Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

This week:

- 2025 predictions

- Sentiment on socials

- Market update and outlook

- Opportunities in mining stocks

As we step into 2025, the commodities market is poised for significant shifts and opportunities. Let’s delve into what we see ahead for key commodities such as gold, lithium, copper and uranium, with insights for investors and industry insiders alike.

Gold: A Bullish Outlook

Gold has always been a haven for investors, and 2025 is expected to be no different. The dramatic rise in gold prices nearly doubling in the last 5 years and with no sign of slowing down. Despite initial skepticism, we believe that gold could reach $3,500 this year due to ongoing global uncertainties.

Several factors contribute to this bullish outlook. The geopolitical issues in Africa, particularly in Mali and Congo, are likely to push companies to seek safer mining locations globally and within the continent. This shift could reduce the supply of gold, thereby driving up prices. But more importantly, the demand for gold as a financial asset is becoming mainstream (after all, Costo still less a bunch!), fueled by economic uncertainties and inflationary pressures.

Moreover, the resurgence of interest in gold is not limited to traditional markets. The rise of digital currencies like Bitcoin was initially seen as a threat to gold, but both assets have shown resilience and growth. This dual demand underscores gold’s enduring value as a stable investment.

Lithium: A Market Set for Rebound

The lithium market has experienced significant volatility in recent years. Market dynamics indicate that while lithium has been depressed, there are indications of a rebound. Several voices have spoken out: Pilbara’s CEO Dale Henderson views the market bottoming out as an inflection point; Benchmark Mineral Intelligence, one of the leading pricing agencies, forecasts a shift to deficit from 2026 onwards. We share the cautiously optimistic perspective, and believe prices will improve by the end of the year.

We also believe the distinction between hard rock and brine producers is crucial. Brine producers, with their more stable cost structures, are better positioned to weather market fluctuations. This stability is expected to attract more investors, leading to a potential premium for companies with brine exposure.

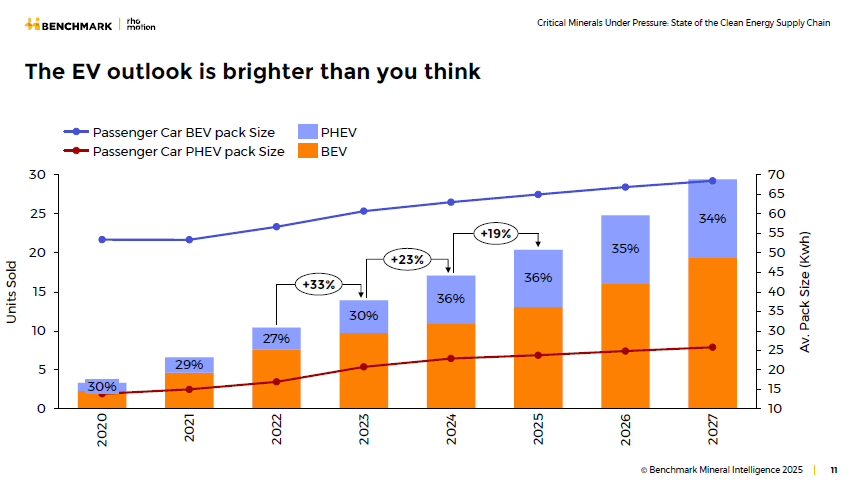

Technological advancements and increased demand from the electric vehicle (EV) market continue driving the lithium market. Innovations in extraction technologies and the expansion of EV manufacturing and BESS applications are expected to boost demand for lithium, further supporting price recovery.

Critical Minerals and Trumponomics

The broad critical minerals sector is set for a transformative year, driven by geopolitical shifts and policy changes. We believe Trump’s policies will have a significant impact on the sector. His focus on reducing dependency on foreign sources is expected to drive volatility in gold and support the critical minerals sector.

Trade tensions between the US and China have already reshaped the critical minerals market. The imposition of tariffs and export controls has prompted companies to diversify their supply chains and increase domestic production. This trend is likely to continue, with further disruptions expected as broader tariffs on imports from Mexico, Canada, and China are implemented.

The emphasis on securing strategic materials is also driving investment in critical minerals. Governments and companies are increasingly focusing on local production and strategic stockpiling to mitigate supply chain risks.

Uranium: A Stable Future

Uranium is another commodity we view as poised for growth in 2025. The market has seen a resurgence in interest, driven by the global push for clean energy and the development of small modular reactors. We predict a more stable uranium market by the end of the year, with increased acceptance of uranium as a critical energy source.

A second lease in life for old reactors and the construction of new ones are key evidence of this. Countries like China are leading the way in building new reactors, while other nations are extending the life of existing ones such as California’s Diablo Canyon. This increased demand is expected to drive up uranium prices, potentially nearing triple digits.

Geopolitical factors also play a significant role in the uranium market. Sanctions on Russian uranium imports and production cuts by major producers like Kazakhstan’s Kazatomprom have disrupted supply chains, adding to the upward pressure on prices.

Copper and M&A Activity

Copper remains a critical commodity for the energy transition, and 2025 is expected to see significant M&A activity in this sector. We believe the action will be particularly strong among mid-tier companies, with at least one major deal involving top players like BHP, Anglo, or Glencore.

The demand for copper is driven by its essential role in renewable energy infrastructure and electric vehicles in addition to traditional growth. Despite some volatility, the long-term outlook for copper remains bullish, with prices expected to remain stable or increase.

The M&A activity is likely to be driven by the need to secure copper supply for the energy transition. Companies are looking to consolidate their positions and acquire strategic assets to ensure a steady supply of this critical metal.

Summing up

The commodities market in 2025 is set for a dynamic year, with significant opportunities and challenges across various sectors. Gold is expected to continue its bullish trend, driven by geopolitical uncertainties and strong financial demand. The lithium market is poised for a rebound, supported by technological advancements and increased EV demand. Critical minerals will see transformative changes due to geopolitical shifts and policy changes, while uranium is set for a more comfortable future with rising demand for clean energy. Finally, copper will remain a key commodity for the energy transition, with significant M&A activity expected.

Investors and industry insiders should stay informed about these trends and consider the potential impacts on their portfolios. The year ahead promises to be an exciting one for the commodities market, with numerous opportunities for growth and investment.

For more on our predictions, catch Lucho and me on our last podcast episode and some additional articles at the end of this newsletter.

Sentiment on socials

This week I mentioned where I sit on this and many of you agreed!

What about you, dear reader?

This week in the markets

Mixed results with Canadian metals & mining week performance, yet Aussie sector stocks stood strong amidst a losing week across ASX.

Meanwhile…

In recent related news…

- China is importing more refined copper from the DRC than from Chile

- Anglo American sells nickel business to Chinese MMG

- Gold reaches a new all-time high

China’s role continues to expand as the West can’t figure out how to grow faster.

Time for research

If you’re keen to jump on the deep end, here are some promising news & developments:

- Featured companies: Fortuna Mining | Atha Energy | Pivotal Metals

Definitely worth a deeper look to learn more.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

- Trade turmoil and the future of critical minerals | 2025 preview – Fastmarkets

- Critical Minerals Forecast: Surge in M&A Activity Expected in 2025 – Future Facing Commodities

- Copper price: What’s in store for 2025 – MINING.COM

- Uranium Outlook for 2025 – Sprott

- Goldman Sachs’ 2025 Lithium Market Forecast: A Cautious Outlook Amid Challenges – Discovery Alert