Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

Lately, I’ve been thinking a lot about strategy. When we look at the mining industry from a bird’s-eye view, some interesting patterns emerge.

Most juniors start like this:

- Someone finds a promising project in the commodity of the week

- raises some money for a deal

- gets the company listed

The new company is born and proudly branded, often after that focus.

On the flipside, the largest miners are not single-commodity. BHP and Rio Tinto, the top 2, are a good example. Successful, enduring… and fully diversified.

While having a single commodity to worry about in the early stages makes some sense, as price takers, we are at the mercy of fickle demand/supply. One of the reasons we see so many pivots among juniors.

But even mid-tiers/majors are changing. Barrick dropped the ‘gold’, signalling their ambitions for the top.

To me, this feels loud.

But let’s put a pin on it for a sec and talk about what we’re paying attention to this week:

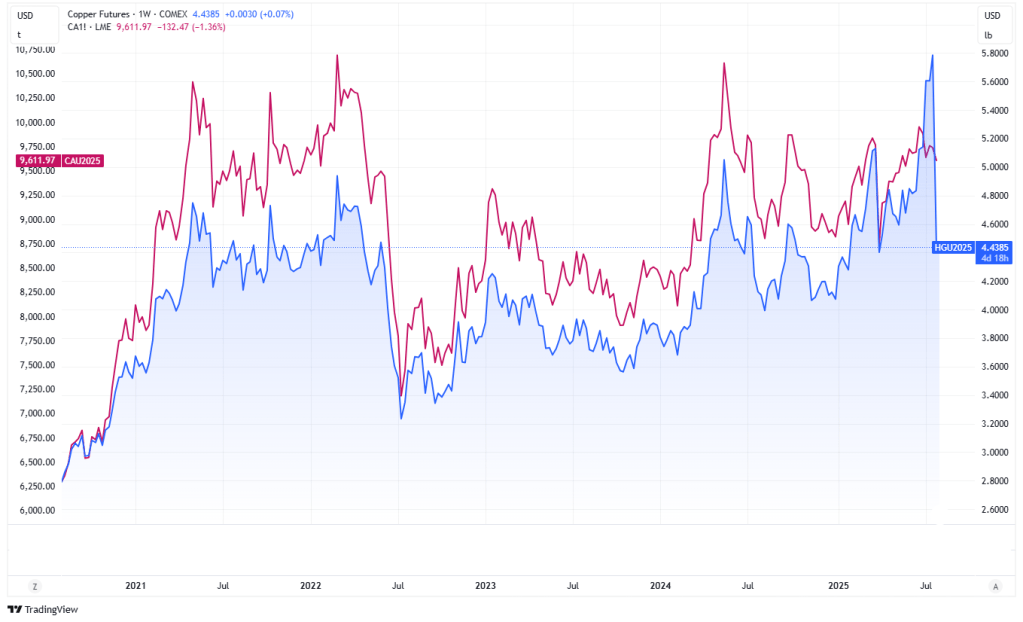

- Will the chasm between LME and COMEX copper continue to exacerbate? Many people expected the run in COMEX to continue (including Goldman Sachs, even advised clients to go short just before it tanked… Ouch!). For now, LME remains more helpful in planning the rest of the year.

- Rare earths on the limelight: there is more conversation across markets on recent moves by the US and Apple betting on MP Materials. But MP is not the only beneficiary, as most rare earth peers have surged, Lynas $LYC nearly doubled YTD to $10 billion just under MP’s market cap. The race is on.

- Economic calendar: this week starts with a bank holiday across Australia, UK, and Canada. Investment in Mexico, PMI from Brazil. In addition, the Aussie reporting season is full steam ahead.

- Regulatory: Trump’s tariffs are set to kick off on August 7. We’d be shocked if no random curveball comes, but note that markets have mostly priced in and moved on, in our opinion. Also, after the accidents occurred at mines in Canada and Chile (sadly, the latter with 5 deaths), safety procedures may come under scrutiny.

Meanwhile…

These companies are making bold moves.

Deals, capital raising and IPOs

- Teck approves $2.4 billion expansion of Highland Valley Copper

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Green and Gold Minerals Limited $GG1 is set for a listing on ASX via A$7M raise; their focus is gold in Queensland. Harbury Advisors is the lead manager and the price on listing is to be A$0.20/share.

- Southern Cross Gold Consolidated Ltd. $SXGC is now also listed on TSX. They are a gold explorer with projects in Victoria, Australia, currently worth over C$1.2 billion.

Normally, we expect to see a lift in targets and weakness in acquiring parties, and often, peers to targets get some extra love, providing some arbitrage chances. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

Announcements and rating updates

- McEwen $MUX > maintained at buy, price target raised to $17.00/share from $15.50 by H.C. Wainwright & Co.

- ST GEORGE MINING LIMITED $SGQ > raised $5M to expand exploration efforts in Brazil, priced at a 13% premium to the 30-day VWAP, discovers high-grade rare earths 1km outside the existing resource estimate

- Newmont Corporation $NEM > reported quarterly results, with earnings coming higher than the previous quarter and expectations, maintained at Sector Perform, price target raised to $72/share from $69 by Scotiabank

- Agnico $AEM > reports Q2 results

- ATEX Resources $ATX > completes program ending in high-grade mineralisation

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Latest alert

Going back to today’s topic…

IMO, having a wider focus early on may provide a competitive advantage and intrinsic resilience.

As an investor, I’d like to see more Minerals, Mining, Ventures, Resources, etc. in company names and less Cobalt, Lithium, Gold and so on.

Especially once companies are beyond the $100 million market cap.

Where do you stand on this one? Would love to hear.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

ICYMI

Keen on the big themes in metals and mining?

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, SRC research. Figures shown in US dollars unless clarified.

Hola Paola.Saludos desde Bélgica en este momento (también vivimos en Bogotá)Cuándo una empresa minera cambia su nombre para que contenga el metal, me pone en alerta. Para mí es una señal para vender. Un projecto c

LikeLiked by 1 person

Let’s see how tarrifs on India affect one of biggest gold buying markets in the world.

Sincerely,

Donny Lowy

https://onlinegoldprice.com

LikeLiked by 1 person

Que tal Patrik – en mi opinión no es una señal inmediata, pero sin duda para monitorear. Es uno de los puntos que considero como posibles ‘red flags’! Saludos desde Australia.

LikeLike