Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

Critical minerals are undergoing a big transformation.

Unless you’ve been living under a rock (hey, no judgement here, sometimes we need to switch off!), you know that Apple $AAPL is committing $500 million to buy magnets from MP Materials $MP, in a partnership that seeks to build a factory in Texas with neodymium magnet manufacturing lines specifically designed for Apple products.

Neodymium is one of 17 REEs and the most popularly used alongside Praseodymium. MP currently produces a concentrate that contains a mix of REEs.

This deal was announced mere days after the DoD invested $400 million (to grab a 15% and become the largest investor) and committed to buy any product at a floor price of $110/kg. For more on the deal, here are the main points.

WTF! These are major signals for what is a pretty small and concentrated market. Small markets can react fast, so volatility may pop up.

The key implications I see:

- MP doubled in less than a week to a cool $10 billion, opening the door to more institutional eyes pouring fresh powder in REEs.

- Bullish for the space and for peers… a rising tide lifts all boats sort of thing but with reason. I expect appreciation across players with US assets and in other Western economies, like those in Brazil and Australia.

- The safety blanket in the DoD deal is a godsend, and gives this a real shot at transforming the rare earths landscape. SUBSTANTIALLY.

With China just imposing REE mining and smelting quotas, as per Reuters, we should be looking at new developments quite closely.

More on this in a sec.

The week ahead

Here’s what we’re paying attention to:

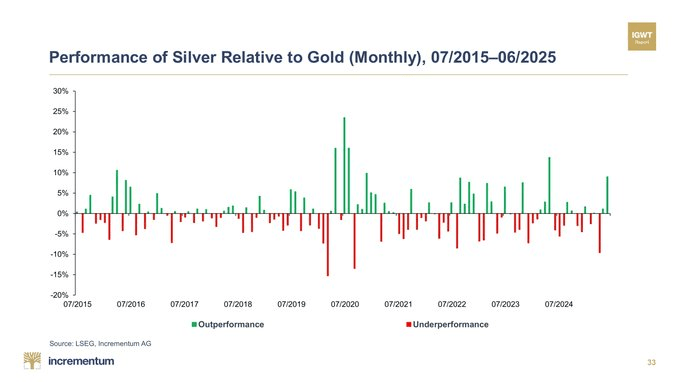

- LFG silver! Silver remains on a roll, with $38/oz acting as resistance, and my X feed is oozing with bulls. PS: The good people of Incrementum shared their June update with me, you can sign up for their mailing list below.

- Copper-heavy? China just announced measures aimed at stabilising growth in key sectors such as machinery, autos, and electrical equipment, which could in turn boost demand for industrial metals, including copper. Let’s see how Dr Copper reacts, from already strong levels.

- Gold is not done, just yet: Gold may have been a tad quiet, but CIBC says not to discount an average of $3,600/oz in the second half of the year and through to 2026. They also lifted targets for Agnico, Kinross, Alamos, Franco Nevada and Discovery Silver.

- It’s the bottom (for lithium) part 2: Albemarle, SQM, Pilbara and Liontown on the mend, after a small recovery in lithium chemical prices. Long way to go, but as I’ve said before, I’m still bullish long term, so I’m cautiously keeping an eye out for any upticks.

- Economic calendar: this week, there will be updates from Australia (minutes from the RBA decision) and the US, where Powell is scheduled to speak (I wonder if he’ll respond to any of Trump’s aggressions? Probably not). Polymarket punters see no change in US rates this month. In Latam, we’ll get economic activity for Argentina and Mexico, and FDI for Brazil. In addition, Newmont, South 32, and Fortescue release quarterly updates.

- Regulatory blues: Nothing too major on my radar for the week ahead, but we did hear that Northern Dynasty is not (at least not yet) in any meaningful discussions with the government regarding Pebble, as previous comments somewhat implied, so the stock tanked. Alaska remains a tricky proposition. Of course, things can change swifly… MP’s mine is in California, after all. When there is a will, there is a way.

Meanwhile…

These companies are making bold moves.

Deals, investment, capital raising and IPOs

- BHP delays Jansen potash mine, expects to spend up to $7.4 billion vs the original $5.7 billion estimate

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Orezone Gold Corporation $ORE is set for a cross-listing on ASX via A$75M raise in early August; they produce gold in Burkina Faso. Canaccord Genuity is the underwriter/lead manager; Euroz, Argonaut, SCP Resources, and BMO, co-managers. The price on listing will be A$1.14/share.

- Southern Cross Gold Consolidated Ltd. $SXGC cross-listed to the TSX earlier this month, focused on high-grade gold and antimony exploration in Australia.

Normally, we see a lift in targets and weakness in acquiring parties, and often, some of the interest bleeds into peers, providing some arbitrage chances. For IPOs, we like to keep an eye on listing day/week, as big swings may point to opportunities.

Announcements, media coverage and broker ratings

- Pan American Silver $PAAS > maintained at Outperformer, price target raised to $46/share from $39 by CIBC

- St George Mining $SGQ > grow Brazilian rare earths resource via StockHead

- Newmont $NEM > maintained at Neutral, price target raised to $74/share from $60 by CIBC

- MP Materials $MP > inks $500m deal with Apple

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Seeking opportunities? Here’s our latest alert

One thing is clear to me.

I reckon the key aspect is the pricing. It could become ‘the price’ across the board.

This would solve a lot of growing pains, and trust me, there are a lot of conversations about this behind closed doors.

Either way, IMO, it’s just getting started for REE with plenty of opportunities. Feels a bit like lithium felt back in 2008, and we all know how that market grew. I wrote a bit more about this and MP Materials here.

Where do you stand on this one? Let me know in the comments.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

ICYMI

Keen on the big themes in metals and mining?

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, SRC research. Figures shown in US dollars unless clarified.