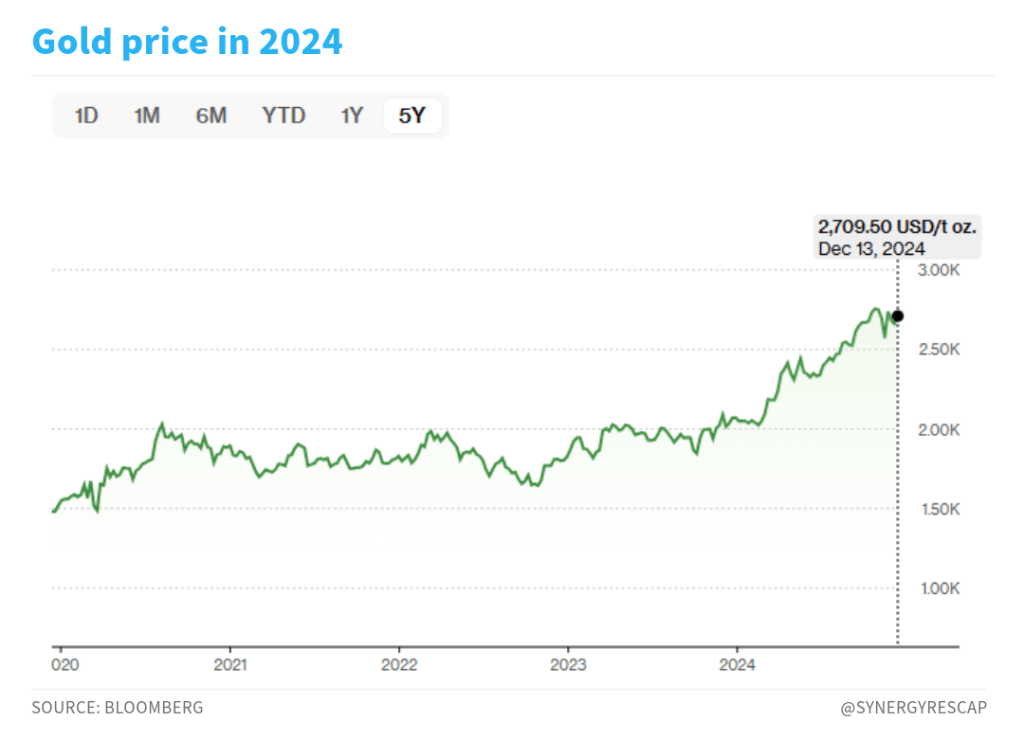

Gold had a cracking 2024. It reached an all-time high just below $2,780 in October, closing the year just above $2,600.

Analysts expected it to end the year around the $2,700 mark. It almost did.

Beyond that horizon…

Incrementum sees it substantially higher.

Their model returns a price of between $3-4K/oz by the end of the decade (their report is a gem to read too).

And they are not alone…

Bank of America expects gold to reach $3,000 by the end of the year.

This is from just a few days ago.

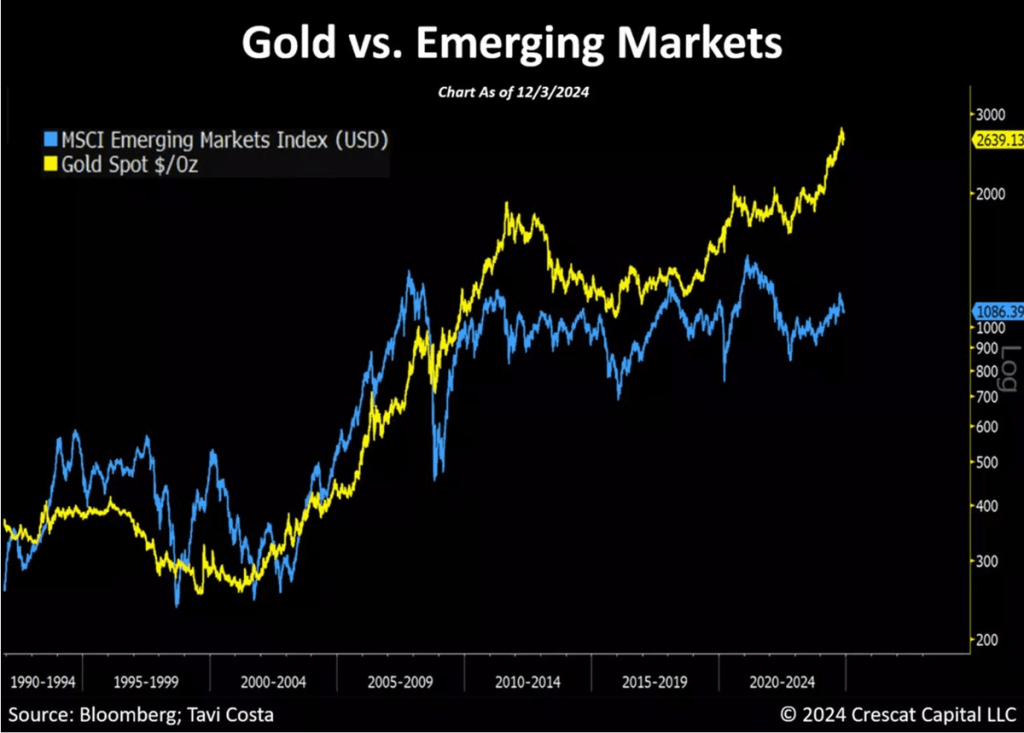

On a more broad perspective, Crescat Capital sees a ‘secular bull market’. They also point out opportunities in relation to emerging markets which seem ‘on the brink of a major catch-up’.

Bull case

In this environment, these are the top 5 reasons to invest in gold:

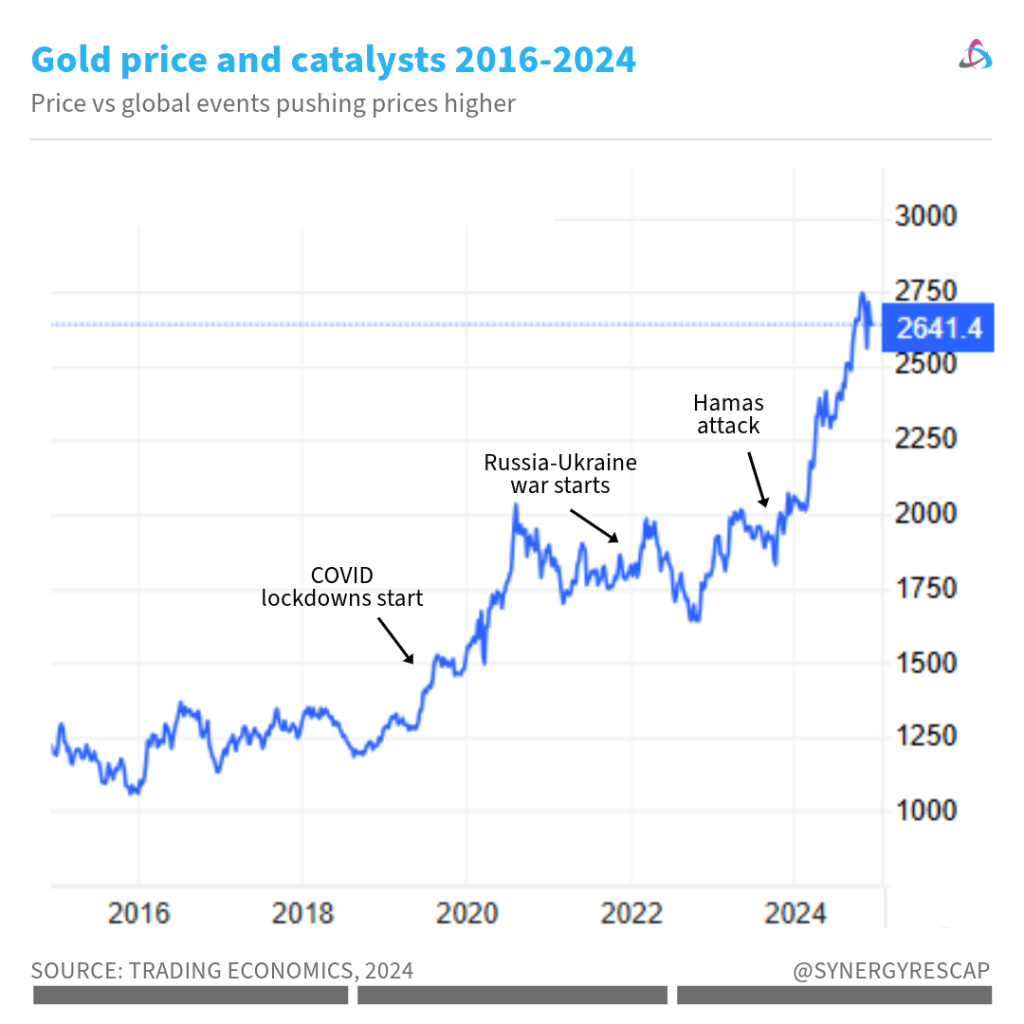

1) Rising uncertainty

Wars, to start, of course.

But perhaps even more pervasive, trade disputes are making things even trickier. Trump is returning to the White House and already plans tariffs to China, and even its neighbours Canada & Mexico.

But this is only the set-up…

2) Central Banks stocking up

China recently announced they are buying again after a 6-month pause. This alone caused a 1% bump in the price.

Eastern European banks are also buying. For instance, Poland recently boasted about joining the “exclusive club” of the biggest gold owners.

(See chart in a sec)

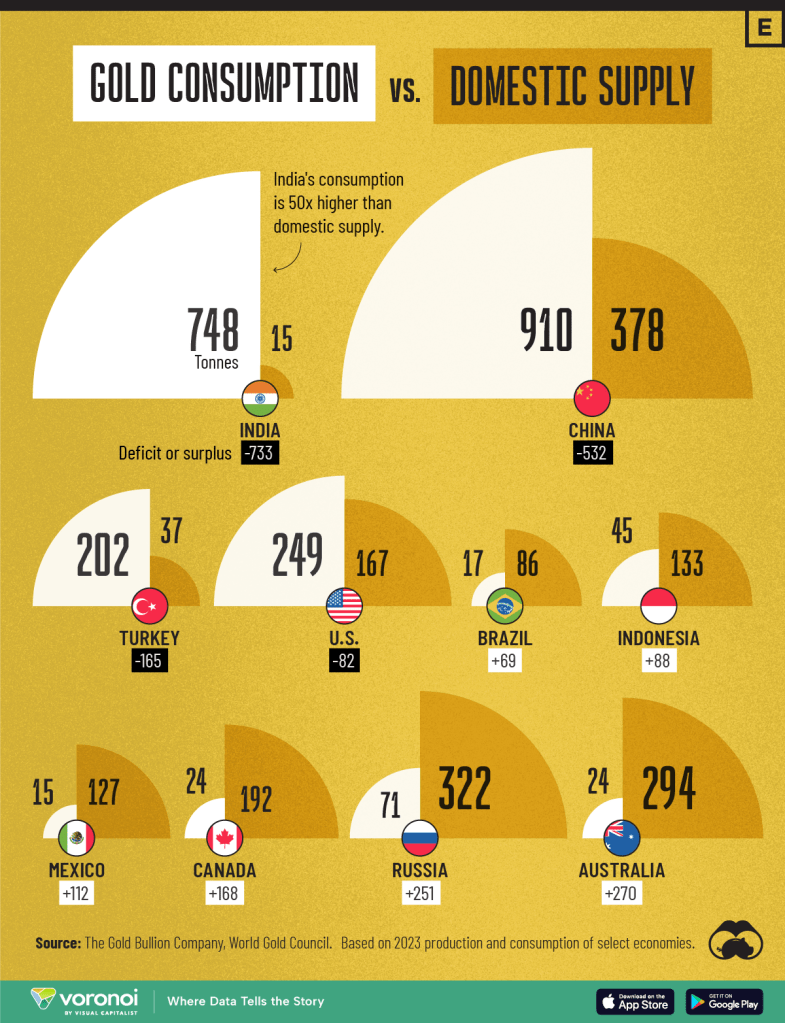

3) Emerging market demand is soaring

In addition to central banks, more gold is flowing from gold-producing countries to emerging economies.

Look at India!

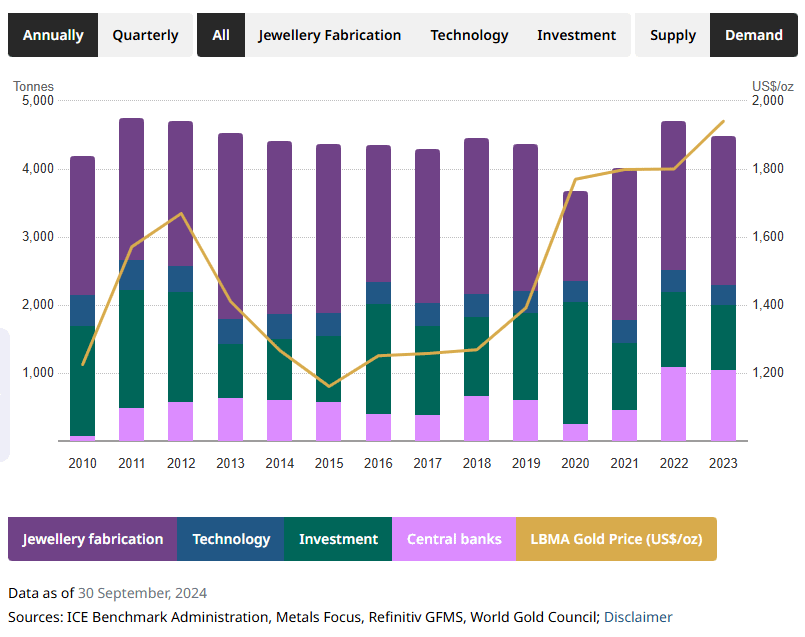

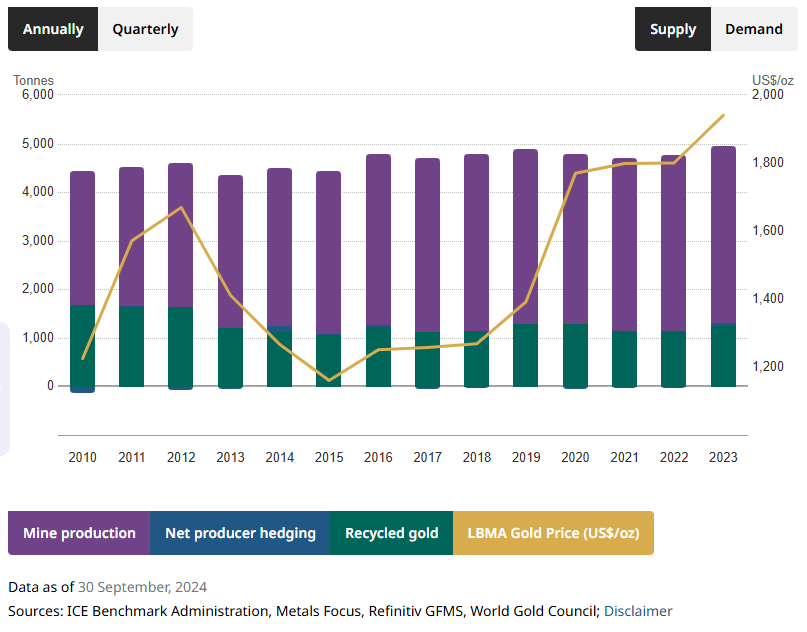

4) Supply vs demand

~75% of supply comes from mines w/remainder from recycling.

Total supply has risen only moderately in the period 2010-2024. Meanwhile, demand fell in 2020 but has now fully recovered.

In addition, demand from investment, central banks and technology already match use in jewellery.

• In Q3 2024, total gold supply grew by 5% year-on-year.

• In Q2 2024, total global gold demand was 6% higher year-on-year.

5) Interest rates

Gold typically performs well when rates are falling (seen below vs US dollar).

If we start seeing more aggressive cuts, gold is poised to benefit (although extended pausing may put pressure on investment).

Allocating capital

So where do we go from here?

Now, given gold doesn’t pay dividends directly, a useful compromise is allocating to streamers and royalty companies.

Among these, you can pick the giants (like Wheaton $WPM) to smaller players such as Empress $EMPR and our long-time favourite Osisko $OR, in between.

In turn, producers are attractive (hence so much M&A happening). We’ve been holding Agnico for ages.

Plus, if you want to squeeze some copper exposure, both $GOLD and $NEM are ideal (although for the latter we’ve gotta see how their resources/reserves statement will land after their planned divestments).

Fortuna $FSM seems well placed here too, after their recent buyback.

There are a number of opportunities among explorers and near developers, but we’ll leave those for a more detailed discussion. I met with a few during IMARC and am still reviewing the best ones.

For now, it’s important to point out that most of the gold exploration budgets this year was spent by majors, and Canada remained the top destination.

Finally, we have seen some migration to silver at this level since we’re at above 80/1 and an equally stunning year with more likely to come.

And that’s it for today!

Investing in gold when markets are turbulent is a must in these conditions. Adding both miners and streamers makes perfect sense.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.