S&P released recently their annual report breaking down exploration strategies and investment.

It comes packed with gems for investors, and clues on where mining is headed.

Here are your key takeaways:

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

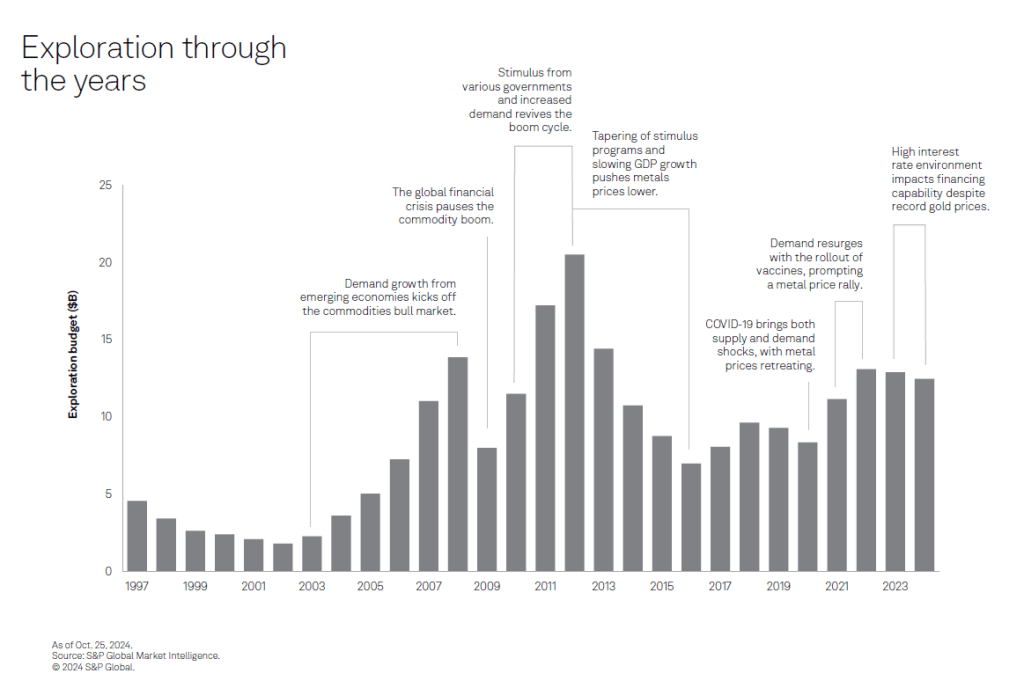

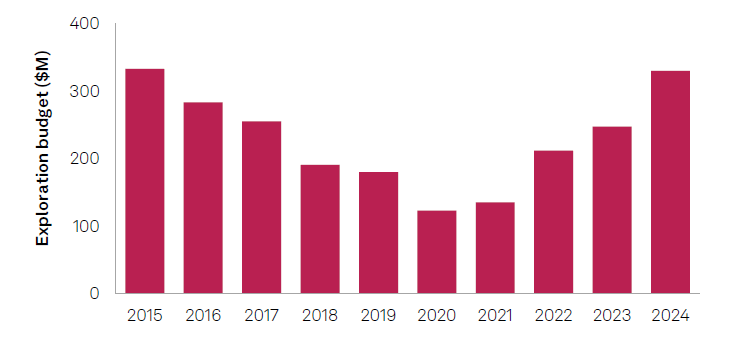

To start us off, last year global exploration investment reached $12.5 billion in 2024*, a 3% decrease.

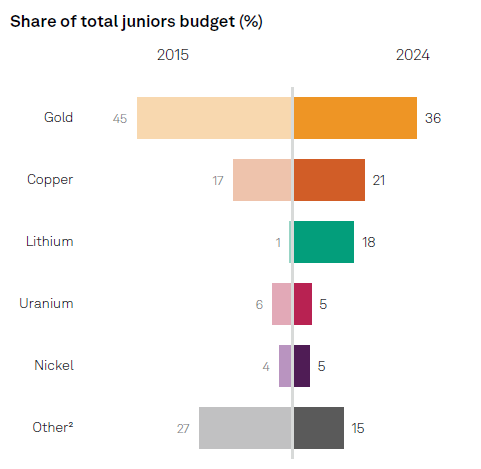

Gold is the top metal

Gold prices may be soaring… But exploration budgets fell 7% YOY.

High interest rates are to blame, hurting financing capabilities across the board.

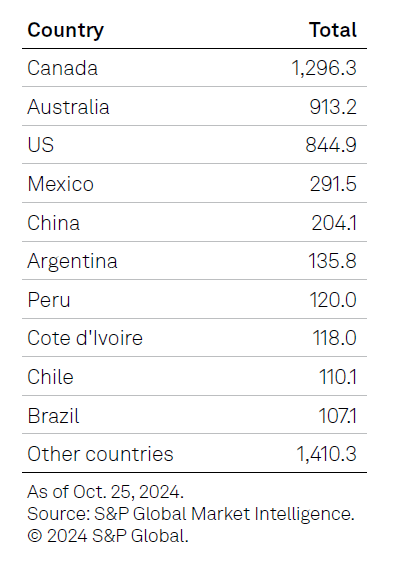

All in all, the precious metal grabbed 44% of global expenditure, still a cool $5.55 billion, with Canada in the lead.

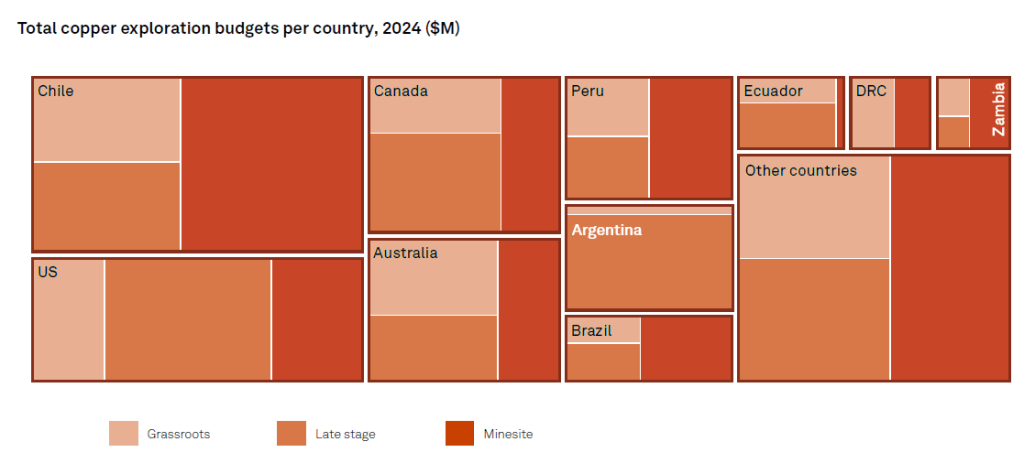

Copper may be the king but here it’s the runner up.

Globally, $3.2 billion was invested searching for it.

Unsurprisingly, 39% was minesite, with Chile, the US and Canada in the top 3.

The kicker is budgets expanded by 2%.

(giants move slowly, after all like copper porphyries)

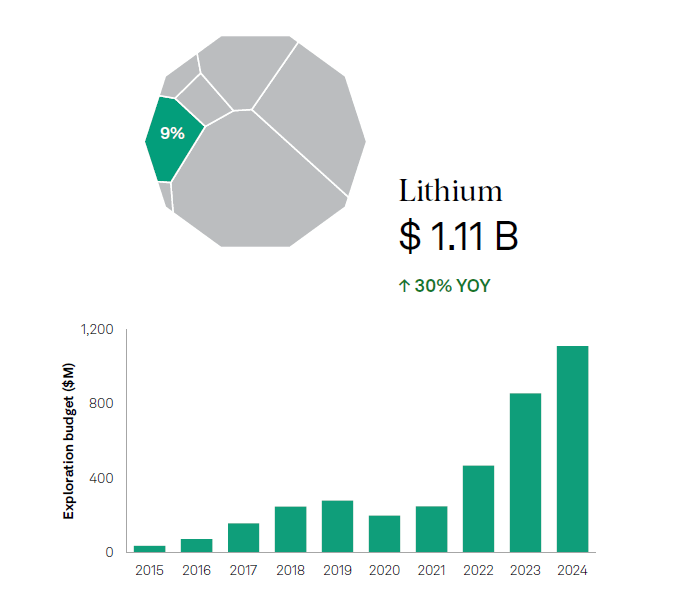

Lithium comes 3rd.

But I bet you won’t see this one coming:

$1.11 billion were spent looking for the battered metal we (still) love.

A whopping growth of 30% YOY!

Canada & Australia tied in 1st place as destinations.

Uranium exploration also expanded quite dramatically, 33% YOY.

It comes 5th, at $331 million, or 3% of the total.

Guess where most was spent?

Answer: Canada!

The report also covers other minerals (some in less detail):

- Falling: nickel, cobalt, silver, zinc/lead, PGMs, potash, diamonds

- Up: REEs, molybdenum

(link to the full report ahead if you’re after more on these)

In terms of the stage, we continue to see late-stage and mine site grab share.

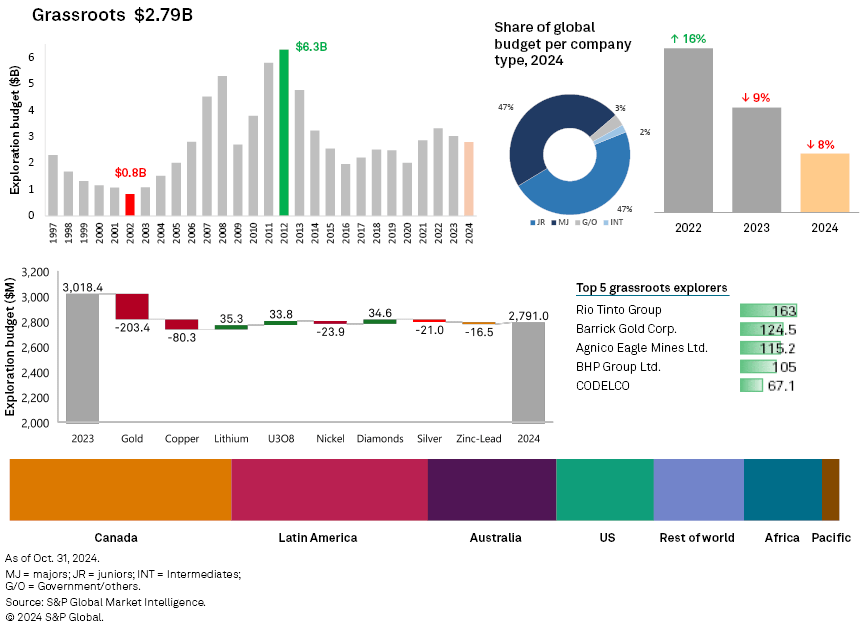

Only $2.79 billion was spent in grassroots exploration, as companies are keen to lower their risk.

This is just 22% of the total, a record low!

(We all know where this is going)

Collectively, all majors spent $1 billion more than all juniors, at $6.1 billion.

Among juniors, comparing 2015 to 2024, there’s been a migration from gold to lithium, copper and other minerals. Majors remained stable.

The top 5 by budget/size:

- Majors: $GOLD $AGG $RIO $AEM $NEM

- Juniors: $IE $FOM $MUX $FIL $DEG

- Intermediate: $OLA $ERO $III $SLR

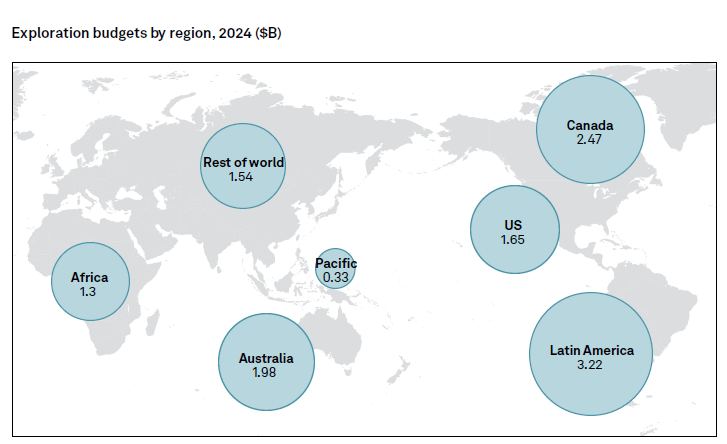

Finally, where were these $12 billion spent?

Latin America remains the leading exploration destination, where the presence of majors has cushioned the drop. Canada is by far, the most explored country.

Only the US and ‘rest of the world’ saw growth in their share.

Given that tough market conditions seem sticky, they expect budgets to follow a similar trajectory in 2025. The report envisions:

- US growth

- Further declines for 2025

- Continue moving away from generative grassroots programs

And that’s it for today!

Exploration is how we find the mines of tomorrow. Understanding how capital is being allocated helps us estimate where the puck will be!

*figures are as of October 25, 2024, the cutoff for this report. If this was interesting, I highly suggest you read the full report as there was a lot I didn’t include.

Get your copy in S&P’s website here or here:

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.