Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

Today, we’ve got production disruptions, trade negotiations and commodity moves to look forward to, plus deals, companies and the meme of the week (hey, I will do what I must).

Let’s dig in:

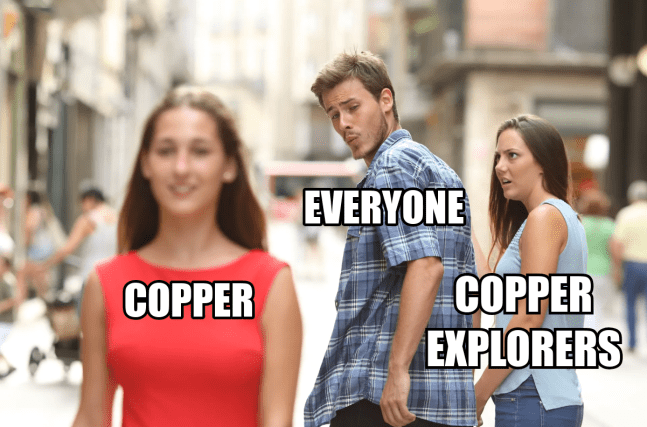

- Copper should see a quiet week, possibly with some upside. On one hand, Chile just reported +13.5%, a strong output for April, which seems to show that we have firmly switched to growth. You’d think that’s a bit bearish, especially with the abysmal valuations for explorers but there’s more happening in copperland…

📊 INE

- A few days ago, operations at Ivanhoe’s Kamoa Kakula in DRC were suspended after ‘seismic activity’. Aside from company-specific implications (and trust me, there are many, including partner disagreement, stock is down 14% MOM and now uncertain guidance) and country impacts (keep Peru in 2nd place?), I see this as a cautionary tale for the whole sector. Yes, we all want more copper, but there are serious technical limitations to what we can safely and realistically do. Even if we feel like running, first, we gotta walk firmly and with stability… This whole thing may have some lasting effects. Mining engineer Neil Ringdahl provided some brilliant insight into the technical situation, if you didn’t catch it:

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Gold should have a mild week, but likely to end up as Trump increased tariffs on steel and aluminium to 50% to ‘protect US workers’.

- Lithium prices seem likely to remain unchanged or with a slight drop. UBS warned that the brutal sell-off in lithium stocks is far from over, cut its long-term spodumene forecast by 8% to $1200/t. I wonder if Rio’s piling up on lithium assets is fully over now, given CEO Jakob Stausholm is on the way out. He may get the last laugh… given he’s stocked up mostly on brine.

- US dollar ended last week higher, with Aussie and kiwi down

- Economic indicators: Australia’s Q1 economic growth and US jobs data coming up

- As trade wars ease and escalate every week, investors switch from bullish to bearish by the hour, it seems 2025 will be most remembered as a rollercoaster year…

But that’s not all…

ICYMI

Keen on the big themes in metals and mining?

Looking for investment opportunities?

Companies

Deals, capital raising and IPOs

- Glencore $GLEN is shifting $22 billion in assets to its Australian subsidiary — and it could all be preparation for a mega merger with $RIO

- Genesis Minerals $GMD bought the Laverton Gold Project from Focus Minerals for A$250M

- Upcoming/recent IPOs:

- Vinland Lithium $VLD Inc listed on TSX-V at C$0.20/share. Piedmont Lithium owns 19.90% of the company

- Greatland Resources $GGP set for a listing on ASX; AIM-listed Australian gold producer via a $50M raising led by Merryl Lynch, Canaccord. Price on listing to be A$5.08/share.

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

Normally, we expect to see a lift in targets and weakness in acquiring parties. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Discover

- St George Mining $SGQ > Niobium in Brazil with major upside ahead (MST Financial Research)

- Fortuna Mining $FVI > invests C$8.26M for a 15% equity stake in Awalé Resources $ARIC and reports substantial results at Diamba Sud, including 8.6 g/t gold over 13.6m

- Agnico Eagle $AEM > makes $4.3M strategic investment in Fury Gold Mines $FURY

- Atico $ATY > signs new 30-year title for El Roble mine and receives ruling clarification from tribunal

Whether we run or walk, this I truly believe:

Copper explorers will have their time in the sun.

Current valuations are just insane. It won’t last forever, but the copper market remains a buy opportunity.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, Investing.com, ASX, TMX, plus our own research. Figures are shown in US dollars unless clarified.