational), while its products are needed everywhere under the sun.

The geopolitical scene has transformed. First, due to COVID and supply chains and now due to these wars and their repercussions. Here are some examples:

- The IRA restricting access to its benefits when China is involved in any part of a firm’s supply chain. This is part of a broad ‘decoupling’ that may end with TikTok banned and a 7% drop in global GDP over the long term

- Canadian regulators blocking or passively dissuading acquisitions such as Solaris Resources scrapped plans to sell a minority stake to state-owned Zijin Mining

- On the other side of this tug of war, China started restricting exports of various minerals such as gallium, and more recently, Russia considering curbs on nickel.

Got metals?

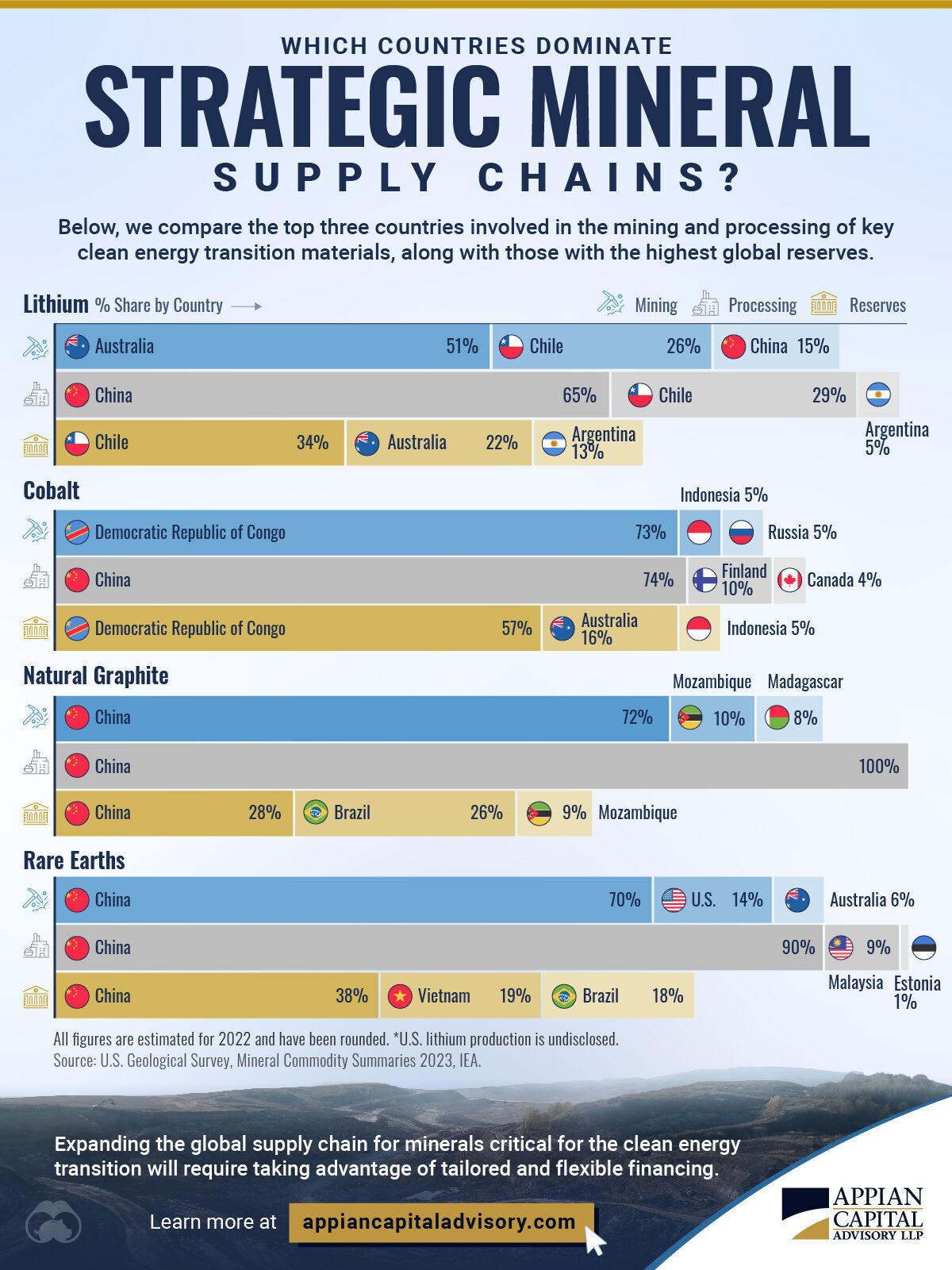

From the geopolitics lens, these metals/minerals are the most challenging:

- Natural graphite

- Rare earths (REEs)

- Cobalt

- Lithium

There are complex interactions between these materials and their place of origin and processing.

Clearly, in these 4 key strategic minerals, China dominates.

Graphite is undoubtedly the most concerning from this perspective, and highly relevant to EVs (less so for other applications such as infrastructure). This is because most popular batteries carry a big chunk of graphite in the anode.

Rare earths and cobalt are slightly in a better position but here’s where almost a decade of efforts have effectively brought very little to the bottom line. Clearly, there is a connection.

Lithium has a more diversified footprint thankfully (plus variety in sources), but still strategically complex and not devoid of issues (we covered some of these as well as a potential solution for lithium in this recent newsletter).

It’s important to also mention that copper is not on this list (at least not now and for the foreseeable future) because Western supply is definitely healthy and much more diversified. However, China also leads in copper refining. Processing is in fact, China’s strength. It’s a tough, expensive and typically dirty job that not every country wants to do (if we’re calling a spade, a spade).

Moolah

And here’s something availability and origin have in common: more capital is needed.

Investment has been growing steadily with a massive jump from 2020 onwards, mainly driven (yes, pun intended) by EVs. But the trend is positive in all sectors.

But the origin piece is much harder to fix and hasn’t been fully successful yet, despite some progress over the last 5-10 years. Much more work is needed in that quest to ease anxiety for all players, from automakers to anyone using vast amounts of computing for AI (and needing lots of energy and surprise, metals to make it a reality).

Opportunities for investors

Meanwhile, in this mess, where can investors find opportunities? In abstract terms, we should always be wondering… where is the puck going? (I’m a Canucks fan by the way).

Goldman Sachs, other banks and even Robert Friedland have said they are expecting copper to reach $15,000/tonne. The recent stimulus that China is pushing forward should be a boon for demand and copper prices and could make this happen. The caveat is we must be careful with Chinese announcements as they have the bad habit of fudging the truth.

Some opportunities may be uncovered in:

- More ex-China supply

- directly via producers and

- indirectly with streamers, royalty companies and other models such as Amerigo Resources.

- African supply of graphite is a big pull (although careful not to pick Chinese-backed firms and water down the hedge), and

- Brazilian lithium is growing by the hand of Sigma Lithium.

- Near production, small to intermediate producers (we see a trend building here)

- Select explorers (our favourite region is the Andes, with options like such as NGEx, Chakana Copper, Camino Minerals. Always remember that exploration is RISKY so novice investors will be better off with ETFs such as COPJ

- Copper futures with a long-term bullish view

- Strong producers, especially those like Freeport McMoran, that still appear undervalued in our view, or South32 (still BHP at heart, but cheaper)

- Any advanced explorer or producer that has received an unsolicited takeover bid merits analysis (rumours tend to be true!)

Following these general concepts can certainly inspire more ideas to research. We’ll be talking more about these and other opportunities in future newsletters.

In the end

We believe that a degree of compromise is necessary to reach sustainable growth. We can’t keep breaking relations with nations and shred these links that have taken years to build and strengthen in what is a very complex dance. The fact is, this rich kaleidoscope of raw materials requires inputs from different corners of the planet for processing, technology, capital, markets and more.

But what about wars, you say? Damn, I don’t have the answer to that. And as I said my war-related predictions are terribly weak.

I do know this: Earth is everyone’s home. We must try.

PS: Incidentally, I’ll be taking part in a panel on financing from a geopolitics perspective at IMARC in Sydney. Register and use my code HEARMESPEAK to receive a 15% discount off current delegate prices or code HEARMESPEAKFE for a free Expo Visitor Pass.

If you enjoyed this, please share it with a friend. The energy transition requires more savvy, committed investors and supporters joining in, to fully enable it.

That’s it for today.

In recent related news…

- Harris walks back support to EV mandate

- Nickel market no longer afraid of losing Russian supply

- China is seeking to grow its sway in metal prices via Reuters

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.