Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

Here’s what we expect to see this week across markets, mineral commodities and related stocks:

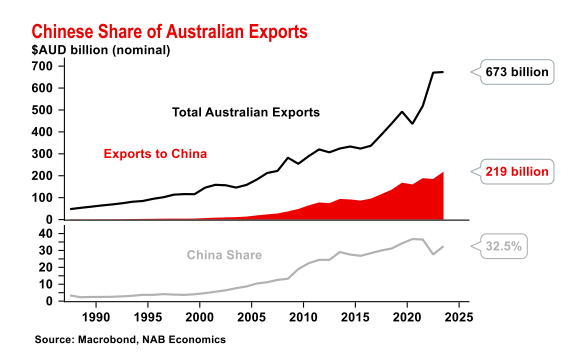

- Australia between a rock and a hard place: Australia’s PM is visiting China, and a lot could come from their meeting. On one hand, there could be meaningful upside, and at the same time, call for some tough decisions for Australia. Albanese wanted to meet with Trump first, but that didn’t happen due to a cancellation during the G7 in Canada. Lithium and iron ore are probably top of mind in their conversations. What can this mean? I’ll get back to my 2 cents on this in a sec.

- Still critical, thank you: Both copper and rare earth players are likely to get some extra attention this week. Copper, soared to $5.71/lb after Trump announced 50% tariffs on refined metal, keeping the momentum. On the REEs side, excitement was high after the announcement of MP Materials‘ cornerstone deal with the US government, which added nearly $2.5 billion to the company’s market cap. The week should give players in both spaces, especially those within 1-5 years of new production, an opportunity to shine brighter.

- Can silver keep it up? Silver had a shockingly great week, so the main question in everyone’s mind will be if there is any air left in this rally.

- It’s the bottom (for lithium)! Canaccord is calling the recent low as the bottom and, with new capacity being delayed or cancelled, they remain constructive on pricing. Baby steps for recovery in related stocks, though.

- Economic calendar: this week, there will be updates from China, Australian jobs (which, if disappointing, may nudge the RBA for a cut next month), and US inflation. In addition, Rio, Santos and BHP have quarterly updates coming up.

- Regulatory: As the US mining landscape endures a deep metamorphosis, Rio Tinto said they are keen on investing locally. Their main play here is, of course, getting the Resolution proposed mine in Arizona out of the doldrums, which they share with BHP. On the flipside, Freeport doesn’t need any new permits for the time being and already produces 60% of domestic needs. Resolution going forward is a long shot, but… it could happen.

Meanwhile…

These companies are making moves.

Deals, capital raising and IPOs

- Royal Gold to acquire Sandstorm and Horizon in $3.7 billion deal

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Everlast Minerals Ltd $EV8 is set for a listing on ASX via A$8M raise; their focus is mineral sands in Bangladesh. Alpine Capital is the lead manager and the price on listing is to be A$0.20/share.

- Atlas Energy Corp. $ATLE is now listed on TSX-V. They are an oil & gas royalty company.

Normally, we expect to see a lift in targets and weakness in acquiring parties, and often, peers to targets get some extra love, providing some arbitrage chances. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

Announcements

- NGEX Minerals $NGEX > discovers ultra-high-grade gold at Lunahuasi

- St George Mining $SGQ > provides update on drilling program, expected timing on first batch of results

- Newmont $NEM > initiated at buy, price target $73/share from $60.00 by Stifel

- McEwen $MUX > announces results of 2025 annual meeting, name change

- Fury Gold $FURY > strong lithium intercepts

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Latest alert

One thing is clear to me.

While the Australia-China trade is highly unlikely to destabilise the world, these top producers of minerals can potentially make waves and China’s dominant role across so many metals and minerals could be a multiplier. They may come up with creative ideas and sidestep, perhaps, some of the measures proposed by Trump.

Stranger things have happened, so we shouldn’t count them out…

Now, tell me, what are you paying attention to this week? Let me know here.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

ICYMI

Keen on the big themes in metals and mining?

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, SRC research. Figures shown in US dollars unless clarified.