Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

Today, we’ve got commodity moves coming up, plus deals and companies in what SHOULD be a quiet week.

Let’s dig in:

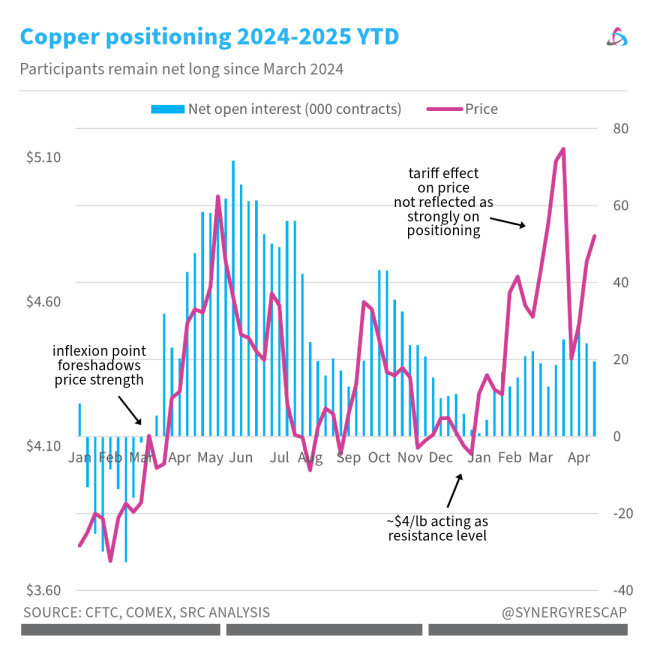

- Copper is having a moment, and it seems it can last for a minute or two. Last week, it surged past $5/lb, where it remains as long positions hold strong and LME stocks fall. Supportive voices mount, such as TD, which said about copper ‘our proprietary real-time estimates point to no evidence of a slowdown in commodity demand growth’. I wrote more about this here.

- Gold has lost some steam as investors seemed to settle down fears and the promise of ceasefires to extend and cool down a bit (the boiling frog metaphor comes to mind here).

- Economic indicators: PMI in China, Chile copper output for May, plus a bunch of holidays which should make this a quiet week, namely Canada and the US (the Trump’s administration is rushing to get some trade deals before the 4th of July weekend!) plus Colombia.

- Mexico remains a killjoy for explorers and developers. The country is decidedly not welcoming new investment, and honestly, things don’t look great for those hoping to develop a new deposit or getting new licences. My 2 cents here.

But that’s not all…

Companies

Deals, capital raising and IPOs

- Central Asia Metals ups offer for New World Resources, valuing company at A$230 million to fend off Kinterra

- Zijin to acquire Kazakh gold mine in $1.2 billion deal

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Upcoming/recent IPOs:

- Ballard Mining Limited $BM1 is set for a listing on ASX via A$30M raise; their focus is gold in Australia. Argonaut, Bell Potter are joint lead managers and price on listing to be A$0.30/share.

- FinEx Metals $FINX is listed on TSX-V. They are actively exploring for high-grade gold in Northern Finland

- More IPOs

Normally, we expect to see a lift in targets and weakness in acquiring parties. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Discover

- St George Mining $SGQ > highlights strong community support in Brazil

- Fortuna Mining $FVI > Reports Voting Results of its 2025 AGM

- Agnico $AEM > kept at outperform with a US$145/sh price target by RBC

- NGEX Minerals $NGEX > reports stunning highlights from Lunahuasi in Argentina

- Fury Mines $FURY > closes $3.1M flow-through financing

- OceanaGold $OGC > gearing up for a US-listing in 2026

Latest alert

And here’s the thing:

Whether you are a copper bull or not, this feels obvious:

Copper seems to be adjusting to this new normal, and frankly, enjoying it all.

Who knew this could happen!

Still, we should say it’s important to ‘monitor the situation’, right?

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

ICYMI

Keen on the big themes in metals and mining?

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, plus our own research. Figures always shown in US dollars unless clarified.