Global copper demand is forecasted to increase by 70% over the next 25 years, with other critical minerals chasing behind.

To get there, the investment required may be as high as $2 trillion.

But here’s the thing.

Supply may not come from where you’d expect:

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

Here’s what $BHP said about investment:

“We estimate the total bill for all expansion capex from 2025-2034 to be around a quarter of a trillion US dollars [$250B] (in 2024 real dollars). This represents a significant increase from the previous 10 years, where the total spend on copper projects was approximately US$150 billion.”

More broadly, @BloombergNEF said in their Transition Metals Outlook that the industry will need $2.1 trillion by 2050 to meet the raw materials demand of a net-zero emissions world.

Despite a decade of growth, availability remains insufficient to meet the rising demand.

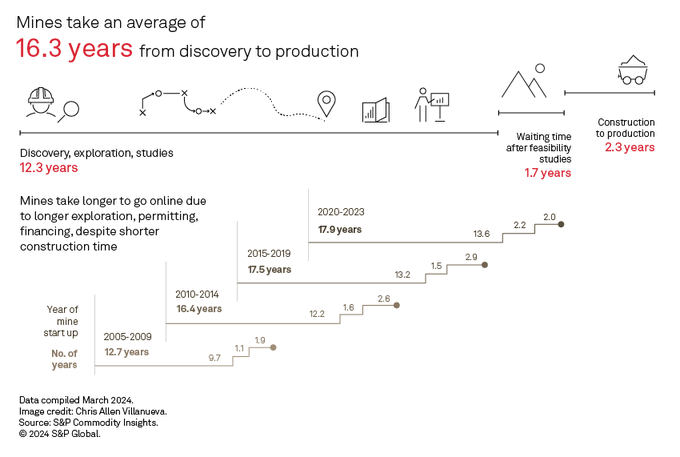

At the centre of this expected bottleneck is time.

Mines take on average over 16 years from discovery to production.

This will only exacerbate needs and push prices higher (and higher prices can lead to bubbles and substitution).

$BHP has highlighted this issue.

“[Lack of new supplies] is exacerbated by a slowing rate of discoveries and the relatively long average time from discovery to production (17 years in 2023), which is making it less likely that greenfield developments will be able to respond to the strong demand signals.”

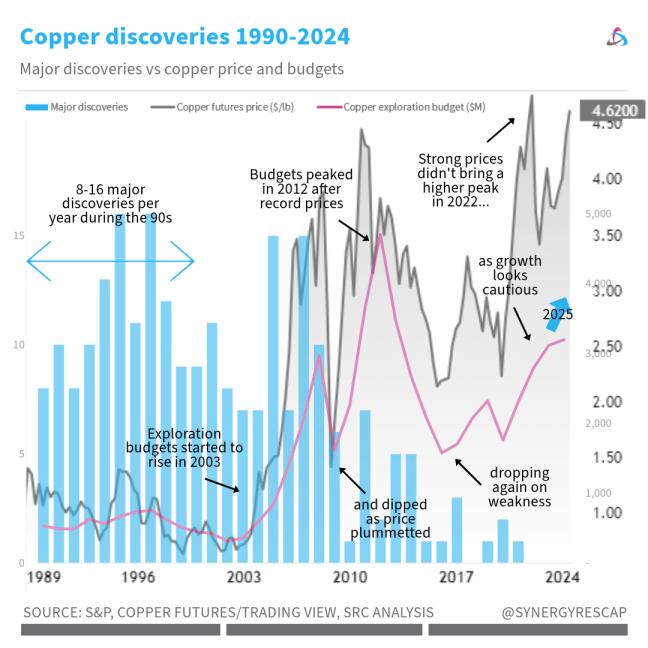

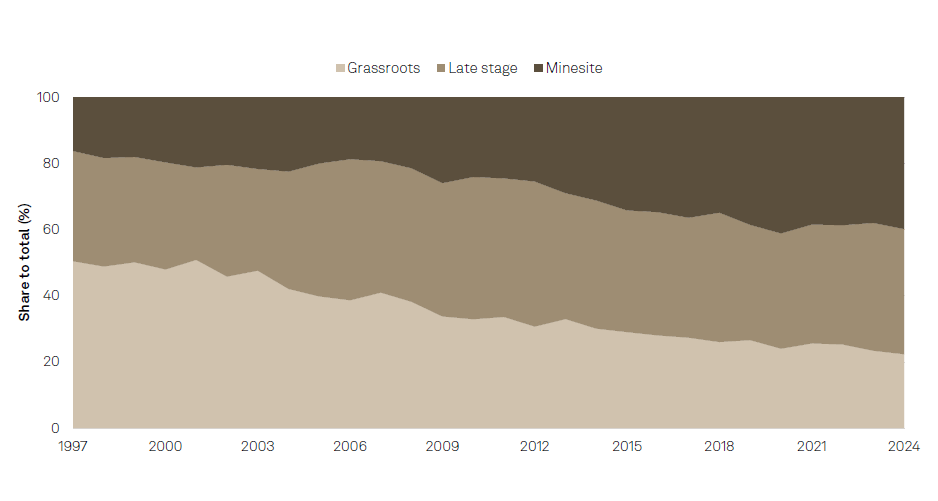

With grassroots exploration at a historic low (as per S&P data).

This emphasizes how corporates are being extremely careful to allocate to the riskier side of the lifecycle.

This will not end well if it continues dropping.

Mine size seems to be a controversial topic.

A @BCG study stated that:

- Major mining companies are reluctant to build smaller, easier to build and faster to market projects

- Typically, these projects have better economics. IRR than the major projects

- Mines are getting deeper, taking longer to build and longer to discover

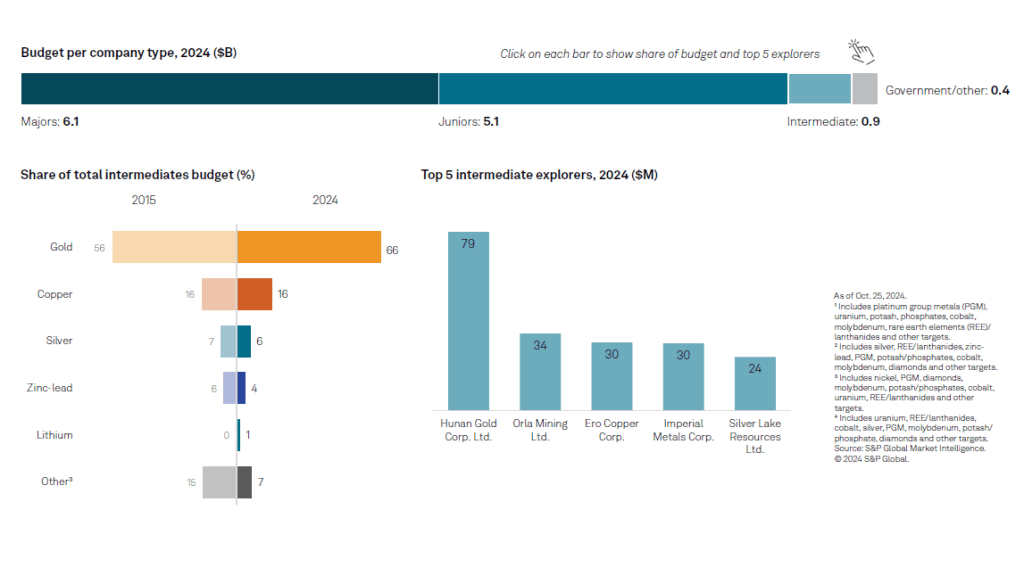

This may relate to the fact that institutional investors tend to prefer big developments.

Typically, conducting due diligence on a massive project takes nearly as long as a small one. Larger deals = larger returns, ergo everyone would rather chase the BIG.

In any case…

There’s a need for smaller projects… shovel-ready… and leaner, agile management teams to fill the gaps.

These groups, often shunned by these big institutional investors, can:

- produce significant amounts

- navigate permitting quicker

- shorten the investment horizon for investors, fixing the duration mismatch, thus allowing more generalists to join in

Gold does this well globally.

Australia is a great example with a vibrant scene of gold producers.

The business model here is find, build, mine vs the typical Canadian miner which explores, finds and gets acquired.

Producers such as $FSM also exemplify this well

For copper, the situation is different.

The market has relied on porphyry giants (think Escondida, Bingham Canyon Mine, or Grasberg) for a long time.

The intermediate to small producer universe is tiny.

Lucho and I have talked about this often in our podcast and in presentations. 2 cases we’ve covered recently were Camino $COR & Pivotal Metals $PVT.

Look, I’m not saying we won’t be developing more elephants.

After all, we love them (and I have a personal attachment to porphyries).

But what I’m saying is we need quicker-to-cash-flow, faster-to-production options.

Smaller mines are a solution for a sector hooked on blue sky and chronic underfinancing. Mine, baby, mine (w/dividends for investors).

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

PS: If you’re looking for opportunities to invest, this is for you:

If you enjoyed this…

- Invest more confidently with Mining Investing 101

- Become a member for weekly opportunity alerts and access to the whole vault

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.