Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

When I finished my first degree (architecture, by the way, long story) I was deeply interested in sustainability and how buildings could have a smaller carbon footprint. Even then renewable construction and solar energy were part of the different avenues I investigated. During the brief time I practised, I focused on non-traditional construction systems that used locally-available materials thus reducing transport, a big part of such footprints.

Little did I know that despite leaving the profession ages ago, that line of thinking was to stay with me, albeit in an unexpected way. But don’t worry, we’re not here to talk about architecture, we’re here to talk about the role metals and minerals, especially copper and uranium, play in the infrastructure needed for the energy transition.

This week in our newsletter:

- The grid, demand and investment flows

- The case for mining less (!)

- Related news

Let’s get into it.

The path ahead

A few years ago, copper and uranium were at $2.10 and $17 per pound respectively. Both metals have since soared, with copper prices climbing nearly 150% and uranium +300%. Despite the deep changes, fundamentals remain in long-term strength and investors feel optimistic. Against this backdrop, the grid is undergoing a pivotal transformation. Warren Buffett summarised the challenge here.

‘There’s no sense in having the wind blow in Wyoming, and people can’t turn the lights in Vegas’

-Warren Buffett

In addition, the industry expects a demand exceeding historical production (as much as 2x over the next 30 years for copper). We sure have the minerals on earth but the bottleneck is getting them off the ground and this process is deeply nuanced.

Geopolitics is of crucial importance given that deposits/processing are not where we want them to be, just where they are. For instance, in copper, most recycling comes from China, and you know the layer of discomfort that brings in today’s environment. More western supply is needed in various degrees per countries (and that’s how we got different lists of critical minerals).

And here’s where the grid matters.

Industry and electricity generation are responsible for almost 40% of total global greenhouse gas emissions. Migrating to cleaner energy sources is a monumental task that implies new and improved infrastructure that serves consumers at all times (not only when the wind blows or the sun shines) and also incorporates cleaner energy sources.

The grid

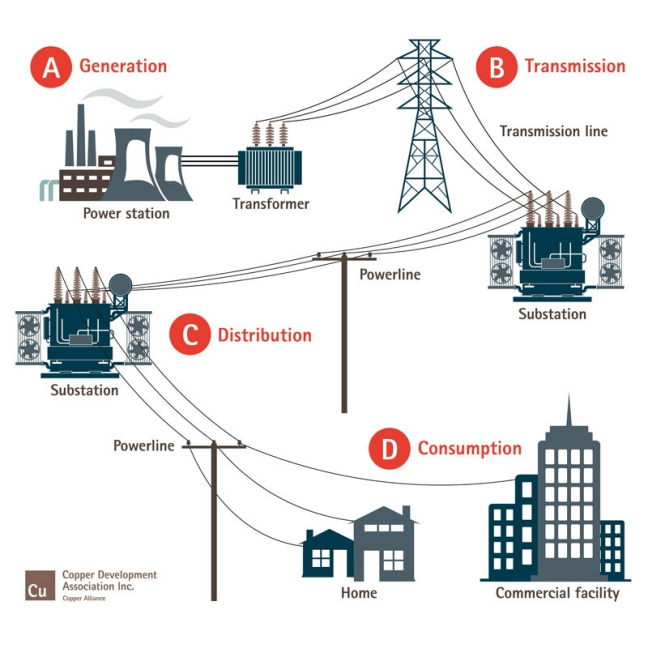

In this, copper has a big role to play. Its high thermal conductivity, strength, pliability and corrosion resistance allow it to efficiently transfer energy from sources to end users. Unprecedented demand, by now, is inevitable.

In fact, copper is central to the whole ecosystem, from generation to transmission, distribution to end use, be it residential or industrial. And none of this would be possible without copper wiring.

In addition, nuclear energy is also going through a deep renewal, as countries reopen plants, and announce new ones and uranium, the mineral making fission possible, gains momentum and regains a bit of support after the Fukushima ricochets finally go silent.

On the investment side, if we consider power grids alongside nuclear and renewables, they jointly exceed transport to take the majority of the nearly $1.8T invested in 2023.

In this environment, investors have plenty of targets for opportunities as discussed in depth here.

Recycling: The case for mining less

Some people are suggesting we should just recycle instead. Is that possible?

With recycling in general, mobility is a great candidate (e.g. battery packs) but infrastructure is not. Power lines carry ‘the juice’ thus still being used for vast majority, and likely to be in place for decades.

There’s a point when recycling will be able to take on a bigger share of use but until then… we gotta mine the stuff first! And secondly, ask ourselves, are we done with ‘the thing’ to be recycled?

It’s unlikely that we’ll be mining less soon.

Summing up

In the end, infrastructure is poised to be a boon for copper and uranium demand and at the same time, a key variable that will enable achieving net zero goals.

Whether we reach these on schedule or not is up for debate (I don’t think we will), but the reality is we’re on our way thanks to copper (and friends).

If you enjoyed this, please share it with a friend. The energy transition requires more savvy, committed investors and supporters joining in, to fully enable it.

That’s it for today.

In recent related news…

- Africa Infrastructure Funder Sees $3 Billion of Projects in 2025

- French Nuclear Firm Says Niger Junta Takes Over Uranium Mine

- Rattled by China, West scrambles to rejig critical minerals supply chains

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.